As always, it’s about the whole thing. A true economic boom spreads out real gains to the vast majority of the population. There will always be some proportion of people who are left out. But in the good ones, the true upswings, that share is minimal.

This is the big problem right now, especially as GDP has been positive in a lot of places for a long time. It is what confuses people into thinking there has to be a boom. The sad fact is that economic output all over the world, the US included, hasn’t been near enough to minimize the proportion being excluded from these small economic gains. There are still too many people on the wrong side of the economic divide.

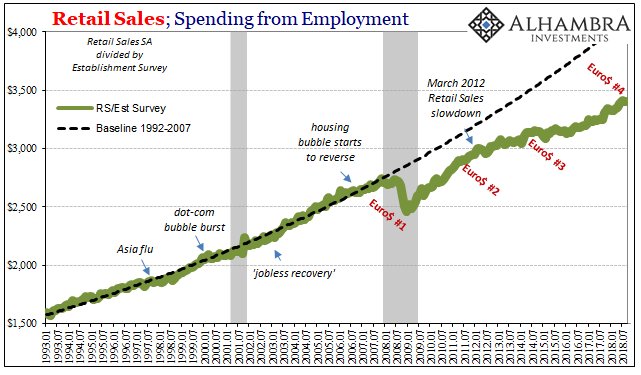

In America, though they go along with the media as to how the economy is described they sure aren’t acting consistent with the rhetoric. Spending remains down across-the-board, and those in the most afflicted of areas are swinging back and forth looking for someone to give them answers.

Two years ago, the Rust Belt provocatively delivered Donald Trump the White House based in large part on his observations about the “fake” unemployment rate. Finally, someone in the right position was willing to say what many actually felt and still feel. He’s since embraced that particular statistic as has so many around him. Last night, maybe the President was reminded?

President Donald Trump got a warning sign on Tuesday from the Midwestern and Rust Belt states that handed him the presidency, as voters delivered big victories to Democrats and offered a road map for the crowd of candidates lining up to challenge him in 2020.

There are a whole bunch of acerbic political factors rolled up in this midterm ballot and it’s far too easy and admittedly convenient to distill everything into these broad economic terms. Regardless of complexity, it’s difficult not to appreciate the possibility.

The US economy is not booming enough, therefore it is not booming. And now it faces far more difficult prospects than the low ceiling.

While everyone is focused on Democrats versus Republicans, who controls the House and which the Senate, in those economic terms attention should be directed towards Oklahoma and Chicago. The oil market is screaming that even if it was a real boom, it is in its dying days.

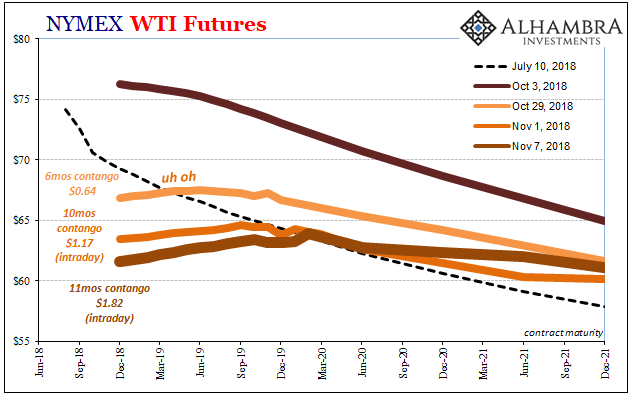

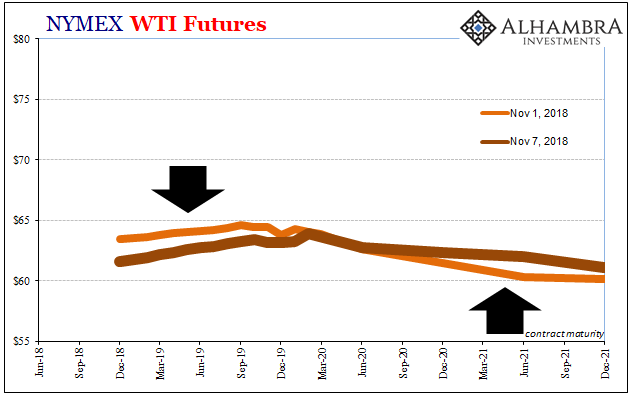

It is now more a matter of morbid curiosity, to see the oil curve contort and recoil bringing back memories just four years old. The curve is behaving exactly like it did in late 2014, another period people have largely forgotten how so many desperately tried to make that one into a boom, too. It failed because there wasn’t near enough “good” growth to stave off the building negative pressures.

Those showed up right on the WTI curve as well as in any number of places. The warnings were ignored because that’s what Economists and central bankers do best. Subprime is never contained because it’s never about subprime.

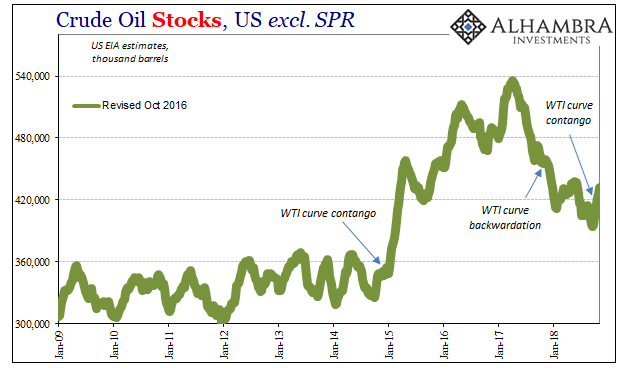

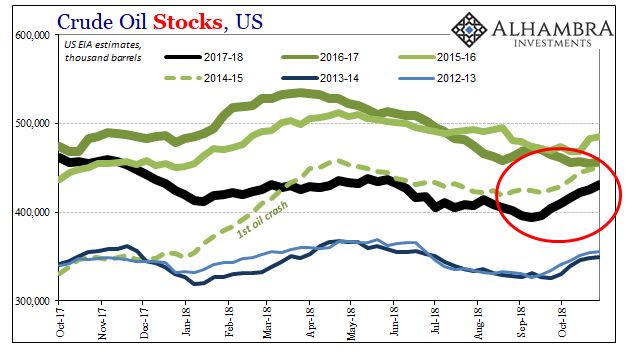

The fundamentals for the oil market aren’t good; they really weren’t all that much better last year, either. The mainstream penchant for making a lot out of a little followed in Cushing, OK, too. Was economic demand really picking up? Judging by domestic crude stocks, it didn’t really seem that way.

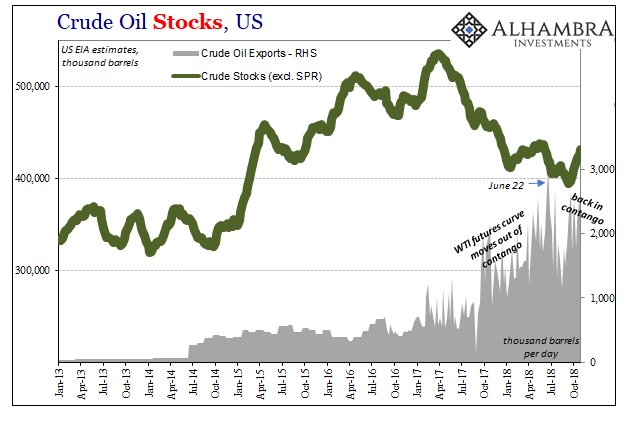

Instead, a large amount of domestic oil was diverted overseas. It made the onshore crude inventory seem more balanced by simple comparison. It never really got rebalanced, and the trajectory in that direction was suspect to begin with.

Now oil is pouring back into Oklahoma and the traders in Chicago (once upon a time, at the old CME pits) are taking note. Is that because oil exports aren’t as robust as the domestic situation needs for physical supply rebalancing? It’s hard to say since crude exports are a new thing. We really don’t know just how much oil “should” be flowing to foreign hands.

But we also should pay attention to the fact that weakness in the global economy might be one explanation for what’s going on in Oklahoma therefore Chicago. We are in a seasonal accumulation pattern, but so far in 2018 it’s been more like 2015 rather than 2017 – which isn’t a good sign.

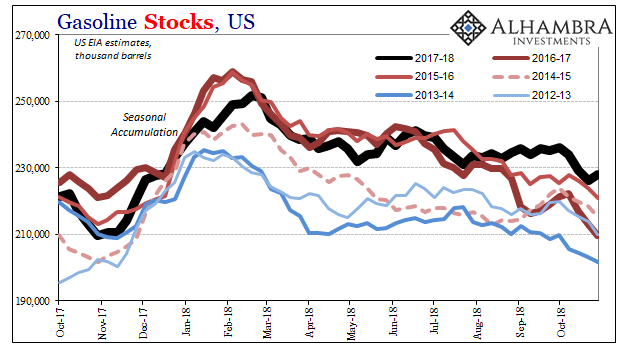

In gasoline and other products, stocks are being drawn down as they usually are at this point in the calendar. As of the latest figures, the aggregate inventory of gas is at record highs for this time of year. This is certainly one reason why crude is piling up in domestic storage.

And now the WTI futures curve is displaying already some degree of desperation for more physical oil to keep going in that direction. The contortion in the curve is, again, entirely too familiar.

Speculators, evil or otherwise, along with producers and other market participants are more and more discounting current oil so as to create a financial incentive for others to take the risk and move crude into future use. The more they discount the front compared to the back end of the curve, the greater the imbalance is perceived to be. In barely a month, the WTI curve has shifted from steep backwardation to that unwelcome, disquieting fish-hook at the front.

It may be that Republicans have just lost the Rust Belt for embracing what is really a fake boom. What if they don’t even have that anymore? If this is the best the US economy can do, it’s going to get serious again.

As much as it may be emotionally satisfying to see, for once, US central bankers uncomfortably roasted, honest analysis requires that we recognize the warming up for scapegoating. Chairman Powell, answer your phone the President’s on the line.

Stay In Touch