The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are.

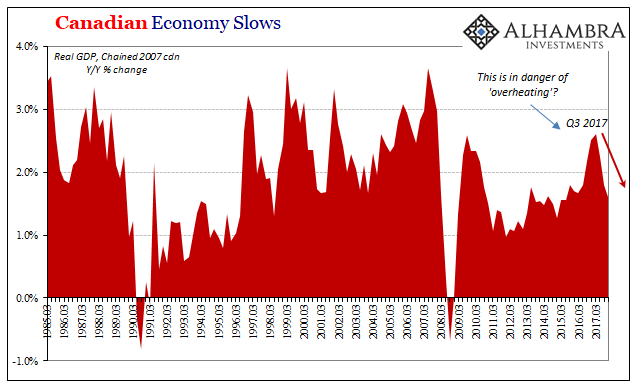

Look to our neighbors to the north. The Canadian curve is slightly ahead of the UST curve in that regard. It really shouldn’t be this way, not according to the narrative. Inflation has hit 3%, the highest in seven years, and Canada’s oil economy is thriving again.

The Bank of Canada is raising rates in the same way as the Federal Reserve, and not coincidentally at the same time. Flash back to 2014 when the Canadian economy was supposed to have lifted off like its American counterpart. Here’s StatCan’s summary of the situation from September 2014:

The pace and composition of economic growth varied over the first two quarters of 2014, as modest gains during winter months gave way to stronger, more broad-based growth during the spring. Household final expenditures accelerated in the second quarter, after moderating at the start of the year. Export volumes, which weighed on growth during the first quarter, contributed strongly to second-quarter gains. Increases in the volume of production were broad-based in late spring. The output of service industries increased steadily through the second quarter, while goods industries advanced in late spring. Auto sales were a major contributor to economic activity in May, bolstering manufacturing sales, wholesale and retail sales, exports and imports. Inflation increased during the spring months on higher prices for food, shelter and transportation.

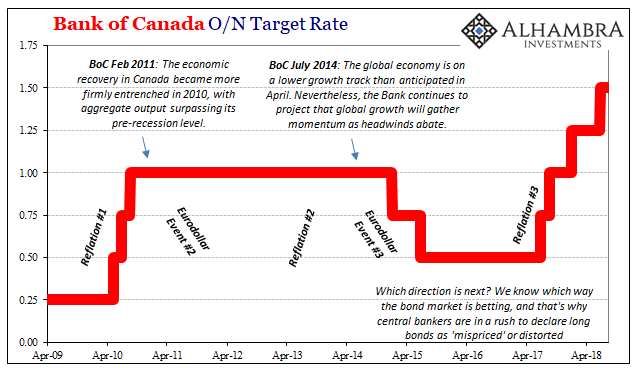

Sounds very familiar. Did the Bank of Canada need to act in 2015? Not raising rates. They did, however, move in the opposite direction, the one long-term Canadian bonds had been signaling throughout sunny 2014. The Canadian economy was beset by “transitory” factors and felt the same economic risks of eurodollar event #3 as everyone else did.

The only difference this time is that central bankers don’t know it’s not different (the double negative is fitting here). Markets aren’t under the same obligation to stay blind and indifferent. Unlike officials who have no skin in the game, there are often severe penalties for being so wrong about economic growth.

This is not the first time ‘round for Canadian central bankers, either. They’ve been fooled by false inflationary dawns before. Slightly ahead of their European counterparts, the BoC preceded the ECB in hiking rates thrice in 2010 (the latter undertook two in 2011).

Which brings us back to Canada’s flat yield curve and why it’s nearly inverted. On that account, BoC Governor Stephen Poloz is almost on the same page as the market:

As Canada’s yield curve sits on the cusp of inverting for the first time in more than a decade, the nation’s central bank believes there’s little cause for alarm. The world’s largest money manager isn’t so sure.

Bank of Canada Governor Stephen Poloz says overwhelming demand for long-dated bonds is distorting the curve’s recession signaling mechanism. [emphasis added]

Oh boy. “Overwhelming demand for long-dated bonds” isn’t a “distortion”, it is the market very clearly rejecting Stephen Poloz’s policy and more so the reasons behind it. He, like his colleagues to the south, thinks the global economy unlike 2014 has finally met its recovery. Eight or nine years late, but here it is.

That they thought the same thing four and seven years ago doesn’t, for them, factor in the least. But you can be absolutely certain it does for the yield curve. We’ve seen this all before, three times already. It is incumbent upon officials to make their case for why what looks more and more like another, a fourth, false dawn is somehow completely different from those prior situations.

Bonds are quite simply betting that it’s not.

Even on inflation, at Jackson Hole last week Poloz inverted Yellen’s term of art. Appearing on CNBC, he said that BoC had expected inflation “would head up towards three percent during these few months. These are transitory factors.”

We are back to the same game of trust us. In other words, central bankers like Poloz and Mario Draghi don’t yet see any convincing signs of anything actually picking up. They just think that it will because, hey, it’s been a decade of “stimulus” and it has to kick in at some point.

I don’t see how, in light of this last decade, that adds up to a face-melting BOND ROUT!!! The nearly inverted curve in Canada, as UST’s, makes perfect sense given heightened “dollar” reality. There is indeed overwhelming demand for long-dated bonds all over the world. Today it’s repeating eurodollar deflation in Brazil, Turkey, and Argentina.

Tomorrow?

Stay In Touch