Who can Jerome Powell thank for the PCE Deflator? Not Janet Yellen who handed off to him instead “transitory” factors. Nor was it globally synchronized growth which was supposed to have been the deciding element. Instead, it appears more and more that the only place where Chairman Powell might legitimately offer his gratitude is the US Congress.

We have to work backward a little bit to get there, but it’s an unusually straight line this time. The PCE Deflator has been now at the 2% policy target thanks to oil prices alone. Without the heavy contributions from WTI, as well as the planned switch to a 2012 reference dollar, the inflation index would never have come close.

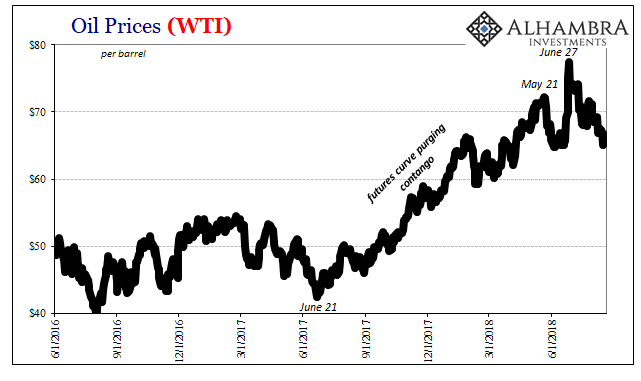

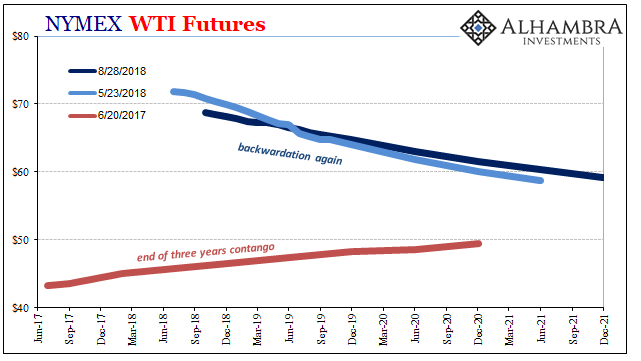

The reason oil prices are adding so much to inflation numbers is the steady rise in them that began in the middle of last year. From June 2017 to about the end of May 2018, oil prices kept going up. The main reason was the switch from contango (the WTI curve in late June 2017 was still in that shape) to pretty steep backwardation.

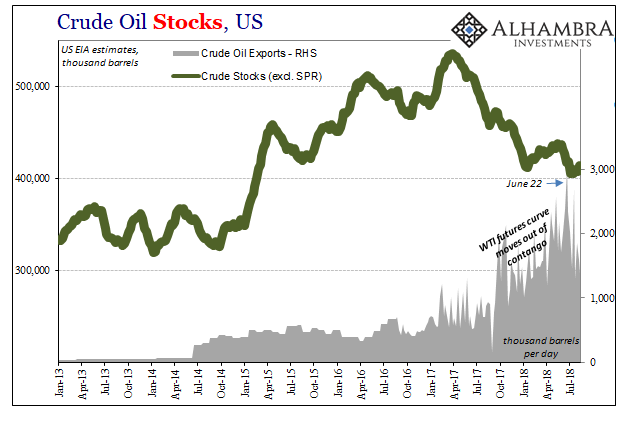

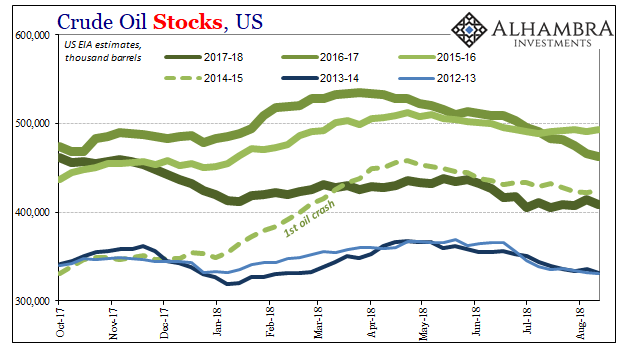

Backwardation indicates a (arguably) more normal state of affairs in energy. Given the massive buildup of crude stocks beginning with the global economic slowdown hitting in 2014, US inventory of oil didn’t really come back down until midyear last year. But it wasn’t really economic improvement responsible for the better internal balance between supply and demand.

Instead, the seeds for rebalancing were planted in of all places the December 2015 budget showdown. The Obama Administration and Democrats in Congress demanded an extension to the costly (and inefficient) tax credits for renewable energy. In exchange for keeping them, they compromised by allowing the Republican majority’s proposal to lift the ban on oil exports into the final bill.

It wasn’t until the middle of 2017, however, when US crude exports really took off. From an average less than 750k barrels per day in the first half of last year, and just 500k throughout 2016, according to the US Energy Information Administration exports surged starting with the second half. By the middle of this year, exports were up to more than 2 million bpd on average. For the week of June 22, US producers shipped 3 million bpd abroad.

That would propose an additional international dimension to US WTI futures. Therefore, Federal Reserve Chairman Jay Powell can look to Congressional action for saving him from another year of uncomfortable inflation undershooting.

He shouldn’t get too comfortable, though, as keeping the PCE Deflator at or above 2% has been the real trick which has eluded both of his two prior predecessors. Powell will need a lot more than oil (just ask Ben Bernanke about $100 crude oil false dawns), but at least that to start with.

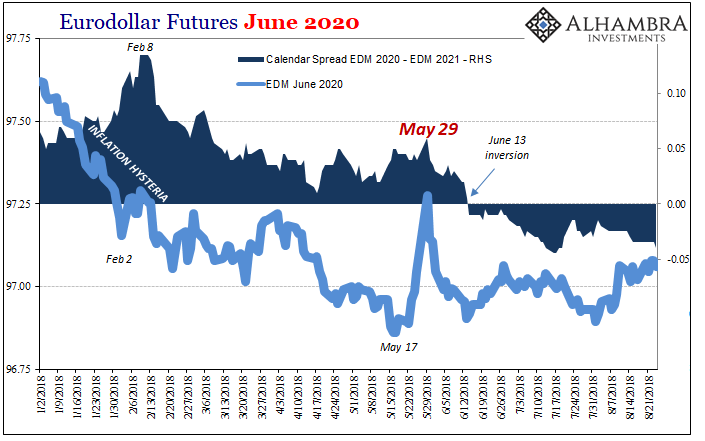

If for some reason markets might get the sense that the global economy and particular international markets might not be so enthusiastic about taking US crude, we would then expect to see some reversal in oil prices largely via a flattening of the backwardated curve. Lower front end prices would be the result.

So far, there isn’t any trade war stuff looking in the direction of crude. There has been, as shown above, curve flattening and to this point a change in direction in WTI pricing. That would seem to suggest something else is worrying the crude market about possible “overseas turmoil.”

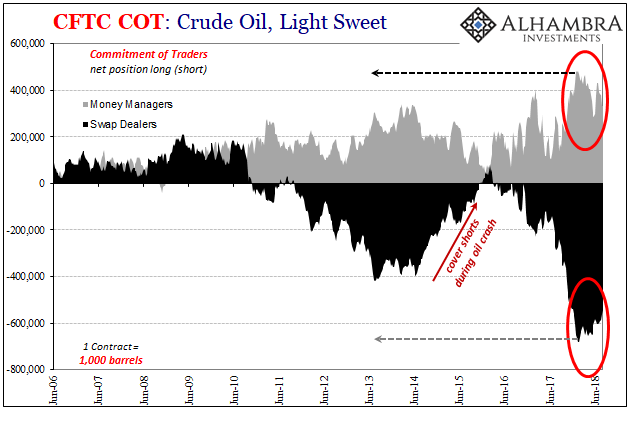

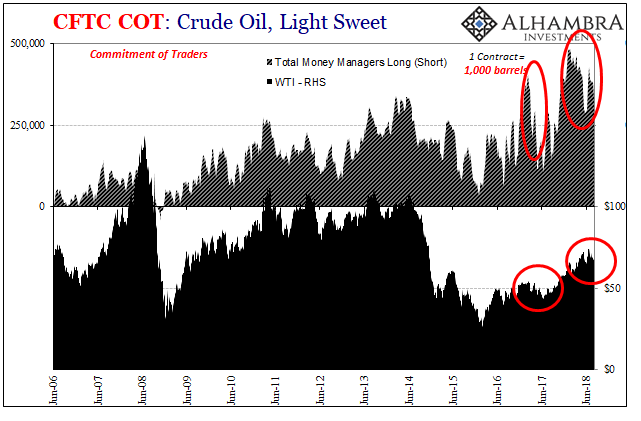

In WTI futures, the record long Money Manager position is itself long gone. From a high net long of nearly half a million contracts in mid-January, first the global liquidations and then everything else have taken their toll on the prior certitude expressed by this class of speculator (the very category which before the “rising dollar” had always set the price). The position really started diminishing around the middle of April – the re-rerising dollar.

MGR’s are still net long and by a lot, 331k contracts long through last week. It’s much less than earlier in the year, which is the only direction that matters.

The thing is, there is no established seasonality to crude exports. We don’t really know what should be what when. All we do know, according to the US EIA anyway, is that since hitting 3 million bpd in June crude exports have dropped off rather dramatically. In the latest figures for last week, they were just 1.16 million bpd, about a third of the peak rate just two months ago.

Is that normal? A worldwide slowdown ahead? We don’t know, and I suspect the crude markets don’t, either. It is rather uncertain and uncertainty doesn’t work in favor of rising prices and steeper backwardation.

For one thing, oil inventories remain elevated despite moving so much product offshore. There are as high now as in August 2015 when the global economy was already in some varying degrees of contraction.

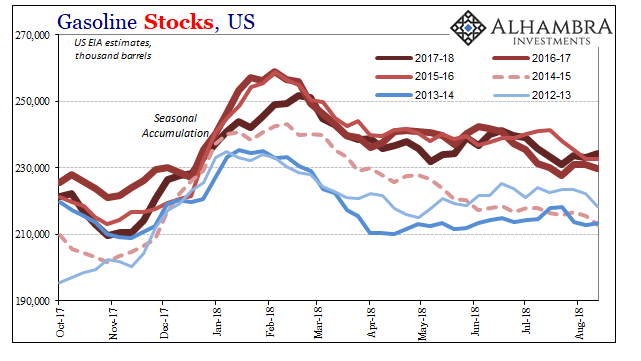

More concerning of late are gasoline and distillate stocks. If US oil isn’t required in foreign markets to the same levels, then it can pile up in various forms here domestically. One of them is gasoline in inventories, which last week were the highest on record (just above 2016) for this time of year.

Not only might that be confirmation of global concerns about where US supply might go, or might not be able to, it isn’t a positive reflection on US demand, either. And certainly not in terms of this supposed US boom nor the globally synchronized growth presumed to be accompanying it.

Maybe the oil market is taking a few months to digest everything before resuming its rebalancing act. Jay Powell certainly hopes so, his last hope maybe. Then again, WTI and the futures market did react to something else. Right around the end of May, the market shifted. If only there was something we could attribute that to, but alas there was nothing written or spoken about in the media describing a massive global collateral call or anything like that.

Stay In Touch