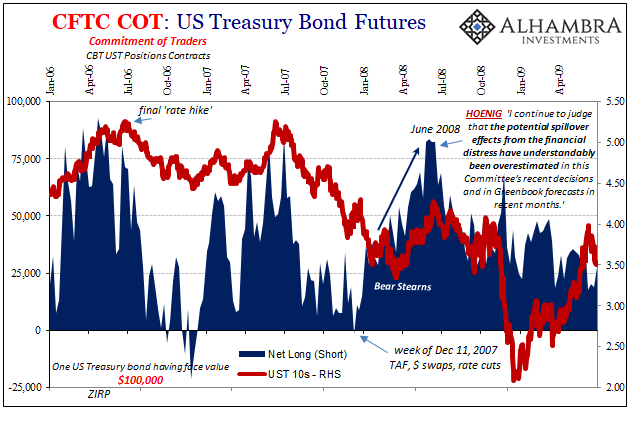

On December 12, 2007, the Federal Reserve announced its entry into emergency “non-standard” policy measures. In a belated attempt to “address elevated pressures in short-term funding markets”, the US central bank would begin auctioning reserve funds “against the wide variety of collateral that can be used to secure loans at the discount window.” The Term Auction Facility (TAF) would become, in essence, the first attempt to work around the Discount Window.

At the same time, the Federal Reserve would coordinate with four other central banks, Bank of England, Bank of Canada, European Central Bank, and Swiss National Bank, so as to ensure dollar funding could be made available by those foreign public institutions – to foreign private institutions. Distracted by “toxic waste”, no one really thought to ask why there was, or how there could be, a massive global-scale dollar problem requiring something entirely new.

In December 2007, and over the months that followed, all anyone cared was that officials were doing big things so as to prevent the occurrence of bigger things. Yeah, it’s bad but they’re working on it, right?

For a time even the Treasury market was fooled. You are taught from the first Economics class that the central bank is central. Greenspan in the late nineties was the “maestro” and in 2002 Bernanke said they would use the printing press if push ever came to shove. In late 2007, global markets were being shoved all in the wrong dangerous direction and in rode Bernanke to the rescue with his press.

Or what he called a printing press, anyway.

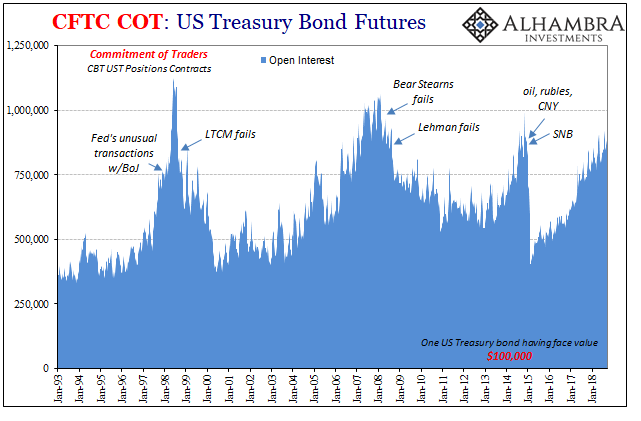

From that particular week in December 2007, Treasury futures bought it. Even throughout the terrible quarter of Q1 2008, the one that saw astonishing setbacks culminating in Bear Stearns, even the first major contraction in GDP in twenty years, Treasury futures were betting the Fed would still get it right.

It is funny looking back on it, how for quite a long time the market kept affirming failure; the Fed would do something only to be forced to raise the stakes time and again. The market, including UST’s in the spring of 2008, looked upon all that as the mere expense of time before the world’s central bankers would eventually get it right. It was entirely upside down.

TAF was expanded as were the dollar swaps, to greater amounts and among more foreign central banks, and yet up until June 2008 the market like central bankers and many Economists kept seeing the most positive outcome for all of it.

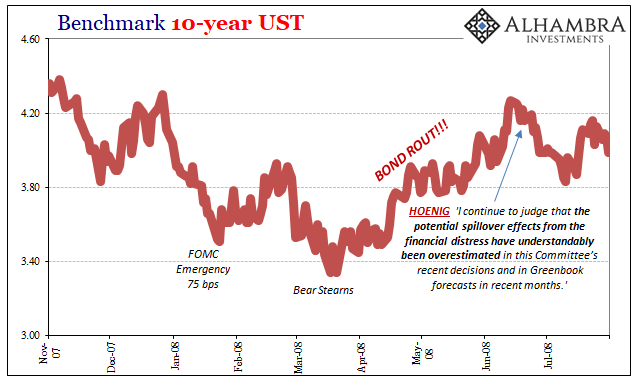

The BOND ROUT!!!! that shook the Treasury market from the moment Bear Stearns was plucked by JP Morgan until just before the FOMC meeting held about three months afterward makes the current one(s) look like minor molehills (which they are). In the middle of 2008!

It wasn’t until mid-year that it finally dawned these “best and brightest” central bankers had no idea what they were doing. They weren’t all-powerful technocrats fine-tuning their inputs, they were clueless incompetents groping about totally in the dark. The turning point in June and July 2008 was the growing schism between so much official optimism, like KC Fed President Thomas Hoenig’s, and real-world monetary risks and conditions that were still going the wrong way.

If Fed officials refused to appreciate how much trouble there was, then there was zero chance they could come up with anything effective no matter how much time they might be given.

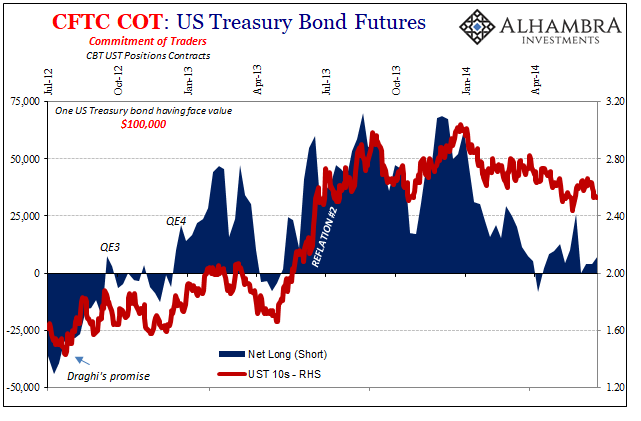

This market schizophrenia has been repeated, in fact that’s what these reflation periods generally amount to. It is emotional and to a certain extent irrational, but always understandable. There is a deeply ingrained impulse to give central banks the benefit of the doubt, to believe that at some point there is the non-trivial risk they may actually discover their inner printing press and come up with the “right” mix of monetary policies. And that those policies if given “enough” time will lead the world back to normalcy.

Not everyone can remain so thoroughly unconvinced as I am.

For bonds, it would mean the mother-of-all-bond-routs. A real one. That much I agree with, only I don’t think we are anywhere close to it yet.

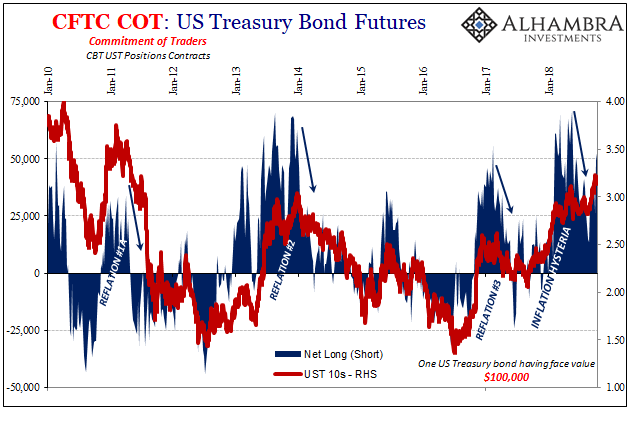

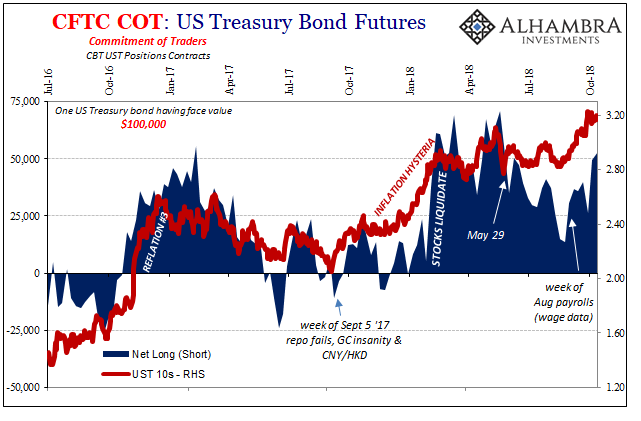

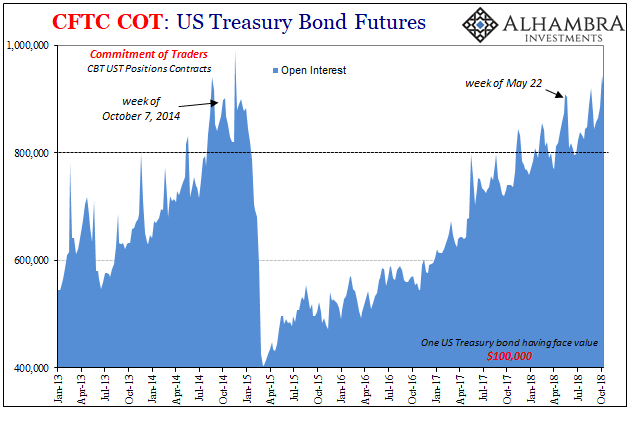

Between May 29 and the last week in August this year, the Treasury futures market agreed with me. The net long position fell precipitously as it had at the end of other reflation episodes. The huge collateral event shook every market and reminded anyone paying attention the robust liquidity risks that remain to this day.

In terms of nominal yields and even Treasury futures, risks were moving back against Jay Powell’s optimistic view of the world. The inversion in the eurodollar futures curve showed that the market was sort of torn; Powell wants to raise rates to the max, but will he be able to get there (wherever “there” is)? In the aftermath of May 29, it seemed again less likely.

Then in early September, the August payroll report shifted market probabilities. The Fed would in all likelihood seize upon the wage data to justify ignoring everything else including May 29 (“strong worldwide demand for safe assets”). I don’t think it’s the same as it was in the first half of 2008. In other words, I don’t believe the market is on the same page as Powell believing fully in that wonderful normalcy scenario. Instead, the market seems to believe that with the wage gains estimated recently there won’t be anything to convince the Fed to reassess its position before “something” big happens.

It’s not a trivial difference.

There are, then, essentially three scenarios for the market. One, it agrees with Powell, like Bernanke before (spring 2008), and the yield curve steepens as nominals rise. Two, it disagrees with Powell and the curve flattens or perhaps slightly inverts signaling that the market expects the Fed in the future will be proven wrong even as it goes about its business. Three, the curve heavily inverts as nominal rates (long end) fall, meaning the market pricing that the Fed is wrong right now.

Given the COT swings, I still think we are firmly fixed in number two. Whichever way it goes from here, the futures market is already worried about “something.” Part of that something is having bet on central bankers too many times before, realizing Federal Reserve policymakers can remain in a state of denial for a very, very long time.

Stay In Touch