The Boston Fed held its 62nd Annual Economic Conference over the weekend. Not quite as well-known as the KC Fed’s Jackson Hole symposium, this Eastern branch’s meeting still attracts many big-name speakers. The “right” speakers, that is, meaning academic and mainstream bank Economists, supranational think tank thinkers, as well as current and former central bankers. The echo chamber is just as thick and impenetrable as it is in Wyoming.

Appearing in Boston alongside former Treasury Secretary Larry Summers, Goldman Sachs chief Economist Jan Hatzius, and Cleveland Fed President Lorretta Mester was Olivier Blanchard. Dr. Blanchard has every bit of pedigree covered: former director of research at the IMF, M. Solow Professor of Economics emeritus at the Massachusetts Institute of Technology, and now a Senior Fellow at the prestigious Peterson Institute for International Economics.

The purpose of this year’s gathering was to decipher if there might be any lingering effects from “long spells” of low interest rates. From what I can tell, nobody addressed the biggest one – why there were long spells of low interest rates. They’ve moved on from all that to fretting over what that might say about the ability of Economists to decipher the major economic problems confronting the global economy.

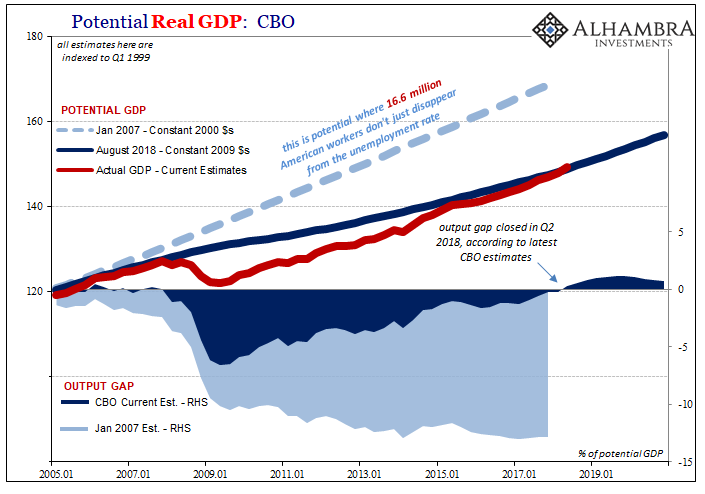

Having achieved the numerical criteria for economic recovery, by purposefully moving the goalposts, with Economists all agreeing that this prolonged spell of low interest rates was responsible for it not getting worse, there was considerable pressure to look ahead. Even if you believe that recovery story, there is no time to celebrate. Jay Powell and Eric Rosengren, President of the Boston branch, may insinuate that the long end of the UST (or other) market is mispriced, but people are really talking about the yield curve either way.

Blanchard’s purpose was to diagram what a low-level turnaround might look like. Unlike past business cycles, this one, if it is one, isn’t going to give the Fed much room for “stimulus.” Bernanke’s Fed started from a fed funds target of 5.25% (fat lot of good that did); Powell’s Fed is facing 3% max, which is right around where each curve (eurodollar futures in particular) is drawing as a line in the sand.

Without much altitude for fed funds, Economists think they’ll have to deliver monetary “stimulus” in other ways. Quantitative Easing used to be the next big thing, but even in academic settings there isn’t much remaining enthusiasm for it as it was tried. As hard as they’ve looked, officials and academic Economists just can’t find much for significant results.

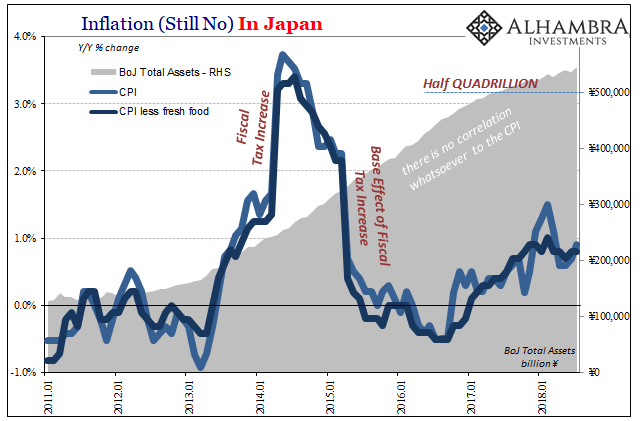

There will surely be future QE’s without a doubt. They just won’t look the same. Blanchard in Boston suggested expanding the list of assets to be purchased, to include among other asset classes US stocks. In other words, since they have no truly new or novel ideas they’re determined to follow Japan no matter how closely the US economy follows Japan.

Groupthink.

On theoretical grounds, the idea is expectations. Rational expectations theory demands that if stock prices are sinking consumers and business will adjust their current habits accordingly. Stock prices are believed in the orthodox treatment an important indication for future economic conditions (the discounting mechanism of myth).

Thus, if a central bank wanted to influence consumer behavior more directly then buy up stocks to keep aggregate prices from falling too much in the first place. Again, ask BoJ how that’s turned out.

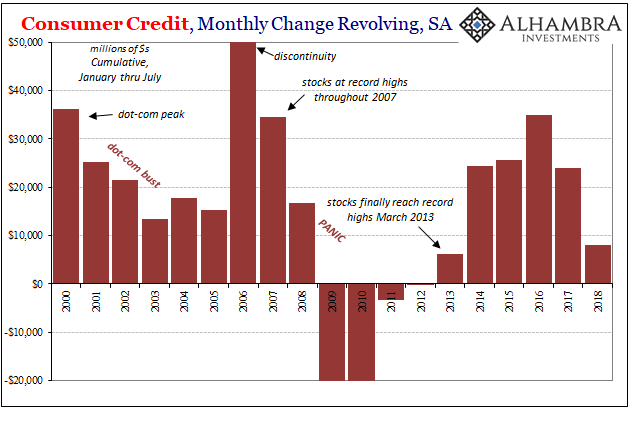

There is some empirical data support for the theory. In US consumer credit, for example, revolving credit does appear to follow at least new highs. When stocks are up and Americans hear (endlessly) about new stock market records there is a loose tendency for them to use credit cards. When stocks are down, you do the math.

It isn’t a perfect relationship by any means, but the changes in revolving credit do seem to align in that general direction.

But that brings us to the past few years. Stock prices, at least according to the main big cap index, the S&P 500, reached a record high in March 2013 in the wake of QE3 and QE4 (aside: not as a consequence of any “money printing”, there was none, rather as the reallocation of savings in anticipation that whatever QE was it would work; eventually). The following two years, revolving credit began to rise substantially for the first time during the “recovery.”

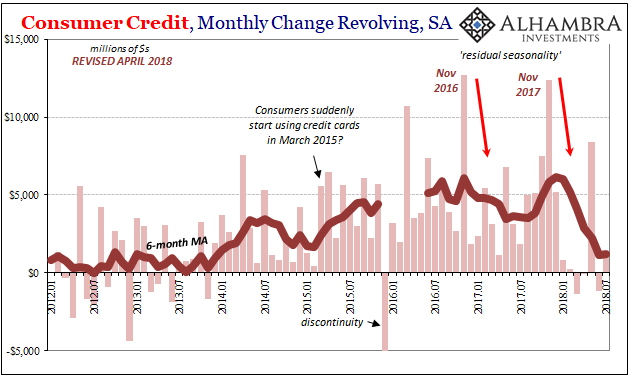

But in 2018, consumers haven’t gone back. The intra-year pattern is a familiar one, this “residual seasonality” that suggests more nuance than simply share price records.

In the latest data for July 2018, released today, revolving credit was up once again by a minimal amount. That makes almost no credit growth in six out of the seven months of 2018 so far. Was that because stocks hit a snag in January?

Perhaps. I think it a little different, though, in that workers turned to credit cards in early 2015 out of a combination of factors. The labor market started to slow, as did the economy surely raising the level of angst about everything in the current sense. Consumers turned to revolving credit as a temporary supplement which may have seemed a rational choice given the stock market’s behavior especially in 2013 and 2014 and what that might have proposed about the future (“transitory” negative factors, after all).

Except, the labor market kept slowing in 2016 and 2017, quite the opposite of share prices. I don’t think January’s liquidations are responsible for the change in behavior with regard to revolving credit (and other economic factors). Instead, I think it’s how the economy for yet another year isn’t living up to record high prices. Slowdown in credit may not be a choice.

The divergence is pretty large, bigger than it was in 2015-16 during what was nearly a recession. In other words, consumers may be coming back down to earth before stock prices have; the S&P 500 having registered another record high again recently.

If that is the case, and it is certainly arguable, then that’s double trouble for Blanchard’s thesis. Not only would the Fed have to being its reverse from a significantly lower high, once they realize the economy is no way in the shape they think it is, as the eurodollar futures curve inversion already proposes, if they do attempt to buy stocks “next time” and consumers are already jaded about what share prices actually mean, what good can it realistically achieve?

That’s a rhetorical question, of course. In June 2003, the Fed criticized the Bank of Japan for primitive QE (LSAP’s using only government bonds) on the basis that the execution by BoJ was flawed rather than the theory. And then less than six years later they ended up doing it exactly the same way and predictably achieving the same results anyway (nothing).

Japan’s central bank began buying REIT’s and ETF’s in October 2010. It has obtained almost $250 billion in Japanese shares, making the Bank of Japan a “major” shareholder in 40% of listed issues. It was one of the ten largest shareholders in 1,446 companies among Nikkei’s 3,735 on exchange.

I’m sure Western central bankers will assure themselves that they’ll do it right if (when) the time comes, but that will require a shocking lack of self-awareness. That’s the one thing, however, Economists can supply endlessly. Especially when they get together.

They really have no idea what they’re doing. That’s Japanification in a nutshell.

Stay In Touch