Central bankers will often tell you exactly what you want to know, at least when it comes to their intentions. You can first begin by reading Milton Friedman and Anna Schwartz’s 1963 monetary bible A Monetary History. It’s all in there. From it, central banks all over the world have devised technical schemes intended to hold fast to the old theories.

I mentioned last September that before Brazil embarked on its suicidal course in the summer of 2013 the country’s central bank had published a paper on the issue of reserves and swaps. The timing wasn’t coincidence given how Banco do Brasil was in the middle of managing reserves via swaps.

A well known advantage of issuing such contingent liabilities as currency swaps is that authorities become able to intervene in the exchange market indirectly, without affecting the money supply or varying the stock of foreign exchange reserves.

There are a couple reasons why any foreign central bank might be reluctant to mobilize its foreign reserves. The first is stigma, something like a bank going to the Discount Window at the height of panic. If Brazil during the currency crisis of 2013 had begun “selling UST’s” then there was the nontrivial chance this could make it worse. Something about encouraging speculators (of the “evil” kind).

The bigger problem is internal money supply. The loss of reserves has a direct effect on the central bank’s balance sheet. Withdrawing foreign reserves means shrinking central bank assets – an actual QT. Without some offsetting internal maneuver, itself fraught with difficulties, domestic currency and bank liquidity must suffer.

Swaps therefore propose something like the perfect solution. A central bank can deal with “outflows” (eurodollars) without having to pay for its intervention immediately. In Brazil, they subsidize local banks into borrowing eurodollars on their behalf without disturbing the reserve stockpile nor the domestic monetary condition.

Like a magic trick, the evil speculators are left stunned and bewildered, retreating from their dastardly antics as central bankers successfully protect their national interests.

That’s not quite how it works, though. To start with, “speculators”, evil or otherwise, aren’t that stupid because they aren’t really speculators. They are global eurodollar banks who to a central bank might seem like speculators but in reality are the basis for global reserve money. Information asymmetry is working against the 21st century use of a 1963 monetary handbook.

More than that, however, while central banks may focus on the reserve stockpile eurodollar banks work out risks now and in the future. To put it bluntly, it doesn’t matter how you intervene as a central, selling reserves or swaps, what matters to them is that you did (what I’ve called the nightmare scenario; briefly, the more a central bank does, the worse it makes things by doing something). In some cases, the fact that you’ve tried to obscure it by going the swaps route can itself be an even more negative signal (how bad must it be if the central bank feels it has to hide the problem?)

The published level of reserves might not change if you use swaps, but those have to show up somewhere. The question is where.

After the disastrous experience during the summer of 2015, it had become somewhat noticeable that China’s central bank was following in Banco’s footsteps. The reasons were more obvious; to fool Western Economists and the media which uncritically parrots their every opinion.

The PBOC wanted to hide some of its eurodollar interventions, which it did starting that September. In the media, we were treated with a number of stories proclaiming that whatever it was in August (they weren’t sure, which should’ve been their first clue) it was definitely over.

Eurodollar markets were unimpressed because China had simply become Brazil. I wrote exactly that in October 2015:

The Brazil case is not exactly analogous given its unique financial connection to the eurodollar system and how its central bank attempts to manage it, but the situations are in general terms identical. Brazil found itself in “dollar” trouble in the middle of 2013, instituted swaps and forwards and “bought” only a few months peace and the appearance of calm. Once the maturity transformation took its place, starting September 2014, the real has been obliterated an order of magnitude worse than imaginable at the start of the program in 2013…

In the parlance of what I have used to describe for Brazil, the PBOC like Banco do Brasil enticed Chinese banks already short (synthetically) the “dollar” to become more so – all because they are coaxed into believing, as Yellen, that the central bank will have it covered on the other end. The PBOC’s motivation is only immediate, just hoping that the unwind into the future can be more manageable. What Brazilian banks found was quite the opposite, and Brazil is now suffering greatly for it.

The exact mechanics of these swaps aren’t known. We can sketch out their rough outlines, always keeping in mind we are working in the dark (shadow money, after all). State-owned Chinese banks were borrowing “dollars” via increasingly expensive swaps with eurodollar banks and then selling them domestically in cash to dollar-starved local banks desperate for them (shorts and shortages).

They did so because like in Brazil the central bank was subsidizing the swap via its own forwards, liquidity backstops, and I think even some term repos collateralized by those UST’s it holds. But where does the central bank end of these triparty transactions show up?

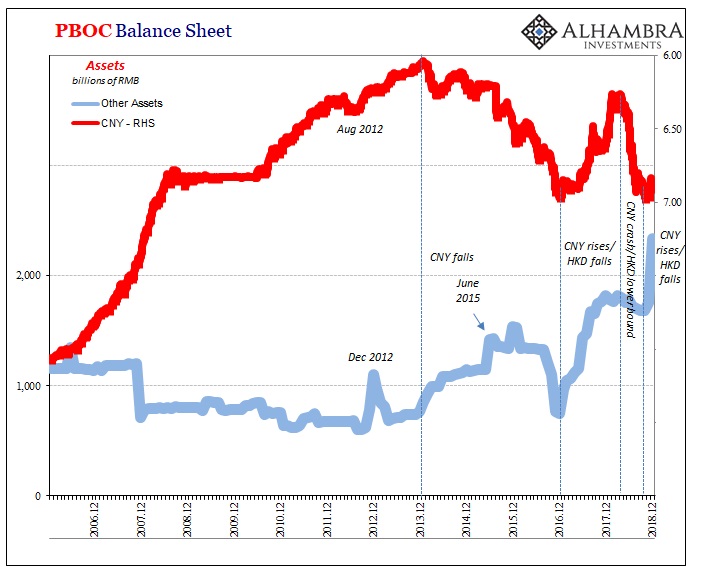

Like any financial institution, the PBOC as Banco reports a line on its balance sheet for “miscellaneous” or “other” assets. It is the proverbial black box of sundry remainder items, one of which might be our extremely important eurodollar workaround. It is, again, impossible to say for sure but the pattern is intriguing to the point of being compelling.

Our main interest here is December 2018 (and whether what happened in December is over, or whether like August 2015 it might just be getting started). Unusually, for the last half decade anyway, last month was obviously awful with the equally obvious exception of CNY. If CNY DOWN = BAD, then why was CNY up during some of the worst conditions in a very long time?

The more obvious answer was and is intervention. Given how HKD has performed alongside, it was almost a guarantee. Our task is to try and find any residual evidence more so of the Brazil type. To wit:

It’s not conclusive, of course, and could be related to a number of possibilities but this (above) seems pretty persuasive anyway. It isn’t a small number, either, an increase of RMB 587 billion, more than half a trillion, in the single month of December 2018.

The added benefit for the PBOC is that as a positive asset value, whatever this is, it contributes the same for the liability or money side. As we’ve chronicled for a long time, eurodollar squeezes of this type (#4) constrict China’s domestic money supply in the manner Banco’s 2013 paper outlined. If you can use swaps/derivatives instead of reserves and at the same time boost money supply, pure magic – for a little while.

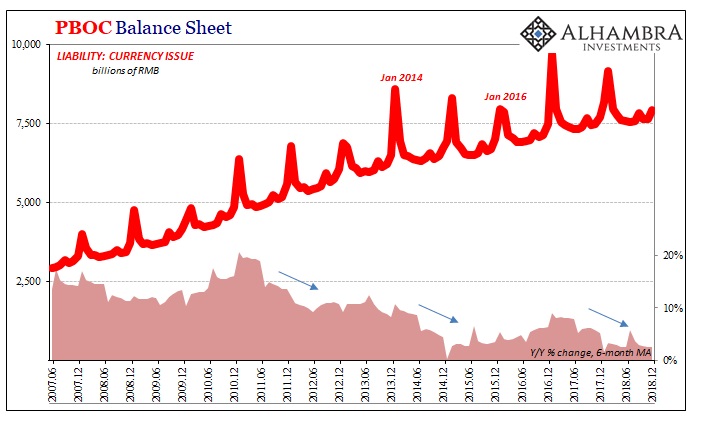

That actually overstates what was accomplished in December. The PBOC’s “other assets” didn’t really boost RMB money, they merely made it less bad. Currency growth was +2.7% year-over-year in December, always a crucial month ahead of Golden Week bottlenecks, an unbelievably low level for such an important time in the calendar and just the smallest improved from November’s sick +2.1%. Bank reserves fell by 3.4% last month, which was only marginally better than the -6.3% the central bank managed the month before.

In my view, I don’t see this as an ongoing effort. I think it was a one-time panic move (not unlike December 2012). How do we know? The PBOC announced not one but two RRR cuts in January, suggesting that these potential swaps (short subsidies) in “other assets” aren’t going to be around for much past this current month. This in addition to “record” liquidity injections everyone has been talking about the past week or so.

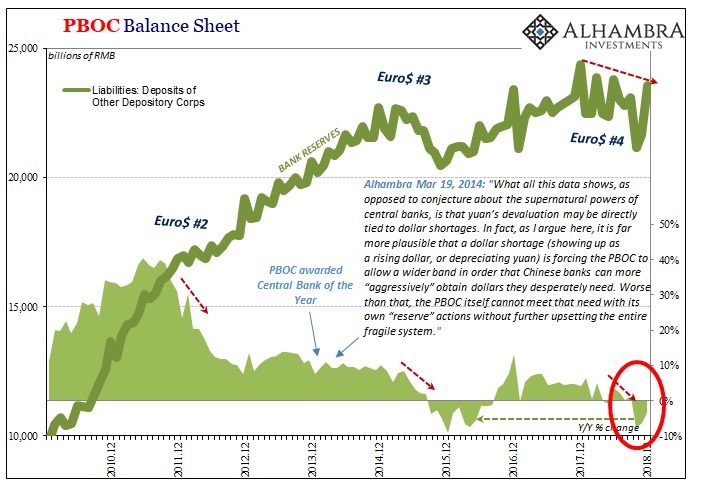

Things were really bad in December and China’s monetary authorities needed a short-term answer, even if it was a bad one. They didn’t want to contribute to another CNY collapse (the economic fruits of which are just now being recorded) at the same time they had to try something. If officials could keep it hidden in the darkest parts of their books, so much the better.

The big problem, which the Brazil case proves beyond any doubts reasonable or otherwise, is how this is just short-termism. The bigger the crisis the more you tend to focus on just getting through the day (or the month) at the expense of figuring out how to solve the actual big picture problem which takes time. You make some questionable moves to survive today, and tomorrow your task is that much harder.

To me, that’s what the PBOC’s “record liquidity” interventions are all about; the hole that was dug by the eurodollar retreat in December was enormous, and these possible swap interventions made it that much deeper and wider for the near future. Thus, any added liquidity in RMB through either the regular windows or in private reserves (RRR) aren’t “adding” anything; they are trying to make up for what has already been subtracted.

Judging by the huge spike in “other assets”, yep.

What we don’t know right now is when. Is this possible (likely?) “ticking clock” set for one month? Perhaps, but remember the Golden Week is the first week in February. That would be very far from an opportune moment to unwind. Perhaps later February? More likely.

Like September and October 2015, between then and now things will probably look and feel better without China directly contributing to worldwide eurodollar pressures. Then the clock strikes midnight, and with greater emphasis than before the intervention. The nightmare scenario. Still.

Stay In Touch