We can add realtors to the list of those who are angry with Jay Powell. The housing market continued its perplexing slump in October, according to a broad section of data encompassing everything from construction to sales of existing homes. We have been told since Economics 101 that the central bank is, well, central, therefore it is easy to infer causation from mere correlation.

The Fed is “raising rates” but unlike what’s taught in schools the FOMC doesn’t control all that much. Very little in the modern diagram. But because monetary officials claim to be tightening and now the housing market is clearly within a slump we shouldn’t ignore that correlation does not mean causation.

After all, we begin this study under false (mainstream) pretenses.

The housing market is stumbling through its longest slump in four years, as the divergence between a booming U.S. economy and weakening home sales that many had dismissed as temporary now looks poised to continue.

We can add real estate to a very different list, too, one that would contain an actual as opposed to imaginary economic boom. Already included on it are automobiles (people buy lots of autos during a boom), capex-starved businesses (firms build and borrow in a boom), and now the housing sector. If the economy was booming, people would be buying and building houses. A lot of them.

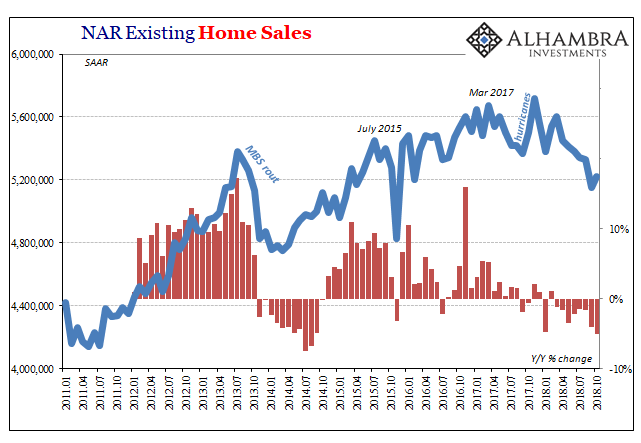

First, the slump. According to the National Association of Realtors (NAR), the level of resales in October 2018 rebounded by only a small amount from the multi-year low in September. The estimated number of transactions was 5.22 million (SAAR) last month up only marginally from 5.15 million the month before. November is merely the second worst month in three years.

Year-over-year, resales have fallen in each of the last eight straight and in nine out of the past ten. You easily notice those on the chart above and maybe miss the prior inflection which shows up far earlier in the summer/autumn of 2015.

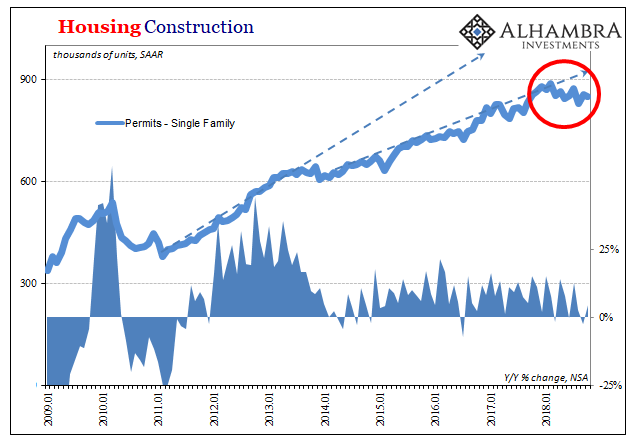

It’s the same in the construction of single-family homes. The Census Bureau reports that in the month of October the number of permits filed to build these residential structures was stuck at around 849k. That’s down slightly from earlier in the year but more importantly nowhere near historical levels of construction activity.

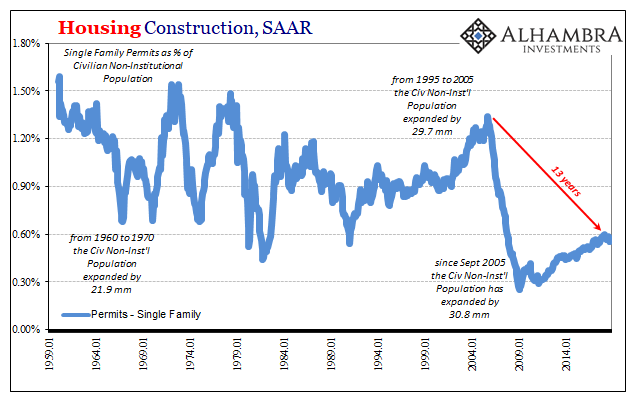

It’s the same with resales; if the housing market has turned downward in 2018 it does so having never actually recovered from the last housing bubble.

That, more than anything, gives us a clue as to what’s really been going on in the real estate market. It, like the economy overall, appears robust but only in the narrow context of the last decade. It’s clearly better than it was at the bottom, but that’s a meaningless evaluation. Yet, this is what is used to set expectations about where things stand housing and economy. Better than the bottom does not equal boom.

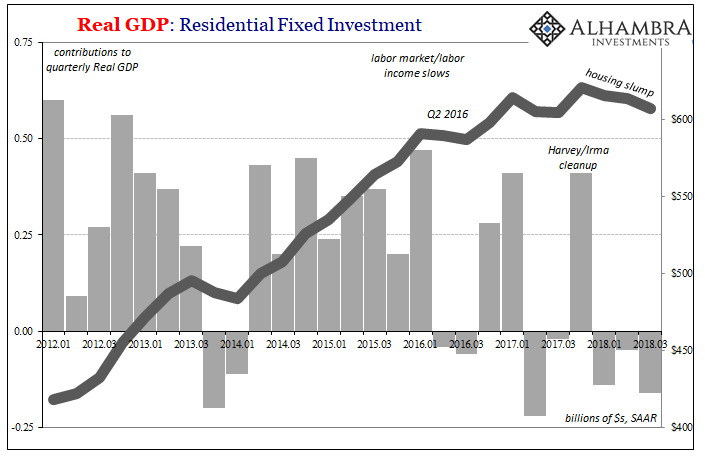

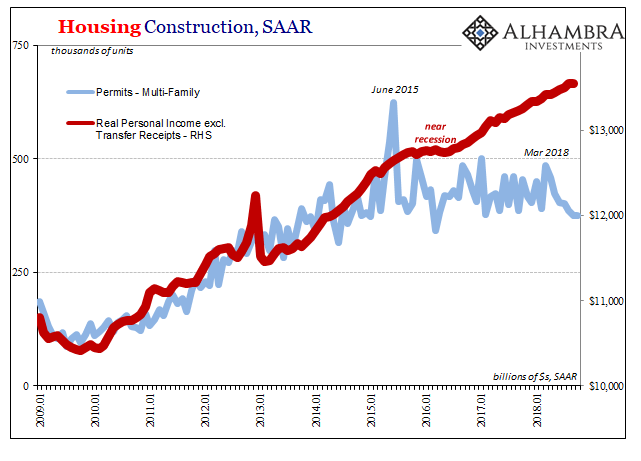

If the economy as a whole has been in a more precarious shape than otherwise discussed, you might understand why housing has slumped for more than just this year. In 2015, the labor market was hugely disturbed even though there was nary a peep from the NBER about cycle troughs and not a word in the media about how close we were to full-blown recession.

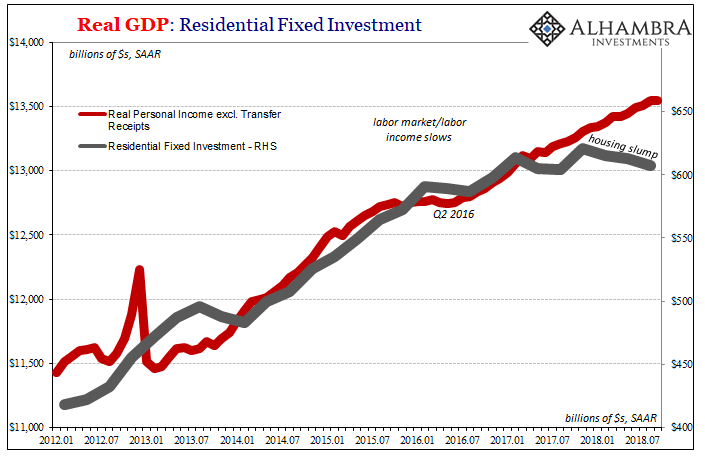

Though it wasn’t officially recorded in the narrative, it happened nonetheless. The results, as noted above, show up in a lot of key places. As a consequence of the US labor market slowing rather than speeding forward, the trajectory of income growth changed dramatically.

In last month’s GDP report for Q3, the BEA figures agree with the change in direction as well as its timing. You can choose to focus on only the last three quarters and make them about federal funds, but it is pretty clear that the housing market was changed in behavior all the way back at the end of that last downturn.

Putting the two together this way leads away from confusion; the economy slowed, the labor market, too, and people at the margins have been behaving as such for several years now.

Workers/consumers were right to become concerned about “overseas turmoil” in 2015 and 2016. Experience has showed that the occurrence of financial irregularities happens to coincide with more negative economic developments no matter now they might be downplayed or ignored throughout.

We aren’t surprised then that during another year where “overseas turmoil” “unexpectedly” returns American, workers/consumers are acting more cautious in the same manner no matter what they tell sentiment surveyors. You don’t buy big ticket items nor commit to huge payments when in your own experience the labor market and economy aren’t so robust.

This view obviously applies to rent as much as mortgage payments. The whole construction market began to slump when the economy did in 2015. This cannot have anything to do with Jay Powell as Janet Yellen.

It only got a little bit better during the reflation of 2017, not enough to make all that much of a difference. Eurodollar tightening like back in 2014-15 has reappeared and though nobody knows it that’s why the overseas turmoil is back again. The dollar rises and people stop listening to Economists and central bankers.

Consequently, the confluence of negative factors has led to a renewed slump in housing, and perhaps (likely?) much more than housing. Blame Jay Powell if you want, but if you do so you must realize the futility of it. Not that he won’t chicken out at some point, the FOMC almost certainly will (important markets right now are betting on it). Rather, when he does and stops the “rate hikes” it won’t mean a thing because they weren’t ever the problem.

We’ve got much bigger ones than this. Or, as I wrote several years ago:

They targeted a monetary rate that nobody uses in order to project a story that nobody believes just so the media would write about an economic recovery that doesn’t exist. The Fed is truly a joke, and though it isn’t funny it is for now the only one we can tell. Until enough people hear it, we are stuck in only bad scenarios.

Again.

Stay In Touch