The word contagion is easy enough to understand. Whether the spread of disease or disaster, sometimes it is difficult if not impossible to contain. In financial terms, contagion is often thought of along the lines of 2011; Greece started it and it spread throughout the rest of Southern Europe. The euro was coming apart, and what “it” was didn’t seem to matter.

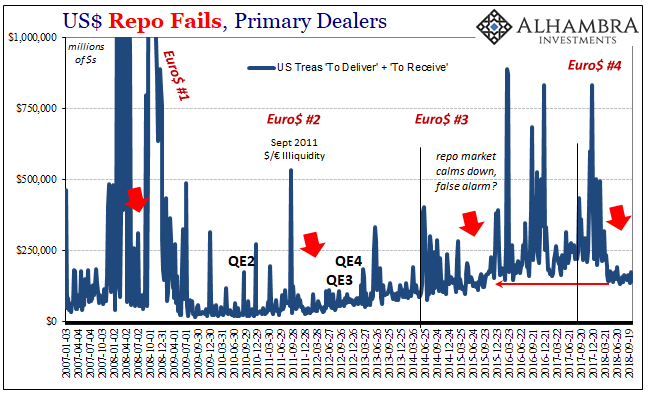

The eurodollar system is not a single, monolithic whole. It features many different pieces that sometimes don’t fit together at all. There is always something wrong somewhere, even during the best of times. It is eerie in hindsight, but there was a huge outbreak of repo fails, for example, in 2001 following September 11th. It kept up for months on end, until the middle of 2002. Outside of dot-com stocks, the system didn’t crash.

Quite the contrary, while the repo market was awash in trouble the recession which had begun months before ended. Economic recovery, though tepid and shameful, emerged out of those difficulties which were at times quite severe (there were more than $1 trillion in fails the week of February 13, 2002). The dollar, in fact, would start to fall and keep on falling consistent with rapid, massive eurodollar system growth and inflation.

Contagion is where funding issues in one part of the system spillover into another; and then another. Rather than operate like a seamless global money system, the parts break down and not always one by one. Parabolic contagion, which is what September 2008 really was, can be lurking.

The effects are not always financial and economic. Two examples from this weekend remind us of this fact.

Both the parties in German Chancellor Angela Merkel’s governing coalition have suffered heavy losses in a regional election, early results show.

Her centre-right CDU party and the centre-left SPD were each 10% down on the previous election in Hesse state…

The federal government must find a “reasonable way of working”, after what looks to be the SPD’s worst result in the western state since 1946.

Brazil has been one of the world’s most exciting emergent nations, yet its evolution over 30 years from dictatorship to hesitant democracy seems to have stalled. Bolsonaro has exploited the oldest politics, that of self-interest, and also the newest, that of anger, polarisation and fear. Voters have stomached his distaste for gay people, feminism, rainforests and the rule of law, to rid themselves of a corrupt leftwing regime unable to contain street violence. A famously tolerant nation has opted for military and economic discipline.

These are the fruits of constant dysfunction. Central bankers keep saying that everything is working again. They aren’t just wrong. When it becomes clear enough to regular people, the everyone-for-himself regime is the least surprising aspect.

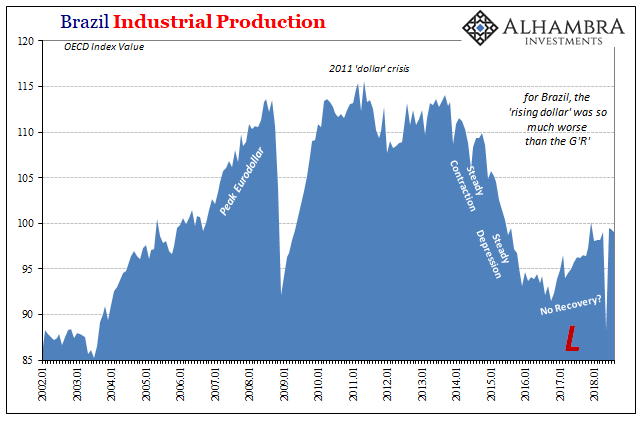

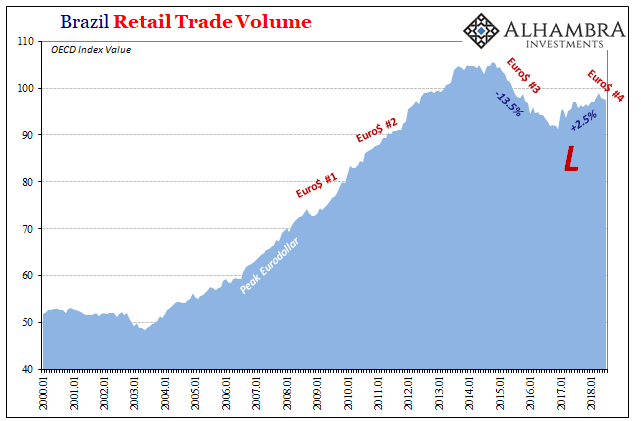

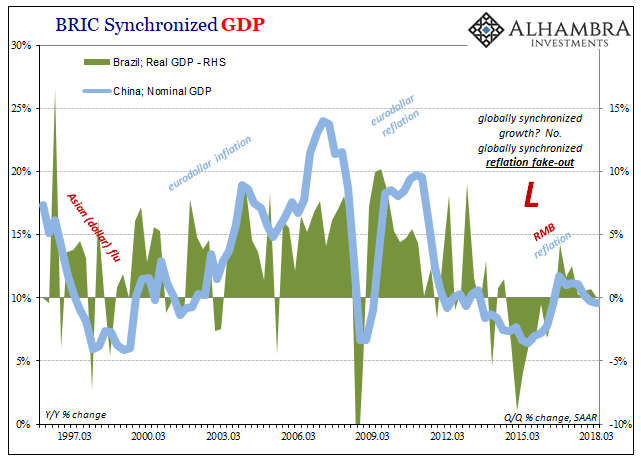

It is a systemic breakdown that keeps breaking down. After a brief respite from the middle of 2016 forward, we’re seeing it all again. Since last September, the warnings multiply and escalate. Contagion has been the word, even as things that were going wrong started to go right.

Repo is a perfect example. The outbreak of fails that popped up in September 2017 suggested serious problems. That repo fails haven’t been an issue since March suggests contagion. It may have started with US domestic collateral (or the limited extent of what’s reported to the Federal Reserve by primary dealers) but unlike 2001 and 2002 it sure hasn’t ended there.

I warned at the start of May over the growing but false sense of calm especially in repo that it wasn’t a one-off but instead an evolving wave of global monetary deflation. The word contagion is somewhat misleading in this context.

To be perfectly clear, I’m not suggesting there is a crash looming in stocks or even “dollars.” More realistically, what does seem to be happening is a widening of difficulties in terms of the dollar shortage and the dollar short. Rather than being an anomaly, we keep finding escalation.

That the repo market sat it out in late March and most of April doesn’t necessarily mean anything other than handing off problems into the next segment (FX). It could also be nothing more than the far side of reverberation, with renewed dealer hoarding April 18 indicating the possibility of the boomerang returning on its backward leg.

The big picture is this; whatever “it” is and has been, it doesn’t seem to be going away at least not yet. Instead, it may be snagging other parts of eurodollar and funding markets that were previously in “reflation.”

This is what’s especially concerning about the new shape of the WTI futures curve. If oil capitulates, has capitulated, to the eurodollar squeeze, too, then we can’t help but conclude that “it” is still spreading too far and wide. Repo and collateral may have recovered from the initial bout of the disease, just as in the first half of 2015, but not before they infected too many other parts of the global system. And that may only mean it is a matter of time before they, too, succumb to another round of infection.

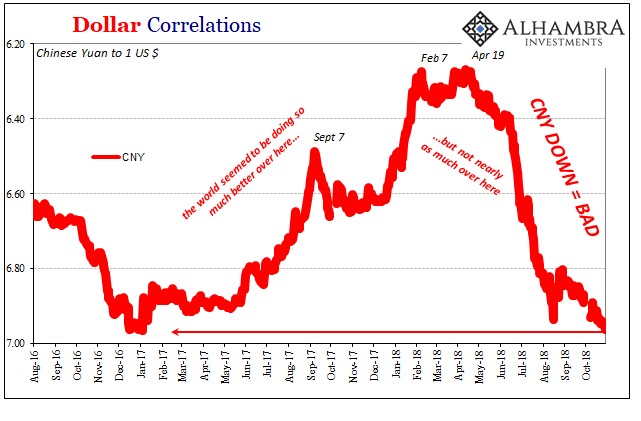

Despite a lot that has happened in response since mid-year, there are key indications threatening to break out all over again. China and CNY have reminded everyone of the simple 2015 truth; CNY DOWN = BAD. Though not enough people learned “why” that is from the last outbreak, they at least appreciate this “what.”

A lot of times, what’s happening in funding markets is just hidden way out of sight. We can see things like repo fails, but what’s driving those fails we may never know. The shadows are deep and very dark.

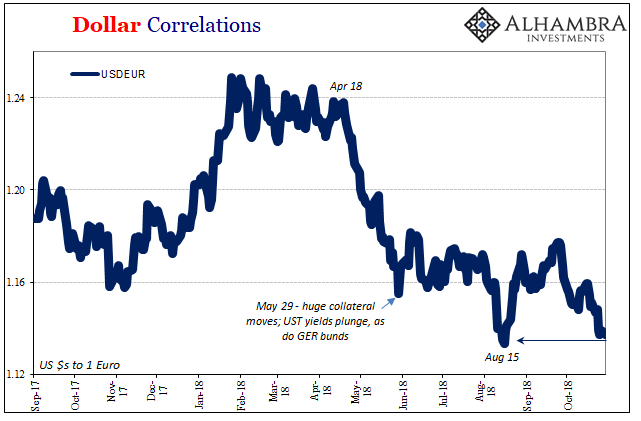

In Europe, one of the central points of Reflation #3 was European banks. The euro has been hanging by a thread since May, and with a small push over the coming days it will make a new cycle low. It would matter for broad sentiment as much as technical risk and eurodollar money.

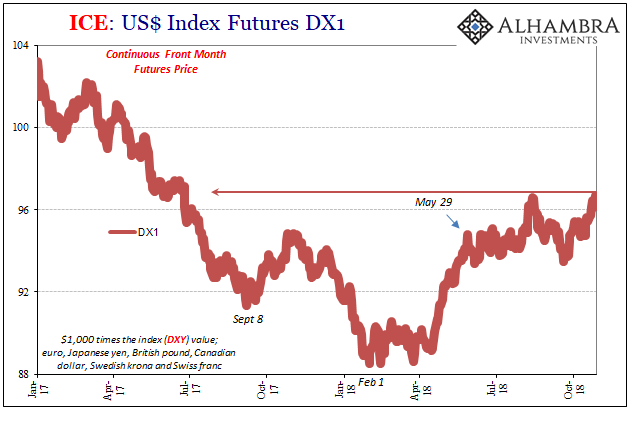

DXY, the narrow dollar index, has fractionally bested August 14 to set a new cycle high today. Again, sentiment matters especially in light of what is becoming pretty well-defined contagion.

The warnings still escalate.

Stay In Touch