All better now. It’s a Christmas miracle, the plunge erased by market closure as if FDR had just been re-elected and taken the oath. The Dow is on everyone’s mind, so trading on December 26 has understandably stuck.

Stocks posted their best day in nearly a decade on Wednesday, with the Dow Jones Industrial Average notching its largest one-day point gain in history. Rallies in retail and energy shares led the gains, as Wall Street recovered the steep losses suffered in the previous session.

The sigh of relief is palpable all across the world. The BIS called the steep, worrisome liquidations up to now Yet More Bumps On The Path To Normal, and the rallies especially in stocks and oil have served to confirm the thesis. Just some minor, dare I say transitory discomfort on the road to paradise.

Is it though?

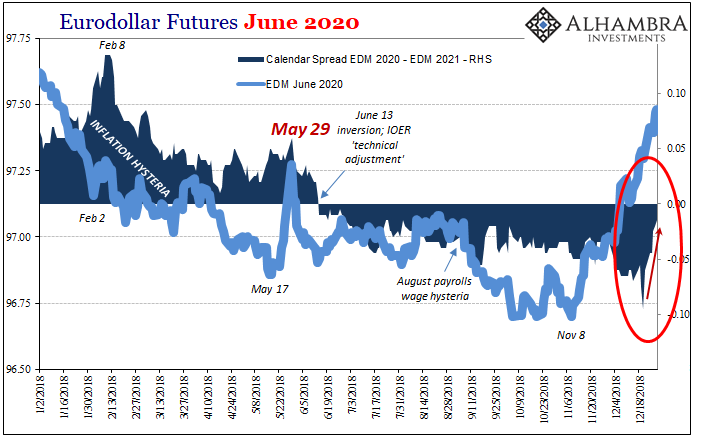

We have been watching eurodollar futures, well, forever but with even greater purpose and intent since mid-June. There is little the eurodollar curve won’t spill information about, and its inversion around then was a huge warning that whatever shook the global money network on May 29 was indeed nothing to just ignore.

Money curves are supposed to be upward sloping reflecting the risks of a healthy environment, including economic opportunity. For it to be distorted to the point of being upside down, that’s big. People have a hard time interpreting regular curves, so unhealthy ones are much more a mystery (thanks to Economics).

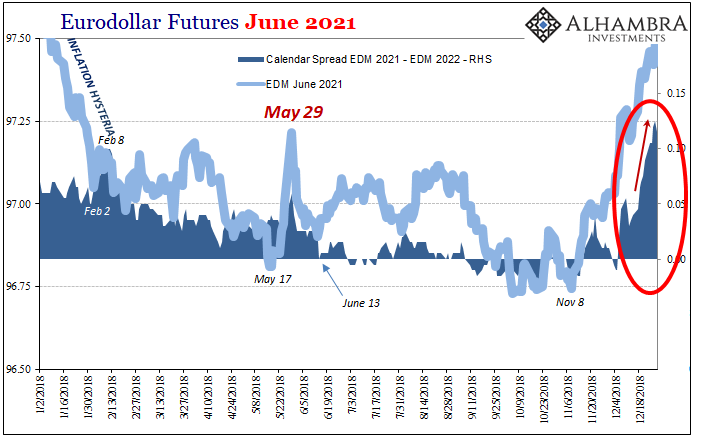

The specific contracts displaying eurodollar’s version of oil contango were those out several years, the 2020’s to 2021’s. For a time, the inversion extended into 2022. For the few who noticed, this didn’t seem too much to be concerned about; a far distant probability of some nonspecific hedging case. Surely the world can be fixed given two or three years.

That inversion has largely disappeared in December 2018. Another sign that things are getting better?

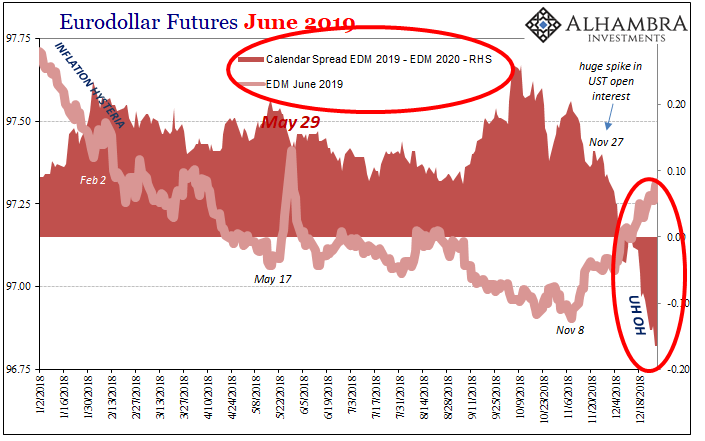

Nope. This is bad folks, right up there with the WTI shifting back into contango as far as warnings go. The eurodollar curve inversion hasn’t disappeared, it has now moved up.

What I wrote back in July showed up this month:

Yes, it is this “bad scenario” that is causing futures investors to increasingly hedge against it. For now, they are doing so in the 2020-22 contracts, but that doesn’t mean they necessarily expect those years to be exactly when all this happens. The curve shape is not meant to be taken literally.

Participants are growing concerned about a future problem that they feel requires some increasing level of protection, and it may just be those contracts are where this protection is most available at the market-clearing price. At just a few bps of inversion, what should be noted here is some future “bad scenario” whose outlines don’t yet show up on this side of the horizon. What’s going on with inflation hysteria and Jerome Powell’s intractable viewpoint only muddies that horizon.

If things continue on as they are, including yield curve flattening all over the world, it may be that the June 2020’s get bid so that they eventually invert with respect to the 2019’s…

That’s just what has happened, in a big way.

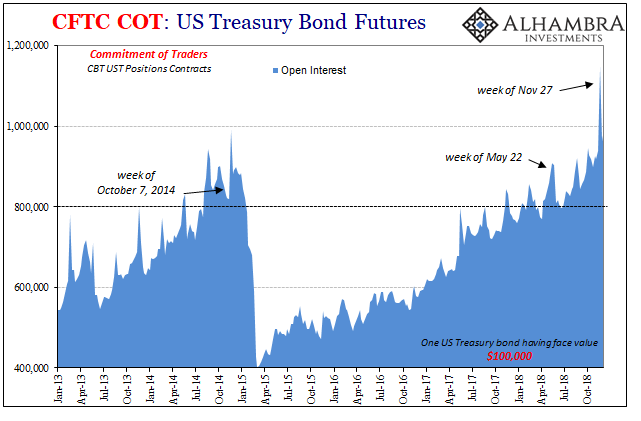

The same week that the CFTC COT records a massive spike in open interest for UST futures the eurodollar curve inversion moves to the visible side of the time horizon. Investors in perhaps the most important market in the world are no longer preparing for some non-specific distant “bad scenario” they are increasingly preparing for specific dangers now within sight.

As noted earlier this week, we’ve surely progressed from uncertainty (2020-21 inversion) into fear (2019-20 inversion, and deep at that). This curve contortion is the biggest warning yet in a month filled only with big ones.

This isn’t about the Fed at least so far as what its officials are intending to accomplish. The market has moved way past a “Fed pause” and into a full-on Fed reverse. Ask yourself, what would force Jay Powell to shift from his current stance of an unshakably “strong” economy and labor market to the exact opposite place, lowering interest rates in a desperate and futile bid for stimulus?

What happened to Bernanke between March 2007 when subprime was contained and September 2007 when the FOMC voted its first cut proving it wasn’t?

I’m not at all claiming that the situations are exactly the same; they aren’t. This won’t be about mortgages, for one. The scenarios are different, too, when considering economic circumstances; up to 2007, there had been some actual economic growth in the world; for a long time before 2018 there hasn’t. The specific challenges will be different and ultimately that’s what the shifting inversion really means.

The global economy is very likely about to be seriously challenged.

Stay In Touch