Yesterday, we spotlighted Brazil’s economy as perhaps a leading indicator for where things stand. Today, it’s China’s turn. Neither are very encouraging. Both offer instead only growing concern. The reason isn’t just the possibility of the world economy rolling over in 2018, rather it’s from what level any deceleration might have begun.

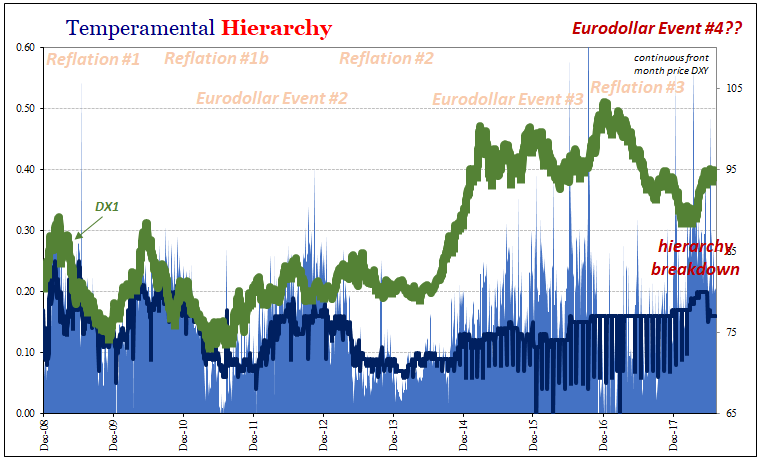

Despite the characterization of especially the US economy as some powerhouse reborn from supply side do-gooders, Reflation #3 never really got going. Markets were up but none outside of stocks actually did all that much, most only having retraced a small part of the “rising dollar” collapse.

Many of the world’s national economies performed in exactly the same way, not that that has been surprising. One follows the other. Brazil has behaved like that, being utterly devastated by the global downturn in 2015 and 2016. They have proved the “L”, an exclamation point further provided if their economy is indeed on its way down again already.

The same for China. Globally synchronized growth was supposed to speak Chinese more than any other language. And yet, there wasn’t near enough momentum at any point along the way. Now, like Brazil, the downside re-emerges from a far shorter peak than anyone has been able to imagine.

That’s really the corruption here. Economics as a discipline is thoroughly, irredeemable corrupt. They’ve learned absolutely nothing, as I wrote here:

There is still no evidence that the US economy is doing anything but continued sputtering. This is not news to the rest of the world, however, as the persistent lack of actual American “demand” has been felt nearly everywhere. Domestic economists, and a great many foreign counterparts, continue to see the US as the sole engine of economic hope. But even just writing that doesn’t make sense, as how can every other place in the world be in economic trouble when the one place that drives economic activity in the rest of the world is “booming?”

I didn’t write that a few months ago when renewed “dollar” issues broke out into the open. That passage was written three and a half years ago. We keep repeating these cycles but they aren’t business cycles, at least not in the way we were taught about them in Economics class.

The word “decoupling” was invented and has been used several times so as to avoid recognizing the repetition. Economics is corrupt because Economists refuse to learn the lessons from each upswing and downturn, even from those just a few years in the past.

We are instructed from Day 1 that every economy just grows. There are various theories on how and why and to what degree, but everyone simply believes that it happens as a self-evident truth. Therefore, if we go for any length of time without evident growth then it can only be mean reversion is closer at hand.

But that’s not always the case. History has proven that there are periods when grave imbalances maintained by just this sort of corruption drastically retard economic growth in what appears permanent fashion. We are in just such a period now, unfortunately, and the Chinese economy yet again demonstrates the global reach of these negative pressures.

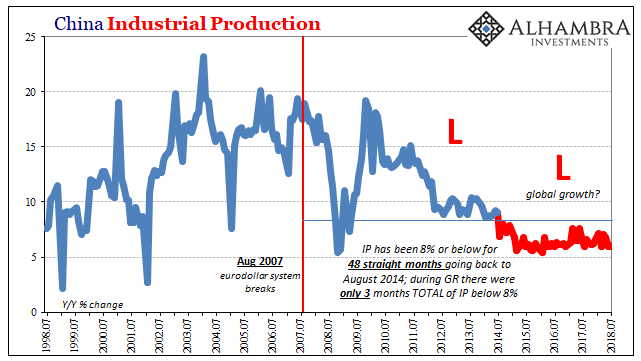

The latest statistics are grim. For the month of July 2018, China’s National Bureau of Statistics reports Industrial Production of just 6% year-over-year. July makes four straight years of IP at or less than 8%, a level which used to suggest global economic cancer. It still does, only Economists refuse to believe the plain comparisons.

Going back to October 2017, IP has been 6.2% or less, at the bottom end of that 4-year range, in seven out of those ten months. In the eight months prior to that, IP had been 6.5% or greater in five of them; 7.6% in two. These rates don’t scream robust, either, but it shows both the lack of upside during the best days of Reflation #3 as well as its increasingly likely end.

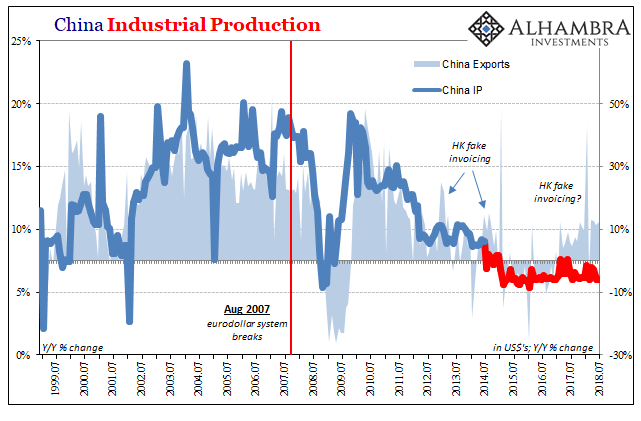

They say the US economy is booming, but the Chinese like in late 2014 and early 2015 have to be asking themselves, where is it? Americans developed a peculiar affinity for Chinese-made goods in the 2000’s, but now that the economy is finally roaring again they no longer want the same? Doubtful.

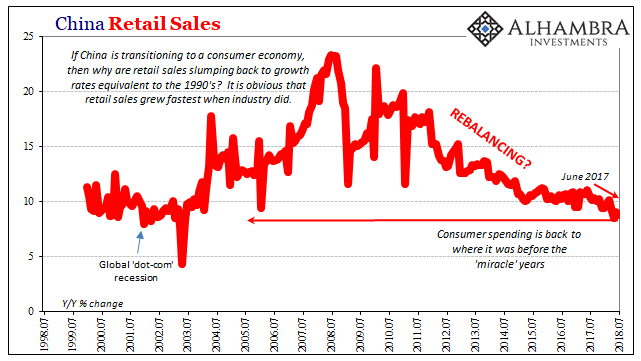

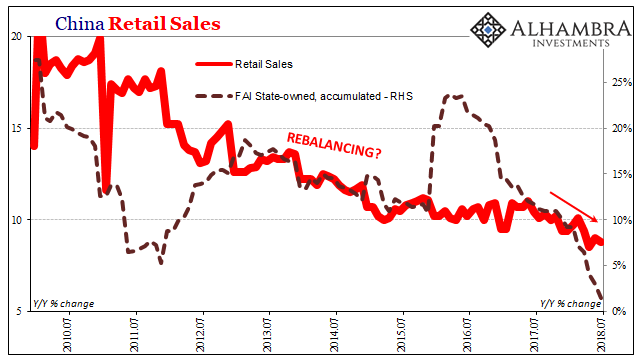

The whole Chinese economy is instead slowing where it would be accelerating if there were global reasons for it. Retail sales, the presumed engine of the Western Economic myth of “rebalancing” have been like IP slowing since last year. The last time retail sales growth was less than 10% for any length of time was fifteen years ago before the full weight of China’s economic (eurodollar) miracle.

In July 2018, retail sales rose by just 8.8%, the third straight month of 9% or less expansion. These are among the worst results of 20 years of retail sales figures.

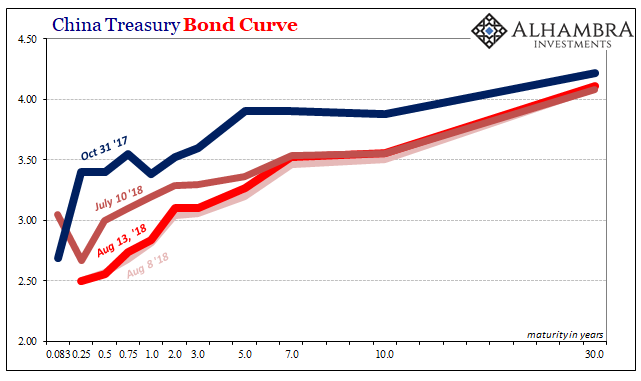

If there is a primary culprit for China’s weakness it has to be the global economy’s continued disappointment. Not even Chinese authorities believe in it, though it is far more likely that they never really did after 2015-16. Whichever way they may have preferred, there is little doubt more than halfway through 2018 which way they are thinking now.

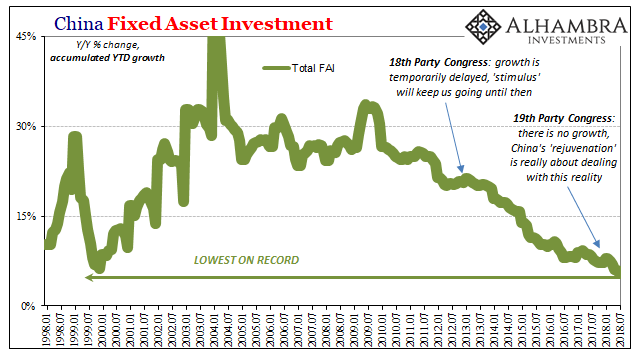

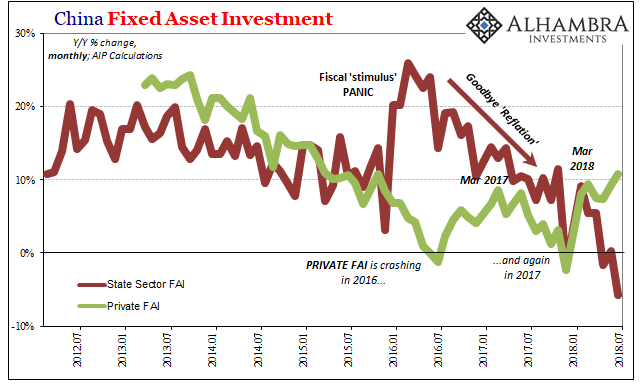

Fixed Asset Investment (FAI) continues to decelerate, and in one specific, crucial sector it is actually in contraction. At an accumulated rate of just +5.5% in July (meaning Jan-Jul 2018 over Jan-Jul 2017), it’s another month recording the lowest on record.

It’s the government who is quite purposefully dragging FAI down. Intent cannot be a question anymore. Why would Chinese authorities stomp on the brakes here? Again, it’s not as if China’s economy came roaring back as everyone in the West has been expecting. Last year was in many Chinese pieces just as weak as 2016.

So why now?

What I wrote in early 2015 suffices as an explanation:

Central banks wasted a tremendous opportunity in 2008, as it was already very painful, to allow markets to reassert conditions that would drive an actual and sustainable recovery. Instead, we are left with fits and starts, the creature of continued instability, that claims not individual economic systems but the unified whole lashed together by the modern “dollar.”

Why bother wasting more resources, going further into debt for it, if recovery, real worldwide recovery just isn’t possible?

If it was going to happen, it would have in 2017. This year, 2018, is about reckoning with yet another false dawn. Economics sees only dawn. That is why it is corrupt. The Chinese are showing us, again, why it’s only ever false.

Stay In Touch