Unfortunately for Jay Powell, labor statistics are at best backward looking and often just plain misleading. Can you imagine if the wage data contained with November 2018’s payroll report had been released last December instead? Today, pretty much nobody cares anymore. We’ve flipped from inflation hysteria to inversion unease and that was always the appropriate direction.

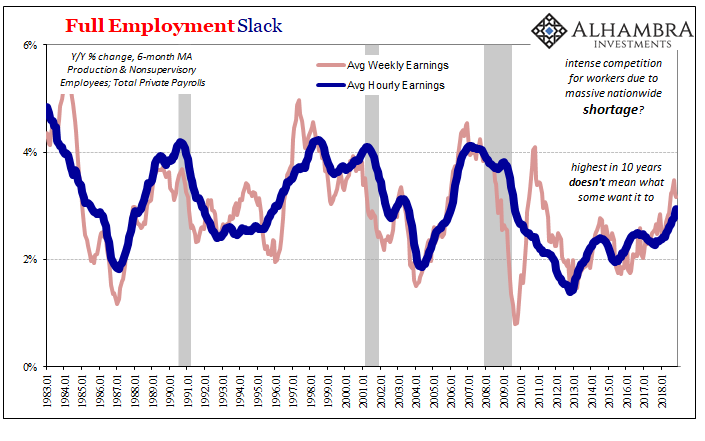

Average hourly earnings increased 3.2% year-over-year last month. Obviously, once again that was the highest increase in almost a decade. Other than October, the last time BLS data counted 3% hourly wages was May 2009. The 6-month average for the volatile series is pressed right up against 3% (still just short).

And it’s just as unimpressive now as last month and the month before. The only way 3% is good is if the labor market is on its way to more normal 4%, or, which would be consistent with a labor shortage of the sort that has been described over the last year or so, 5%. Just passing 3% while the unemployment rate has itself been 3.7% for three straight months is, again, remarkably unremarkable.

That’s why, ultimately, markets and even the media don’t really care as much about this one data point like they did previously. Everything here is being superseded by events elsewhere. Maybe if the economy kept going in its low-grade upswing for a few more years we could see 4%, but the chances of that happening diminish by the month, even by the day.

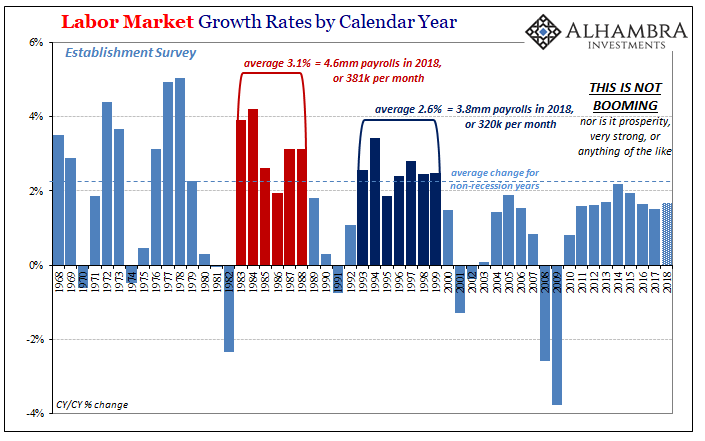

Because of inversion, several of them, actually, many are now forced to confront a more realistic interpretation of the economy – starting in the labor market. It hasn’t really been all that good in 2018, only slightly better than 2017 which was a pretty bad year for American workers.

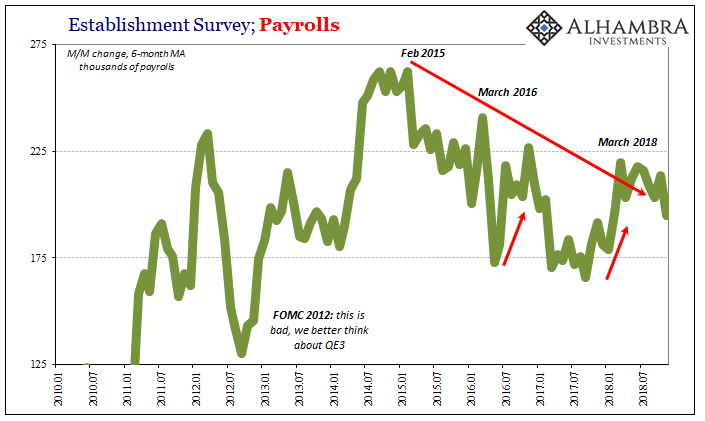

It is nowhere near what would legitimately be classified as an economic boom. Payroll growth so far this year is decidedly less than 2014, and the supposed “best jobs market in decades” during that year was no match for Eurodollar #3.

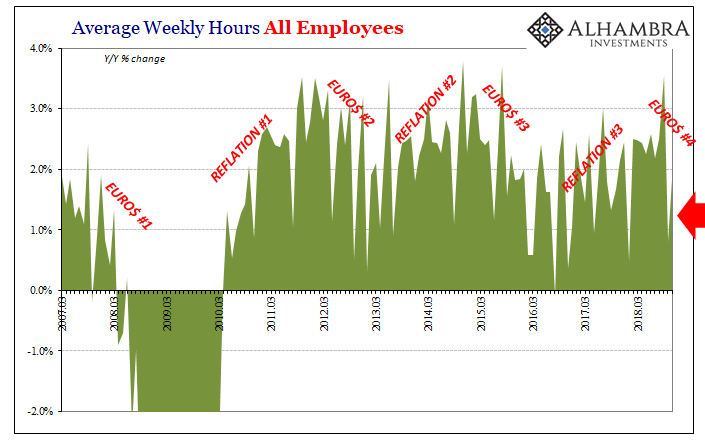

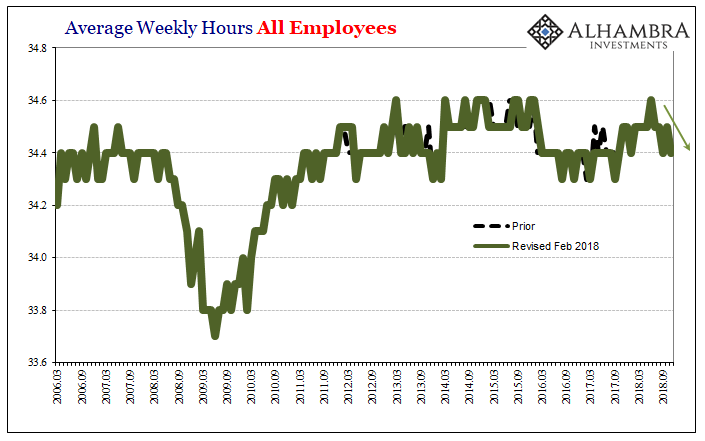

There are, in fact, a couple of concerning developments contained in this overall data. One of the more coincident rather than lagging indications is total hours worked. This series is somewhat volatile so it’s impossible to make any judgements from a specific month.

However, growth in hours tailed off sharply in October (+0.8% year-over-year) and then performed nearly as badly in November (+1.8%). It’s the first time hours have grown by less than 2% for two consecutive months since September and October 2017 (yes, the Harvey/Irma boost is being removed from the annual comparisons).

It’s not nearly enough to claim Eurodollar #4 is already having an effect on the labor market, though that is one possibility suggested here. The figures may be revised in the months ahead, but if they aren’t these were two pretty weak hours numbers piquing our suspicion.

The rest of the report is mostly the same as every month. It’s been so long since the economy has performed anywhere near population growth and potential that it’s become easy, and lazy, to suggest things are good. The headline payroll estimate for November was itself low at +155k but not really that much lower than they’ve been all year.

The only significant factor indicated by the 2018 levels is that if another US downturn does begin to materialize in the months ahead, it will do so from a relatively weak starting point – much lower than in 2015 when the last one struck. In broad labor terms, especially income, we still haven’t recovered from 2015-16.

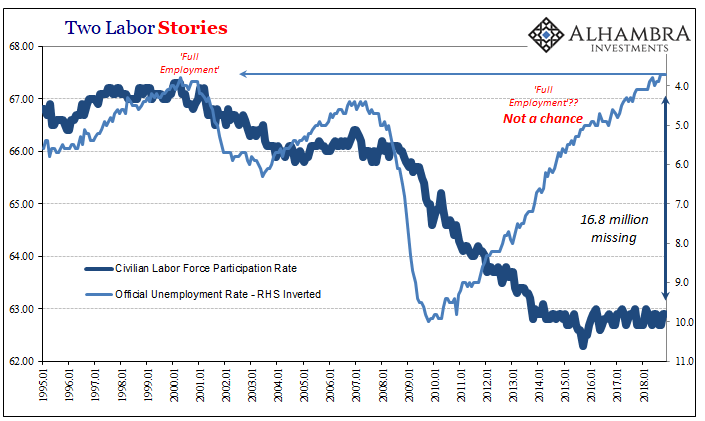

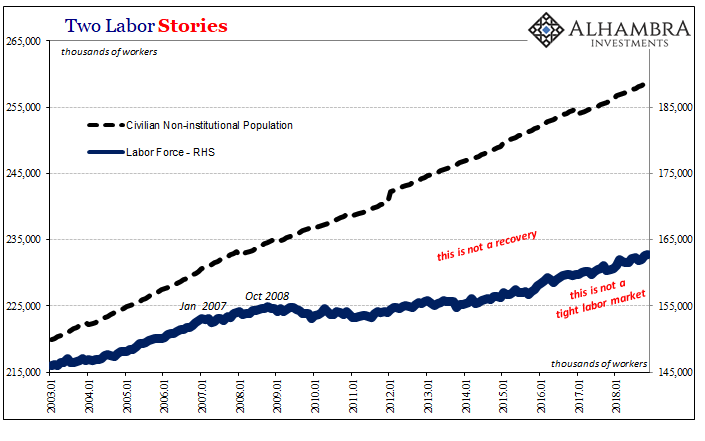

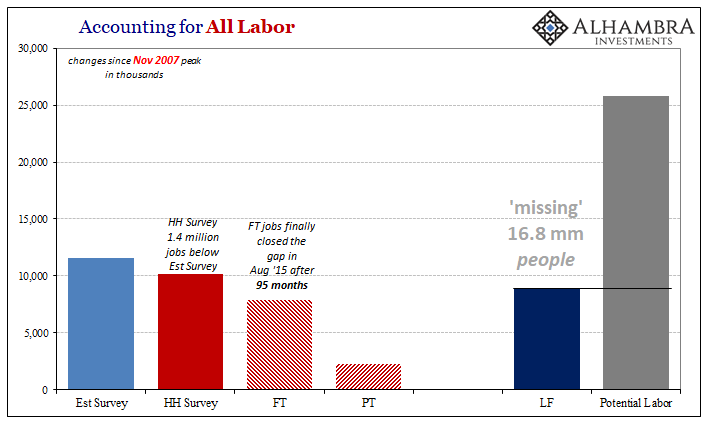

The labor force increased somewhat in November, +133k, after a big jump in October. Yet, the trend remains steadfastly lackluster despite the unemployment rate. All along, Economists and policymakers have been waiting for wage gains and payroll growth to trigger a mass influx of previously sidelined workers.

More than anything else, that would’ve been the definitive signal that the economy had finally achieved recovery. You wouldn’t need any detailed statistics, just people seeing it for themselves and joining in on the good times for once.

The Great “Recession” pushed millions out of the labor force who might otherwise be employed if they were actually given the opportunity. It, opportunity, just hasn’t happened; it doesn’t even keep up with population growth, and that’s just on the expansion side not counting the contraction in the labor force October 2008 to August 2011. The number of “missing” keeps going up, a lot, as each year passes.

A real recovery wouldn’t make it all the way back since the pickup would stop short of participation rates like those prior to 2008. There is some residual from Baby Boomer retirement, but it would find its way much, much closer to population potential than it has been since Lehman Brothers. If that was the trigger for an unrelenting malaise absolutely perceived by the American labor force, it’s a pretty big clue as to what’s been wrong and is still wrong.

What really happened last year is Economists and policymakers tried really hard to talk everyone into an economic boom that didn’t exist. In textbook Economics, that’s what you do; there is no money in monetary policy so central bankers try to wield credibility in its place.

In other words, if it seems like things might be moving in the right direction and then officials chime in with robust interpretations using purposefully strong wording they actually believe that it will become a self-fulfilling prophecy. The textbook says that if you get people believing in the narrative they will start acting on it. Positive numbers plus pedigree for them equals an actual boom.

For everyone else, a boom has to begin in reality. Pop psychology just won’t do it, though it can and did fool any number of people into thinking it was possible. Nothing had changed in 2017, the same depression-like baseline remained in effect. The low-grade upswing of Reflation #3 was all it was.

What a difference a year makes. In December 2017, 3% wages would’ve been plastered all over the media, the end of the bond bull the mainstream chant, and a suite of happy central bankers the plain result. If only their policies, like their suits, weren’t so empty.

Stay In Touch