No, no, no. Everything is awesome. The denials have spread faster than the market prices have changed.

Globally synchronized growth did a number on a number of people. I really think it a function of time. It has been so long since we’ve seen economic growth, real economic growth, that so many just believe it has to happen because it hasn’t. Meaningful economic advance is a given, that’s what we are taught from Day 1. And it is central bankers, our best and brightest, who safeguard that progress.

All the considerable effort undertaken, it just has to pay off at some point.

Therefore, if we go without real growth for, say, ten years then year eleven can’t possibly be anything other than extra special awesome. Who is the bond market and its stupid curves to say otherwise (thanks M. Simmons for most of these).

The yield curve can be wrong. It might signal nothing but the fact that the Fed should never have done the December rate hike.

But it doesn’t matter. There is so much money run algorithmically that stocks are pre-ordained to come down because the recession pattern post inversion has been a reliable one. So, you can’t stop the rain coming down on this market until you get a host of people to realize there are bargains even if we have a big slowdown and if we are in are in a real jam the Fed can cut rates if it has to.

“There is nothing driving the markets today news-wise other than inertia,” said Neil Dutta, head of economics at Renaissance Macro Research. “The market is reacting to itself.”

The paragraph before that, the author notes:

Positioning was one of the driving forces behind Friday’s rally, which saw Treasuries grind higher across the curve after weak German manufacturing data reignited global growth concerns.

So, not inertia?

And Goldman’s stock team:

Goldman Sachs Group Inc. added its voice to those advising against panic over the inversion of the U.S. yield curve, which has served as a recession warning in the past.

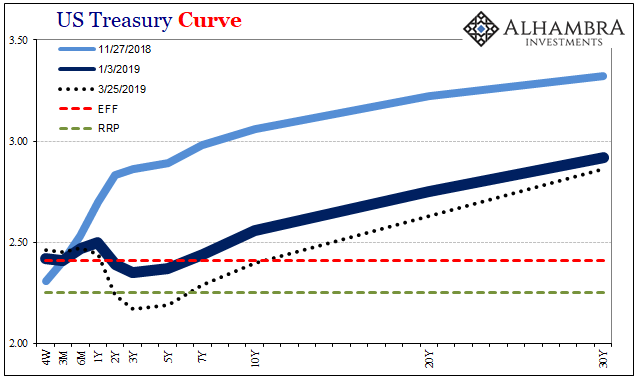

The proportion of the yield curve that’s inverted isn’t as high as in past recessions, and part of the reason 10-year Treasury yields have slumped can be attributed to dynamics outside the U.S., Goldman strategists led by Alessio Rizzi and Christian Mueller-Glissmann wrote in a note Monday. American credit spreads also aren’t telegraphing stress, they highlighted.

If the US$ curves are reacting to “dynamics outside the U.S.”, what might that say about risks inside our borders? There is no decoupling, folks.

Now there’s this:

Federal Reserve Bank of Boston president Eric Rosengren sees a rate hike as the U.S. central bank’s possible next move, according to an interview with Bloomberg published on Tuesday.

Rosengren described himself as “more optimistic” over the economic outlook than his colleagues on the policy-setting Federal Open Market Committee. Rosengren has a vote on that committee this year.

Recession or not misses the point. Any sort of downturn or even softpatch upends the bigger picture. We’ve not yet reached the promise land and already a(nother) setback? Not even Mr. Rosengren is really sure what’s going on, adding this bit of wobbly nonsense to the above: “it is possible the next move would be up but if conditions deteriorate it is also possible that the next move could be a rate cut.”

The US economy along with the global economy was supposed to be breaking out. A new day was dawning, for once something that fit even marginally close to the same category as to what growth used to be.

That’s all gone. However the immediate future turns out on the downside, the upside has disappeared. This all by itself is not nothing. It proposes, in fact, a whole lot of risk particularly to those, like the group quoted above, who were enthralled by globally synchronized growth.

We’ve seen all this before, as my colleague Joe Calhoun reminds everyone. Nothing really is new.

Clothed in immense self-denial, hung up on absurd self-confidence, Federal Reserve officials gathered on August 7, 2007, to discuss how things really weren’t as bad as everyone seemed to think. There were several key conversations taking place at the FOMC meeting held then all leading nowhere. Policymakers would literally laugh off obvious distress in crucial markets.

Like 2007, what we see in front of us, and what we can reasonably make of it, is that something is very wrong. We don’t know yet what that something is (and I can openly speculate all day) or how it will eventually play out, but those scenarios by its very nature are skewed more and more exclusively to the downside.

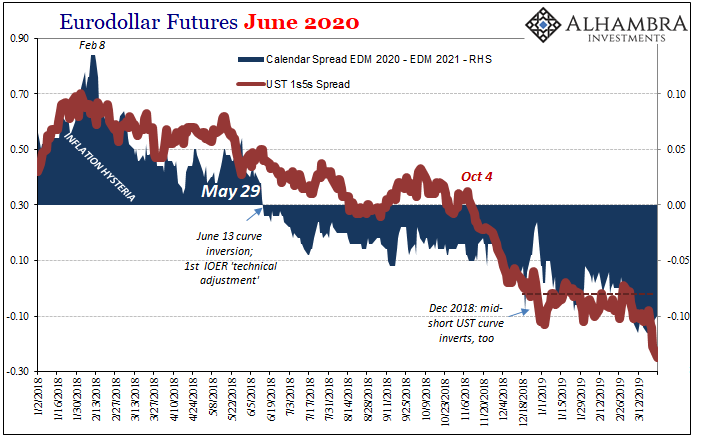

The main part of the yield curve which the mainstream watches (meaning, they don’t actually watch the yield curve) only inverted yesterday. Curves have been escalating warnings for a very long time already. And those warnings have only proliferated and deepened.

That’s what is going on right now. And about all this I offered some advice to Simon Potter, the current head of the System Open Market Account, who is right now preoccupied with IOER; in truth, the guidance wasn’t really for Simon Potter.

He would do well right now to avail himself of Dudley’s grave [2007] miscalculations, perhaps even going back reading (as much as anyone can stomach) and absorbing the gross and really obvious incompetence contained within those absurd discussions…

Liquidity risk is contained in inversion; it’s only liquidity risks at first in inversion.

Those warm, desert waters running down that river in Egypt, though, they are very tempting and inviting at times like these.

Stay In Touch