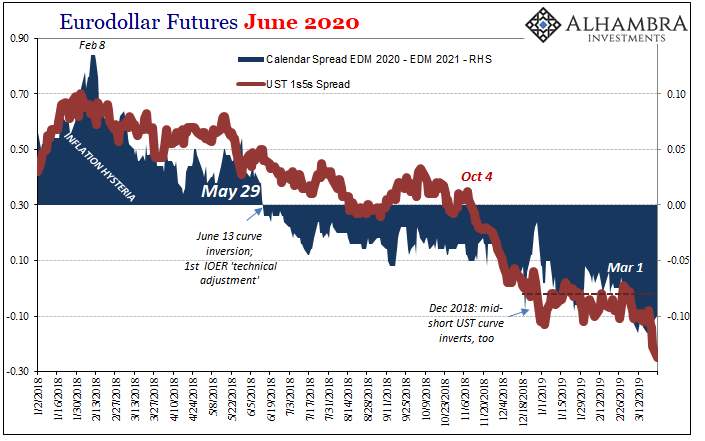

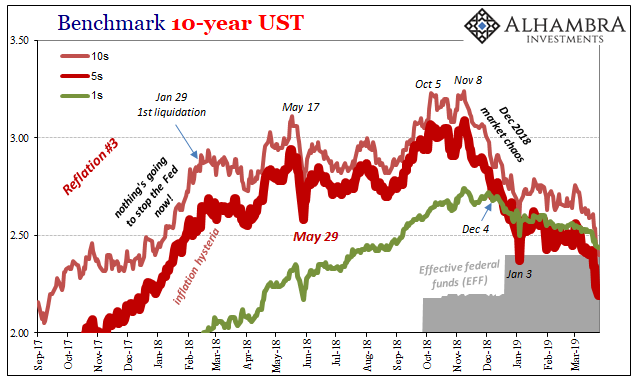

It’s seems like a very long time ago now, back on March 1 the UST curve un-inverted. While most have been focused on the 2s10s, it was the middle front of the yield curve which has been out in front signaling growing distress (liquidity hedging). The difference in yield between the 5-year note and the 52-week bill had tumbled throughout December to as much as -13 bps by January 3.

This is where trouble was first showing up.

The curve largely hung in that shape for the next almost two months while markets paused to digest what a Fed “pause” might accomplish. In late February, the 1s5s popped steeper and on March 1 this part of the curve was positive in slope, if just barely.

Rather than portend good things about Jay Powell’s reverse, it ended up as little more than a footnote in recent history. The curve, and this most recent bond rally in March, was set up during that same last week in February.

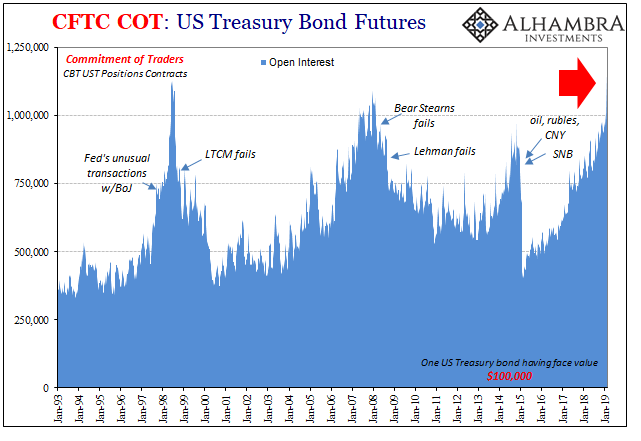

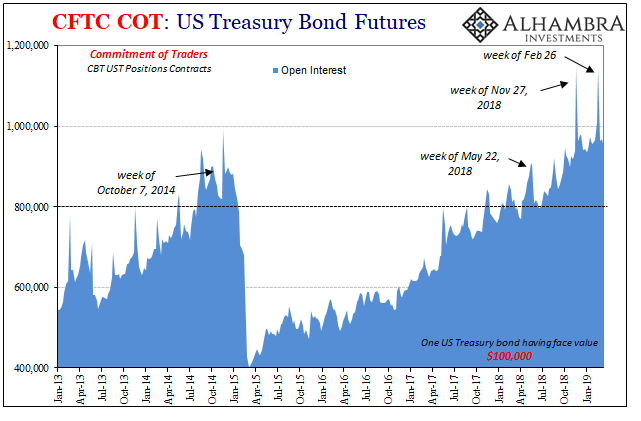

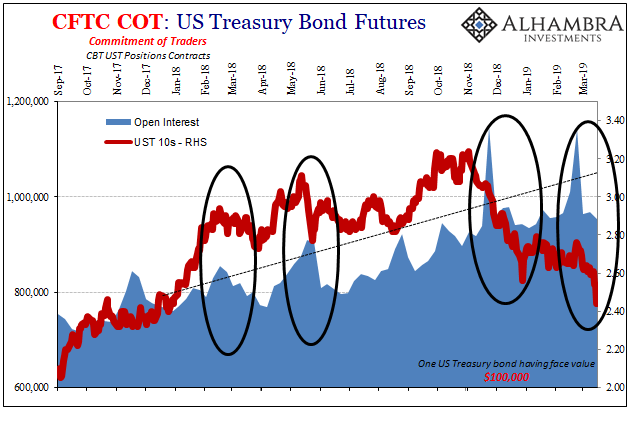

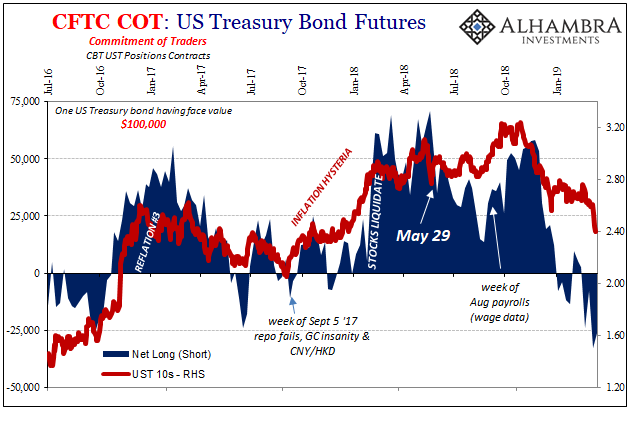

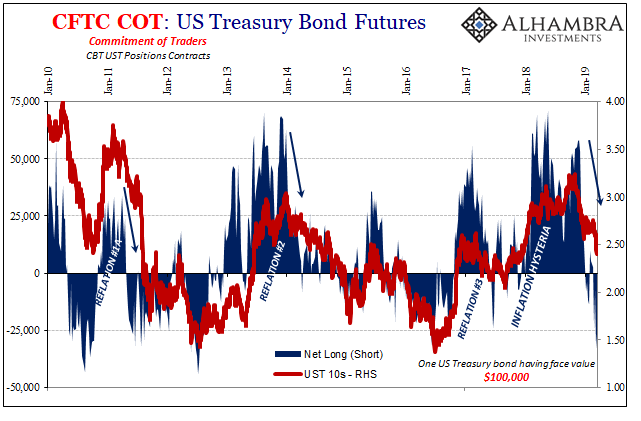

As noted several times over the past few years, UST futures can tell us a lot about what the market is doing. This includes something like Open Interest, which at first blush seems a trivial indication. Yet, bad things always follow when Open Interest rises past a certain threshold. I’ve set mine at an arbitrary 800,000 contracts because that appears to be close enough to where the real stuff afterward registers.

It was the last week last November when OI really spiked, setting up, and warning about, the ugliness which was about to spread worldwide. It appears that UST futures, as you might expect, are very popular when perceptions of risk run very high no matter what officials and financial media tell you on the internet.

It’s hard to see on the chart above, but there was actually a repeat performance. The Open Interest for the last week in February 2019 was only a few thousand contracts less than that startling peak back in November 2018. It appears that the bond market was expecting bad news this month, and then got it on every count.

As the past few times when OI has jumped, the warnings followed through in lower yields. Like December, so far in March they’ve done the same only with the long end now punching through the resistance of the short end like it was nothing (because, when faced with grave risks, it really is).

The rest of the COT report fills out exactly like this; all those who were betting on an inflationary outcome, the aggressive Fed response to an overheating economy which was going to finally once and for all put a declarative end on the 30-year bond bull bubble have now completely, entirely thrown in the towel. Jay Powell was not alone in his capitulation, Bill Gross not the only famous proponent of this thinking to be shepherded toward “retirement.”

The more immediate question may be back to OI; what is it that still remains on everyone’s risk-attuned mind? In those past episodes what followed the surge in hedging was a very clear event, something like Bear and Lehman, an LTCM, the Chinese currency plummeting. I’m not saying we will see another such bank failure, or even something of that type, but clearly there is something financial still out there everyone is afraid of, and hedging for. It’s not just recession risk.

Maybe it’s just the combination of everything: a decade without global recovery now facing the prospects for a third renewed downturn, central banks having burned what was left of their troubled credibility in continually claiming the opposite was about to happen. When you realize federal funds and all monetary policies are a complete joke, and that some people(s) are going to be caught in precarious shape as their bets on Jay Powell and Mario Draghi are “repriced” toward an economic situation more like unavoidable maybe global recession.

In other words, the world’s a very dangerous place where the most optimistic of optimists fundamentally changes his tune, confirming yet again they really have no idea what they are doing. Pretty much every downside scenario is on the table in this situation. Might be better to just be prepared for anything (like EM Eurobond collateral and the unconfirmed German banks who might have transformed them thinking Asia was a pretty sweet place to be after 2016).

Stay In Touch