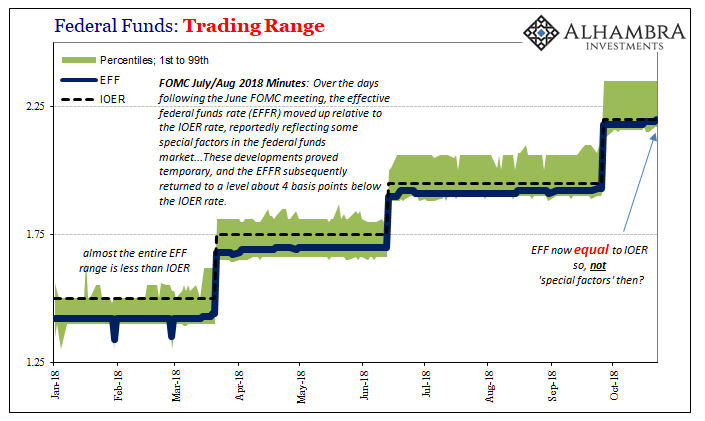

I’ll just repost what I wrote about a week after the “technical adjustment” in June.

How bereft of ideas might they have to be to fall back on IOER? It’s scandalous, really. But the Federal Reserve in terms of intellectual property belongs on the TV program Hoarders. They never throw anything away, so attached do they become to whatever ineffective idea implemented at any time. Practical experience is in their practice impractical evidence.

It’s all binary interpretation at this point; everything works, or nothing does.

I can only imagine how the conversation might have gone:

Empty Suit #1. Hey, federal funds effective has been moving toward the upper range of our target band. Anyone got a theory?

Empty Suit #2. T-bills.

Peripheral Staff Member Somewhat Versed In Modern Money Mechanics. But wouldn’t the increased issuance actually help, especially in the repo market where additional bill supply could offset some of the increase in fails we’ve seen this year?

Empty Suit #2. No, I read somewhere it’s definitely T-bills.

Empty Suit #1. So, what do we do about federal funds?

Empty Suit #3. I know, IOER!

Empty Suit #1. Wait, didn’t that kind of blow up in our face back in ’08?

Empty Suit #3. Yeah, but back then we thought it was a floor.

Empty Suit #2. And if it wasn’t a floor…it has to be a ceiling, right?

Empty Suit #1. I get it now.

Altogether. Genius!

Peripheral Staff Member Somewhat Versed In Modern Money Mechanics. Oh, now it makes sense; the term ‘maestro’ was actually a sarcastic inside joke.

Stay In Touch