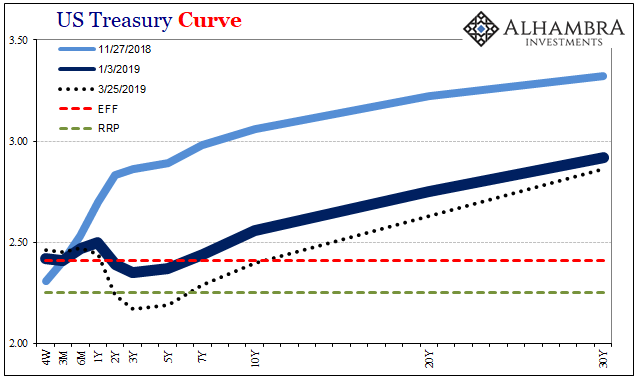

This is really getting out of hand. For the fourth day in a row, unofficially, effective federal funds or EFF remains above IOER. At the same, now the 10-year UST yields less. What was last week pretty concerning stuff before the Fed’s capitulation is this week whatever category lies below.

This is not a resumption of the bond bull market. Despite so many popular stories which had predicted it being called off throughout 2018, a bond bull market never existed. To begin with, there is nothing good about what’s going on in these places. More and more these distorted curves suggest pain ahead, the very reason behind what’s driving them to more ridiculous levels.

When the 5-year UST note is yielding 27 bps less than the shortest 4-week UST bill, 6 bps less than the official RRP money market “floor”, this is already quite a ways into troubling territory.

What will surely come next explains the eerie dichotomy that has set in between stocks and bonds. The stock market is almost fully complacent while at the same time bonds are striking serious unnerve. It is, I believe, what I wrote about a few months ago. You know what’s coming:

This is going to be a give and take; action and reaction like always. The more serious it becomes, the more serious the counterpunching. Powell’s already moved on skipping higher dots and going right to a “Fed pause.” It’s really easy if maybe he starts to sound more dovish still – hinting at rate cuts “if conditions warrant.”

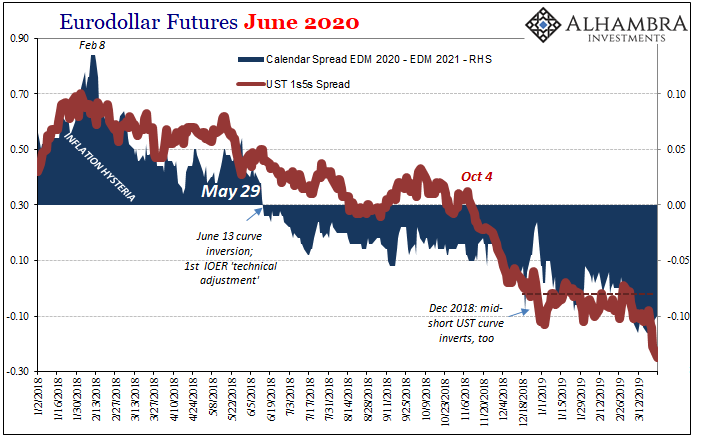

The pause is now fully locked in after last week’s FOMC decision and forecasts. Rather than spark reflation as was probably hoped, curves collapsed since it was policymakers who surrendered. They now have to take the next step which is going to be the first hints of rate cuts. The progression is just that predictable.

The more the bond market suggests this is what will happen I think the happier stock investors will be; more punchbowl baby! Like September 2007, the NYSE is waiting for the (short term) magic to be rekindled, stock investors expecting now that it’s just a matter of time.

Ironically, it’s the very same expectation as what’s being traded in these bond curves only with vastly different interpretations. The stock market holds out hope Powell can and does fix this, several rate cuts if that is what it takes. The bond market is saying, yeah, several rate cuts but why might they be necessary in the first place?

It’s not that maybe, possibly Powell’s FOMC might solve some unknown problem that could turn out badly, the emphasis is on the something that is already rotten.

This bond bull, though, is not a US story. It is a global one. Curves are collapsing all over the place. The Bank of Canada, for example, had been following the Fed’s path in predicting Reflation #3 would amount to globally synchronized growth. The central bank therefore carefully, methodically pushed its overnight benchmark policy rate to 1.75%.

As of today’s close, the 10-year Canadian federal government bond yields 1.55%. Not so happy times in Ottawa.

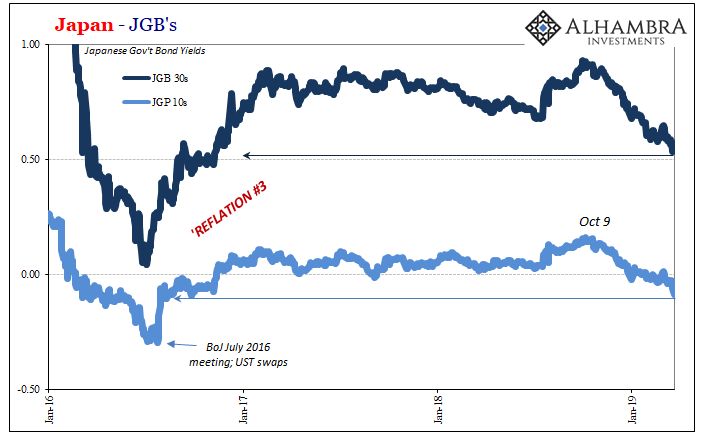

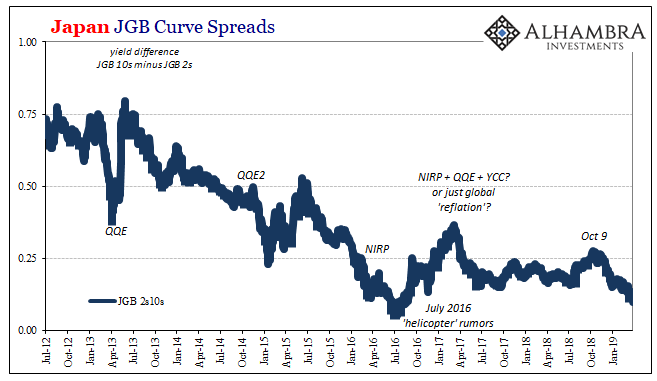

Over in Japan, the bull-est of all bond bulls, the bull is back in full swing. Going back to October 9, yields have been dropping, the complete disappearance of not just last year’s QQE party but of the entirety of Reflation #3. In today’s trading, the JGB 10s are only a small bit above record low (negative) yields.

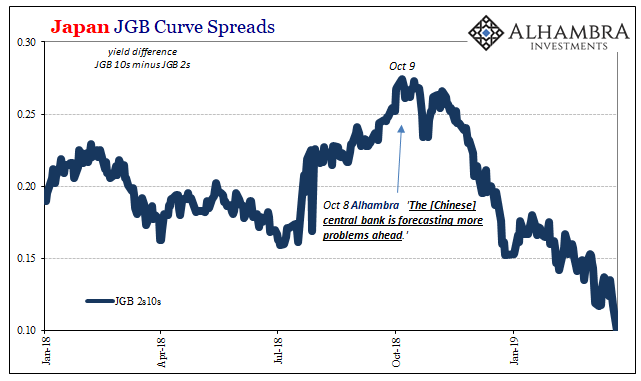

The JGB curve, like global counterparts, are falling apart, too.

The same process is playing out in Germany, Australia, etc. Will any of these other places end up caring if Powell does what everyone now expects of him? In the global bond market, when he does start talking about cuts it will like last week’s circus confirm what is already being traded now outside of stocks.

This isn’t his problem to fix, at least not in the way it is supposed to go. I wrote last May about bonds and curves and how many were saying it was the bond market which had the bubble on its hands; yet, at the same time, you could see by nothing more than historical repetition how nothing was materially different:

That’s ultimately what the JGB market has been saying all along. It didn’t matter what the BoJ had done, nor did it matter for more than a few years that the economic outlook might have appeared brighter, in the end nothing actually changed. The economy remained mired in a massive depression, a slump without end. JGB’s were signaling that there is an economic case where recovery isn’t guaranteed no matter how much time might pass – a circumstance far beyond the business cycle.

Call that a bull market if you want, but no sane person would.

Now that it’s back in full swing, and central bankers forced to indulge in its projections everywhere, a few swats backward in federal funds is the answer? By echoing the long and unbreakable “bull market” in JGB’s, from UST’s to Canada bonds these markets are saying the same thing – there was no recovery and there isn’t going to be. It’s only a little strange for stocks to be encouraged by that, rationalizations being what they are.

When those rate cuts do begin, I think the most interesting thing about them won’t be anything to do with the economy. It will be what might happen to EFF, perhaps rounding out the picture of official relevance a little more for the few who take the time to notice these things. If IOER is reduced by 25 bps, which is what markets are now practically guaranteeing (as a start), what will it suggest if EFF falls by only 24 bps, 23 even, perhaps less?

It’s bull, alright.

Stay In Touch