For days after China shocked the world in August 2015, “devaluing” its currency seemingly out of nowhere, there was only confusion as to what had just happened. Going by nothing more than the mainstream media and economic narrative fed to it by central bankers and Economists (redundant), you wouldn’t have known anything was wrong at all. Manipulating currency for an unfair advantage, probably.

The US economy was booming. The oil price crash that had similarly appeared out of nowhere was a good thing, they said, a tax cut-like effect that would only make the good times better. Never mind the appearance of “overseas turmoil”, that was someone else’s problem.

None of that was true, obviously, and if you were paying attention you could see it coming. There were warnings all over the place, consistent in their direction (deflation, not inflation) spreading throughout markets. CNY wasn’t an outlier, it was perfectly consistent. I wrote on August 14, 2015, just a few days after:

That does not mean, however, that all this is over; far from it. These tremors are warnings that the “dollar” system’s decay is reaching critical points. The mainstream will tender that this is really no big deal, just a tantrum of spoiled markets unwilling to easily treat the coming end of ZIRP and accommodation; that is simply and flat out false. There is a systemic liquidity problem that is and has been fatal, exposed to a greater degree by the continued withdrawal of eurodollar bank participation – the real “printing press.”

Just ten days later, on Monday, August 24, Wall Street flash crashed. It was, for that day, a gruesome session. True to form, the mainstream downplayed it. Here’s but one contemporary example.

Stock markets around the world recorded dramatic declines. It’s ugly. But before you panic, let’s put this in perspective. This is hardly the worst day ever for stocks. This pullback also comes after six years of stellar stock market gains.

Like 2008, it is absolutely stunning how anyone can realize “markets around the world” all doing the same thing at the same time and not wonder about the connection. And then falling only two weeks after CNY, the dots should’ve been quite easy to connect.

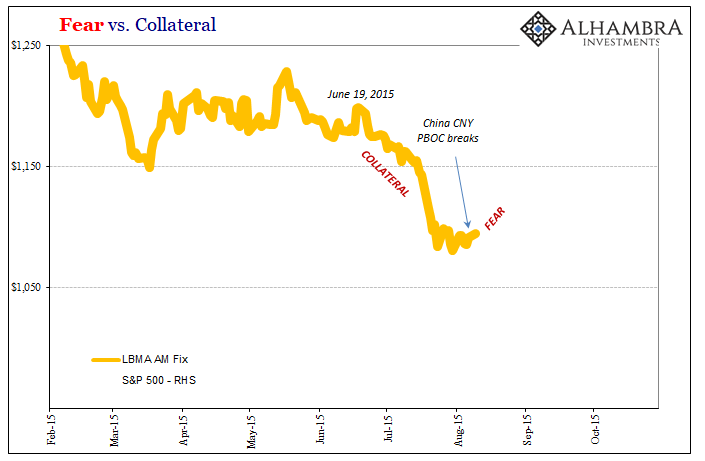

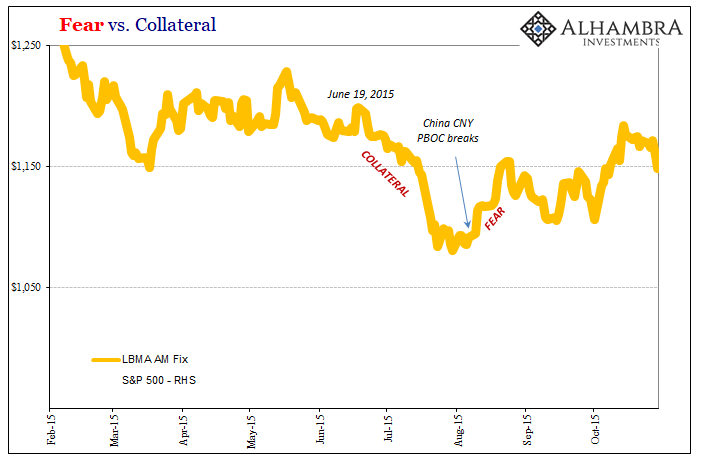

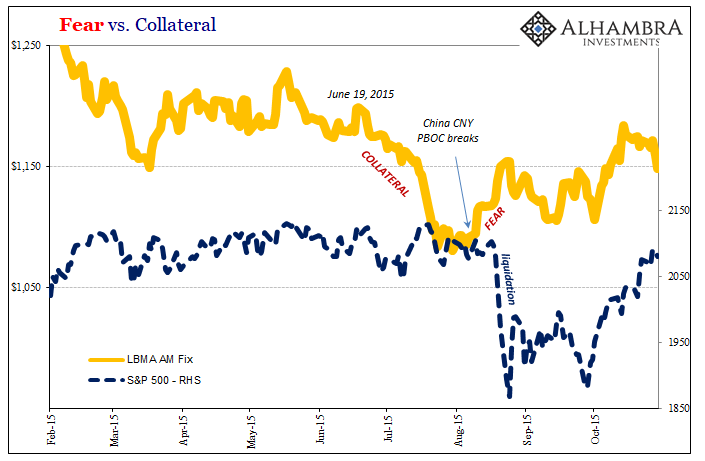

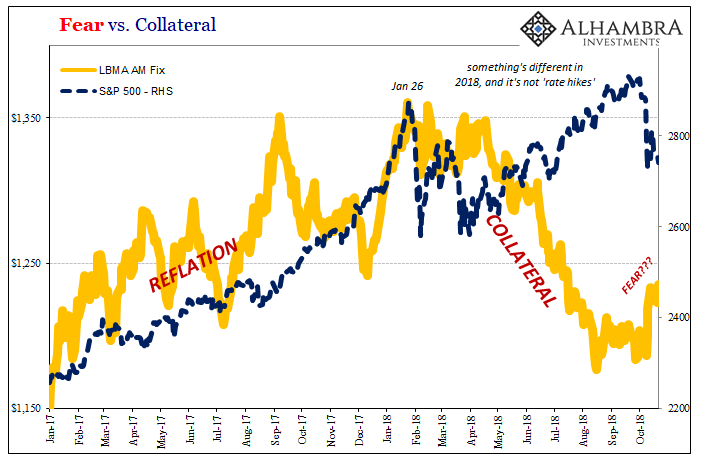

One way to have connected them was with something like gold. The precious metal had been falling for years by then, admittedly, which made it easy to dismiss and ignore. Still, in the months leading up to summer 2015 there was a whole bunch of interesting fireworks in the pits.

From March on through August, the PBOC had pegged CNY making it seem like all that noise in 2014 had been skillfully handled. But from mid-June 2015 forward, gold markets signaled another deflationary wave, likely originating in stalled collateral flow blocked by restricting balance sheet capacity (swap spreads turning negative was pretty conclusive evidence in that regard). Going back to what I wrote on the 14th:

In short, the actions of the PBOC, seen in light of what was a convertibility mini-crisis, a “run” of sorts, make sense where the yuan fix as some kind of “stimulus” in devaluation does not (or is at least far too inconsistent to be explanatory). The PBOC held the yuan steady to a near plateau for five months hoping for cessation of “dollar” pressure, but, like a coiled spring, it only intensified until there was no holding back anymore.

That was the message from the gold market – only, after the “devaluation” the direction completely changed. Instead of continuing its deflationary move lower, gold popped.

A rising gold price is often considered an inflationary, or reflationary, sign. In this case, however, the jump especially during that particular two-week period was hardly of the same variety. It was raw, unadulterated fear permeating the entire global system. Something snapped and though it was never written into the conventional record it still happened all the same.

It was in this window that America finally noticed “overseas turmoil” in their 401k’s.

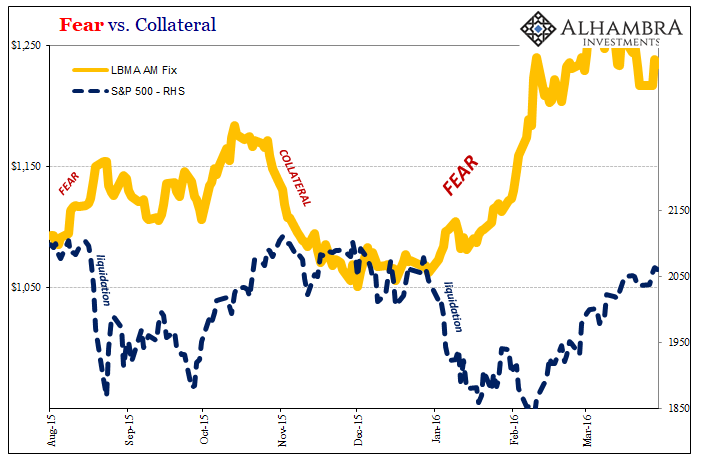

Then, as if to prove these points, the process was repeated in almost exactly the same fashion a second time in a matter of mere months. And to further demonstrate how clueless and useless central bankers are and can be, the Federal Reserve actually kicked off its “rate hike” program in the middle of all this still at that late date believing in that earlier “strong” economy fairy tale.

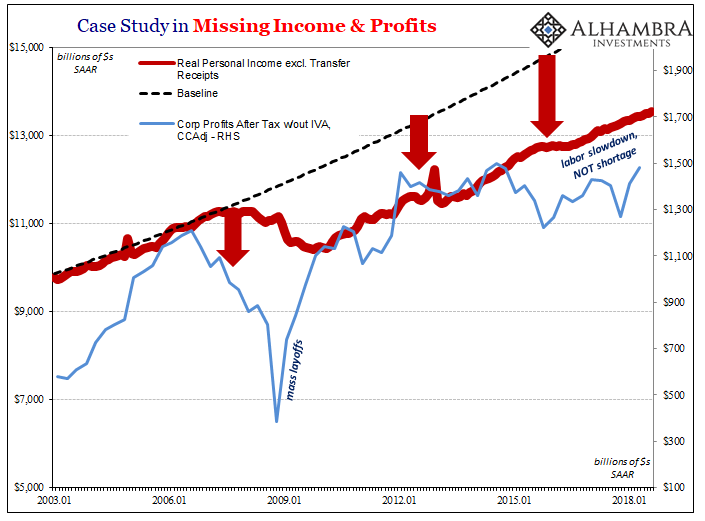

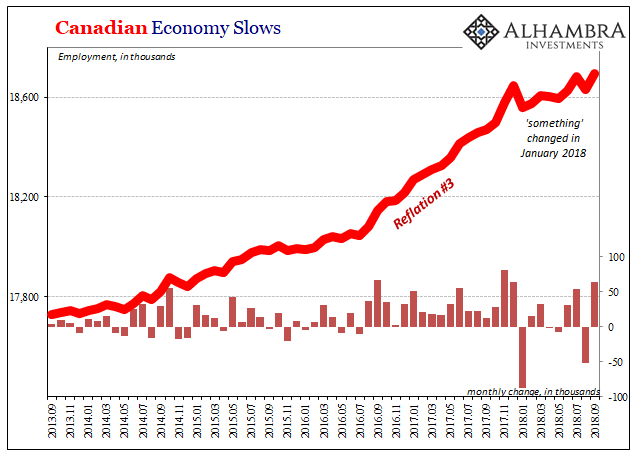

This second deflationary wave ultimately proved more devastating than the first, even if Wall Street never fully accounted for it. In Asia as in other far-flung economies, the eurodollar damage was so severe that they still haven’t recovered from it even after suffering 2008-levels of contraction and shrinking. In many ways, the US economy hasn’t either (labor market, corporate profits), no matter how much the current economy is called strong.

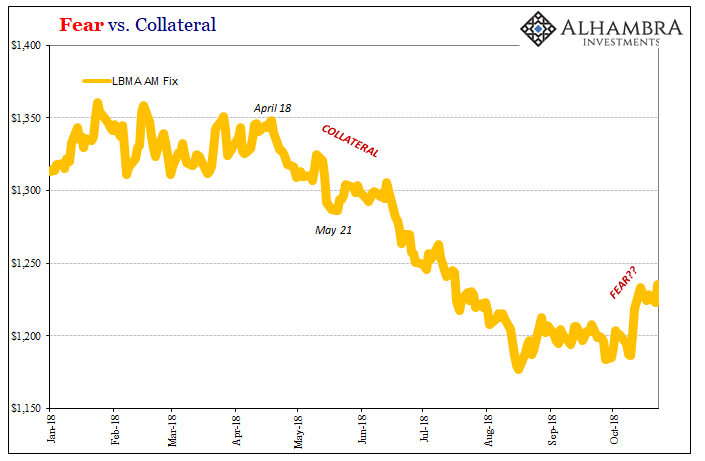

This review is made relevant by gold’s behavior over the past two weeks. After being pounded all year, collateral, gold is up sharply since a few days after China reopened from its National Day Golden Week – under liquidation. For good measure, the PBOC has been practically begging markets to understand its continued dollar warnings.

The collateral part, deflation, is easy. All that re-emerging “overseas turmoil” in emerging markets set off a chain reaction against all collateral forms (haircuts and transformations, EM corporates in particular). Gold stabilized in mid-August and then finally jumps in the middle of October.

Is that the end of the deflation for 2018? Or is it, like August 2015, the transition from cursory warnings to more comprehensively negative signals? Systemic fear in sentiment eventually overcoming the mechanics of collateral in gold.

“Markets around the world” might wish to make that determination. Something, something liquidity. From today’s roller coaster trading session:

At its session lows, the Dow had fallen 548.62 points, while the S&P 500 and Nasdaq had lost more than 2 percent each… The S&P 500 posted its fifth straight decline and briefly dipped below the lows hit earlier in October during this ongoing sell-off. The major indexes are all down at least 4.8 percent for October.

This time it is, apparently, “rising global tensions” rather than overseas turmoil. No matter, it’s all the same thing underneath. It should be clear by now that something’s off about 2018. It can’t be rate hikes, there were those in 2017, too. The question going forward toward 2019 is whether what’s not right is itself evolving even more unfavorably.

The three stages of gold: reflation, collateral, fear. The last does seem more consistent with overseas turmoil that isn’t so far away.

Stay In Touch