The populist pathology is incredibly simple; no one ever takes the blame. Things continually go off-track and officials merely shrug their shoulders and point their fingers. The very idea of accountability is anachronistic.

Now that dark clouds are gathering, in the IMF’s words, the fingers are out again.

President Donald Trump said Tuesday that he does not like the Federal Reserve’s decision to continue to hike interest rates.

He also said that the United States economy does not have an inflation problem and that the central bank is moving too quickly in trying to curb price increases.

This escalates into public what had happened about two months ago, before the last “rate hike” in September. I wrote then:

I suppose it’s only fair. After all, they started it. Earlier in the year, Federal Reserve officials including Chairman Jay Powell suggested it was all Trump’s fault. The abrupt difficulties presented by the dollar were, they said, the result of tax cuts swelling the deficit and thereby threatening capital markets with a “deluge” of Treasury bills to digest.

If that hasn’t been enough, every single mention of renewed risks and dark clouds includes the words “trade” and “wars.” Everyone is jockeying for their scapegoat. And none of them have the first clue what’s really undercutting economic progress for the fourth time. It often seems like they don’t really care whatever it might be.

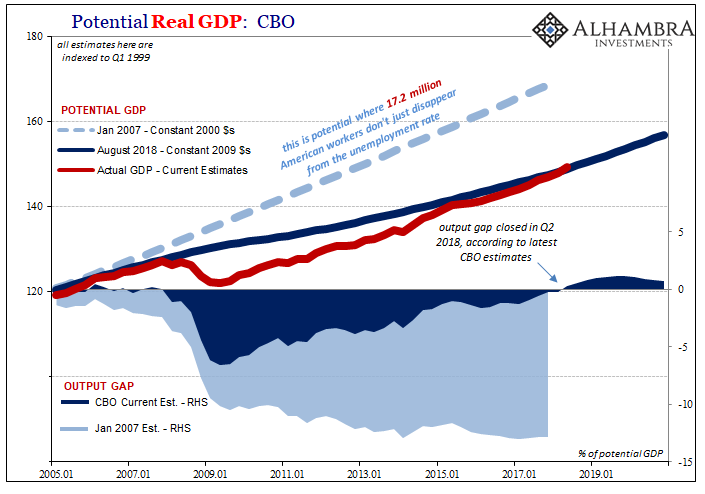

The issue isn’t GDP growth but the lack of it over a long period of time. Economists in the White House, as well as those working for the Federal Reserve, have very likely warned each side that this decoupling fantasy is just that. If there are very real economic risks out there in the world, the US hasn’t been able to overcome them yet.

Even if the US economy manages to avoid a recession next year, which is as likely as any other possibilities at this point, an additional stumble only piles further wreckage on the considerable proportions already achieved. It might, in fact, end up being worse. An outright recession at this stage after eleven years of this might finally wake everyone up; particularly following so much hype and drama over this year’s massive, biblical, indescribable economic boom.

A mere downturn like the US experienced 2015-16 might instead make a lot of noise for maybe for a year or so before ultimately amounting to nothing more than that by the time the low-grade positive numbers come back around again. Trump was, in a sense, lucky enough to have caught that cycle before it registered completely; the election of 2016 was just after the downswing’s fullest extent.

Having embraced the unemployment rate now after campaigning against it, there are considerable risks now emerging to having done so. Thus, I think, the public swipes at Jay Powell.

And Powell is the perfect foil. The guy has shown so far in his tenure that he will not budge. I don’t mean just the last seven months with him running the show at the Fed, rather going back to 2012 in the dark month of September with the FOMC discussing the impossible and dreaded reupping of QE in its third instance.

Powell, as the transcripts show, was against it not because he believed it didn’t work (hey, if you have to do it twice, it doesn’t; three times just proves beyond all reasonable doubts) but because it was, in his mind, unnecessary. The economy was going to boom anyway no matter what, by 2014 and 2015 for sure.

MR. POWELL The question that looms is—and I’m going to, again, leave aside monetary policy—when do we break out of this? And I really do believe that we will. We always have. I can remember many of these cycles where you really wonder if this is it and we’re never going to get out. I really do feel that if you look at our own projections, essentially, all of us project that we’re going to have those 3 percent, 4 percent catch-up years. They’re now scheduled for 2014 and ’15, but really, there’s a ton of uncertainty around that. So I’m going to share this highly anecdotal evidence in an effort to end on something of a high note.

All they required, he said, was patience. Recovery was going to happen, just wait and see.

Everything today suggests he remains convinced of just this. Time and lost compounding just don’t compute for these people. Therefore, if the economy does turn either later this year or next year, downturn or recession, Powell will, in all likelihood, still be singing about inflation, overheating, and “rate hikes” while it does. That’s what the yield curve and more so eurodollar futures are saying right now at this very minute.

And Trump will, wrongly, kill him for it. That’s exactly how it is being setup. If the economy was actually strong in a very real sense, none of this would matter. After all, the economy of the middle 2000’s was middling at best and Greenspan went 17 straight (with Bernanke finishing up the string). Why is Trump talking about a few rate hikes a year all of a sudden?

It’s the Fed’s fault for this one, they’ll claim, no one ever accounting for how it would be, if it turns out that way, the fourth one in the series. And then nothing will change (maybe Trump replaces Powell with a “dove”), and we keep going until something finally gives – probably not in the economy.

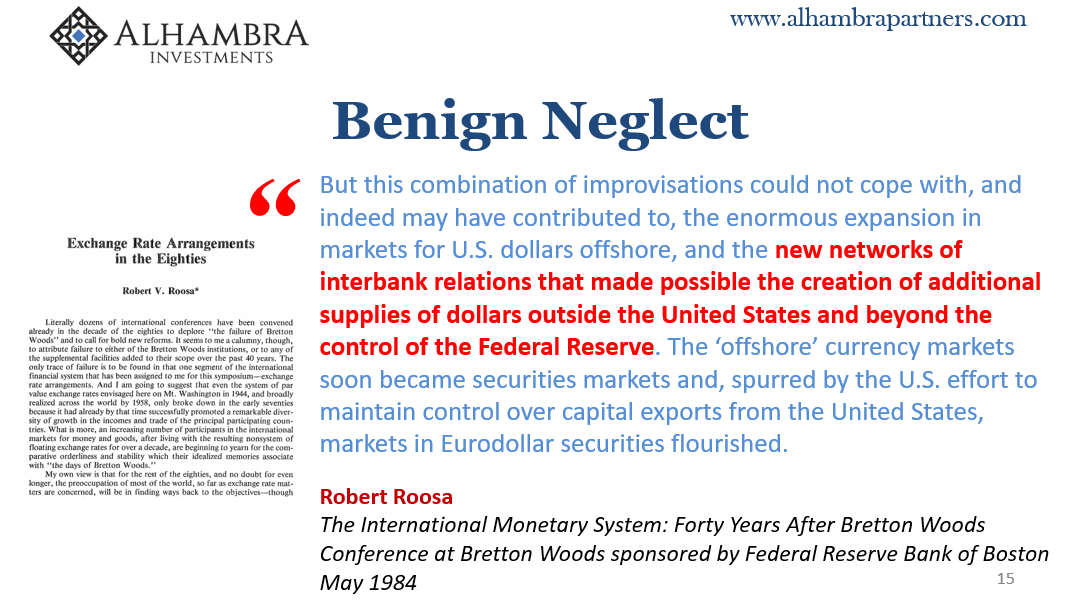

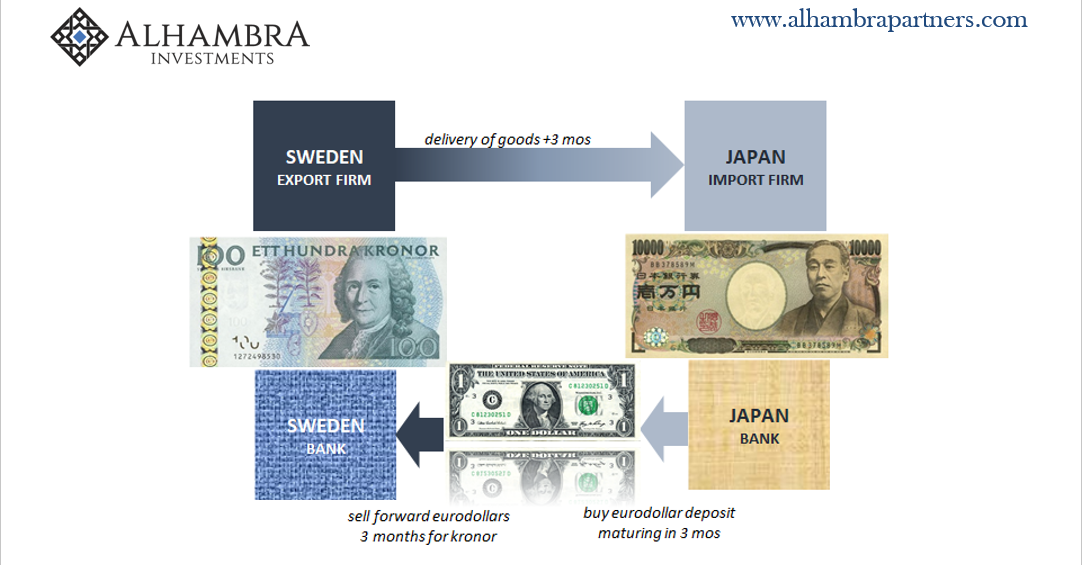

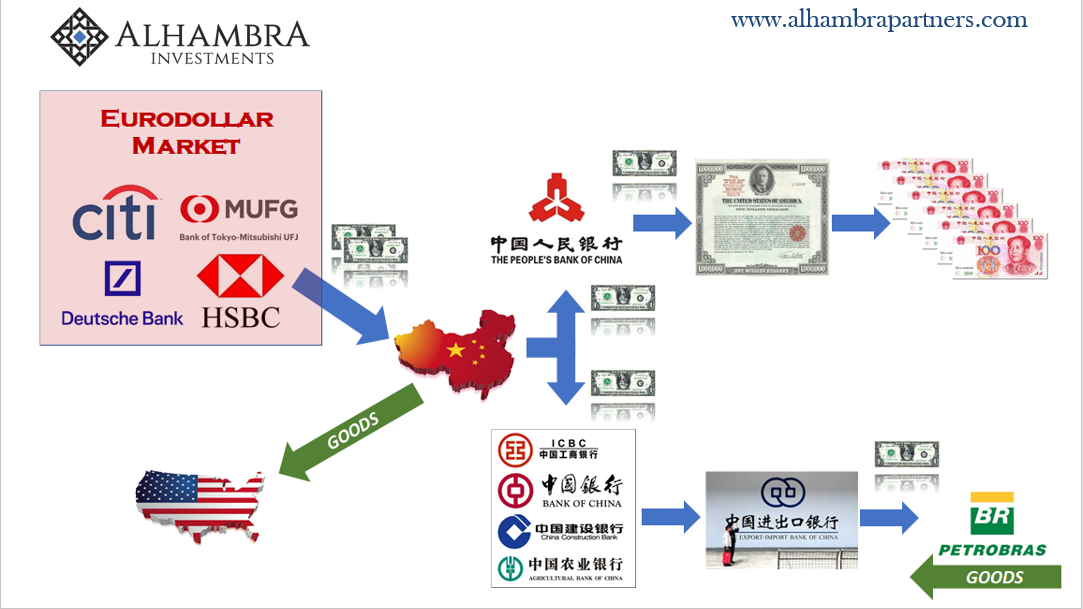

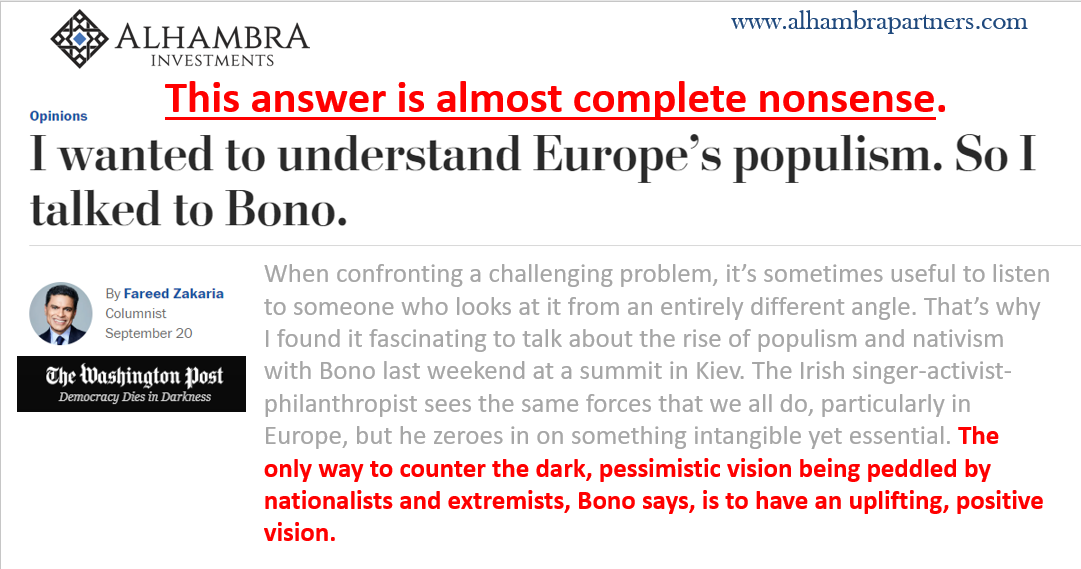

I’ll be in the Cayman Islands this week speaking at the CFA forum on the topic of globalization and the role of the world’s actual reserve currency in its build up and now its demise. This current outbreak of populism is, at its root, a legitimate search for economic answers that risks dangerously taking some very wrong turns the longer it goes without them.

I don’t come to the defense of Chairman Powell when I write that he just doesn’t matter that much.

Stay In Touch