I have to hand it to my colleague Joe Calhoun. In recent months, he’s been able to almost perfectly predict the Trump Administration’s response tactics to all this trade war stuff. Back in July, it was mere comments on the dollar. Not long thereafter, aid to farmers caught up in the China dispute. When that happened, Joe predicted it wouldn’t be long before NAFTA.

According to my record keeping, Mr. Calhoun is now three for three. You might only give him half credit for this latest one since technically the current NAFTA news only includes Mexico and doesn’t yet touch Canada. Yet. With the midterms approaching, you can see where all this is going.

That was pretty much Joe’s point all along. Politics is somewhat predictable in this way. And it reveals something else perhaps more relevant to what’s going on. Is this all really trade war stuff?

The political math adds up in that direction. The Trump administration has been messing with China which would only create collateral domestic damage. Betting on a booming economy, in the data anyway, the President need only clean up the rough spots. He’s doing it and one right after another.

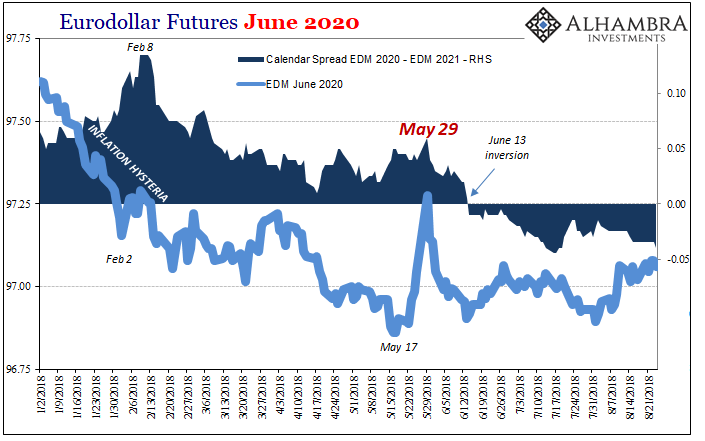

Unlike earlier in the year, however, markets aren’t impressed; at least, those markets that actually count (stocks have no bearing on the real economy). The eurodollar futures curve, for one big example, wasn’t at all impressed and barely budged on today’s NAFTA news. In the all-important EDM 2020-EDM 2021 inversion, it had lessened intraday by all of 1 bps.

The curve was inverted at Friday’s close by 4 bps in that place and during trading today it corrected to at best – 3 bps (as of this writing, the inversion is back to -3.5 bps).

Moving away from politics and political optics, markets don’t care about trade wars. They do care about what has in the recent past greatly harmed global trade. They’ve got bigger problems both in the rearview as well as still on the horizon. While Jay Powell’s Fed keeps feeding the media “technical adjustments” and the prospects of further moves along those lines, we keep finding May 29 everywhere.

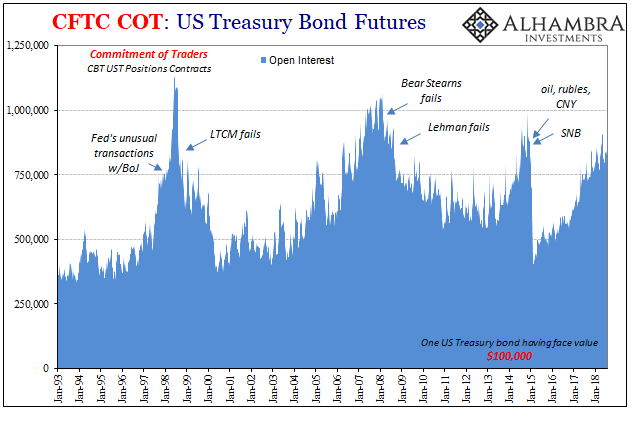

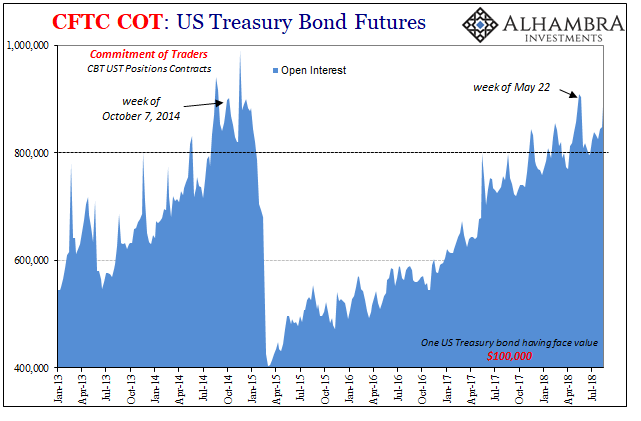

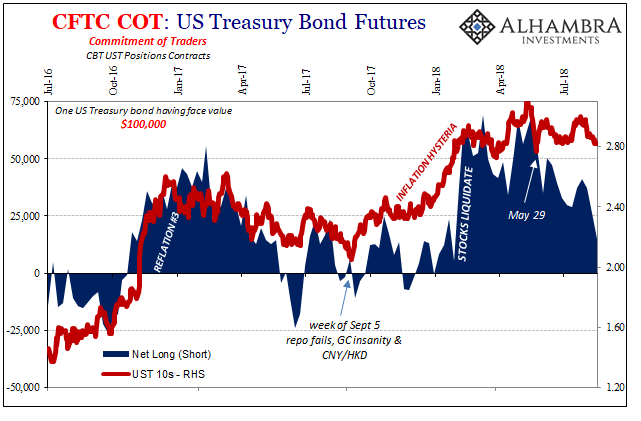

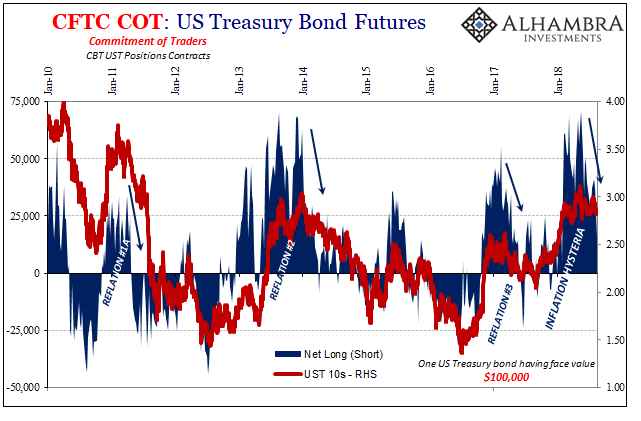

That global collateral call wasn’t out of the blue, either. Rather, it was the culmination of many months of escalating warnings that things were getting out of hand. One of those was in UST futures.

Open interest spikes ahead of the big ones. You can tell when the market, the “market”, is getting nervous by how busy the Chicago (computerized) pits become. It is and has been simple lazy shorthand to dismiss all this as inflation mechanics – the shorting of UST’s in anticipation of “rate hikes.”

Quite to the contrary at times, it’s not rising rates that are on investors’ collective minds at these times. Market uncertainty of any kind tends to lead in the opposite direction for the bond market and the economy, as each time open interest jumps that’s what has resulted. Is this time any different?

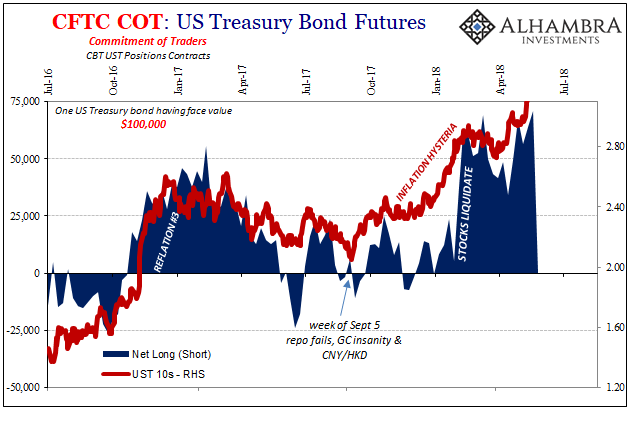

In terms of the net market position, it was all reflation again up until the week of May 22. After a temporary interruption to inflation hysteria after the global liquidations in January and February, by the middle of May the 10-year UST yield was at a multi-year high and the aggregate futures position reflected the massive build up of shorts (by the net long).

Then, May 29.

All of a sudden, the UST futures market isn’t so sure about reflation anymore. The net position has collapsed since then, the same way it has done before at inflections between reflation and resumed deflation. It was during this period where Trump has racked up his political “wins” in the offsetting trade stuff.

Maybe that’s the (global) market increasingly worried about the big picture especially over the China dispute. I doubt it, however, as that merely makes for a convenient excuse. What did any of it have to do with May 29? Even conventional “wisdom” about May 29 put it as Italy and Europe.

In truth, it hasn’t been any of those things – a realization that wouldn’t require any explanation in the market. As the eurodollar futures curve, the UST futures space is more and more betting on FOMC forecast error; as in, where it seemed a decent probability earlier this year to bet on economic growth that could happen it doesn’t as much the further we go in 2018.

It’s not really trade wars. It’s risk, and realized risk at that, the real money stuff that could drag down trade and the economy all over again if May 29 proves as big and ultimately conclusive as it seems. If it wasn’t Trump who broke it, he can’t fix it, either. At least not by following political convention.

Stay In Touch