The Great “Recession” was never a recession. It was a monetary event first and foremost, and it continues to be eleven years later. That means by and large it has been a failure of imagination. Central bankers say they’ve done this and that, but what they’ve never done, apart from actually succeed, is examine the way money actually works in this modern world. Greenspan said it in June 2000, this “proliferation of products.” What might happen if they no longer proliferate?

You’d have to imagine an answer because they have none.

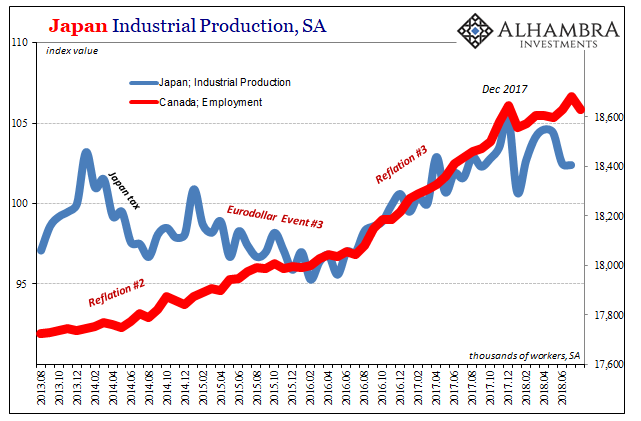

In the spirit of imagination, use yours to mentally draw in below DXY or some other equivalent eurodollar signal like repo or even EFF. None of our economic problems are really that difficult. They just don’t fit in the narrow box Economists have constructed so that their DSGE models can be free from singularities. It’s nice, I suppose, eliminating infinities from certain equations (“rational” rather than adaptive expectations) but at the expense of macro competence?

It takes very little imagination, actually, to see how they really have no idea what they are doing.

Stay In Touch