In the middle of last November, when the Dallas branch of the Federal Reserve convened a conference on “global perspectives”, ironically, its officials were in a very good mood. The institution’s Chairman, Jay Powell, invited to speak at the gathering spelled out exactly why. Central bankers since Greenspan have made a habit of trying to say very little, but Powell wasn’t having it.

After an enormously rough decade, he wasn’t about to beg forgiveness for celebrating an end to it.

I’m very happy about the state of the economy now. Our policy is part of the reason why our economy is in such a good place right now.

On that basis, Powell reiterated his still hawkish stance. Markets, like it or not, would have to get used to “rate hikes” almost certain the following month as well as at any point in 2019.

The mainstream narrative puts Powell’s central bank in the middle of everything. This is one big reason why I use the quotation marks around “rate hikes”; a reminder that the world in actuality doesn’t work that way. At the time he was speaking in Dallas, those “hikes” were already severely undermined and were about to be seriously rebuked.

The eurodollar futures market gives participants the opportunity to be paid by LIBOR. You can make a lot of money figuring out where 3-month LIBOR is likely to be at various points in the future. Jay Powell doesn’t make any more money opining about what his gang of Economists might be able to do next.

For what we’ve all been taught, this should all be academic. The Fed sets short-term rates, so the CME should probably just shut down its most popular, successful product and everyone can go home. These central bank Economists set the trajectory and the market merely obeys; just like Greenspan once said.

Only a month after Powell was in Dallas clearly adoring the reciprocal adoration of the fawning media eager to congratulate him over his and his predecessor’s technocratic prowess, the FOMC met in Washington to mere formality over the next “rate hike.”

Uttering the same premise, strong economy especially the labor market (unemployment rate), they would ignore all this renewed “overseas turmoil” unexpectedly erupting.

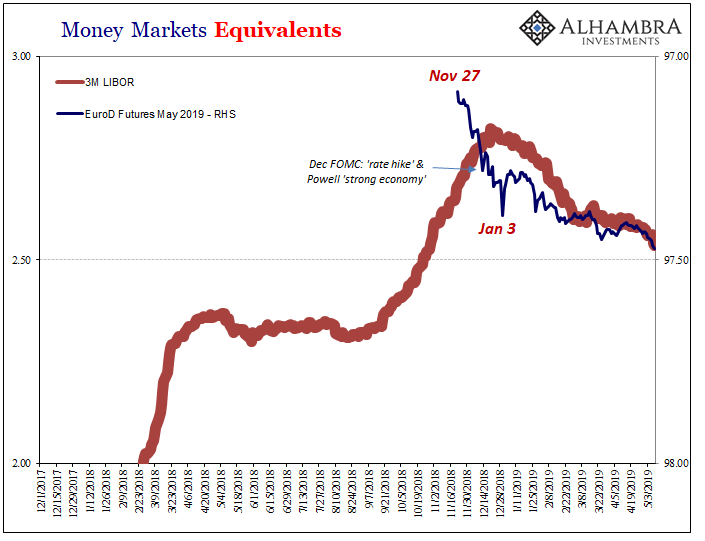

The May 2019 eurodollar futures contract, which currently sits as the front month maturity, being an odd calendar month didn’t really attract much attention nor money until around later November. When it finally started to gain regular volume, this very period in between Powell’s November Dallas junket and the FOMC’s last “rate hike”, the people with billions riding on it were not betting “rate hike.”

Even though, at the time, LIBOR was still rising based on what that market thought Powell could get away with, in eurodollar futures in this specific maturity participants were wagering a ton that something would change Powell’s mind before the contract would come off the board a little over a week from now.

Who was ultimately right? Powell’s strong economy?

Kicking and screaming, these Fed officials. These are rate hikes only if you believe they are. Markets, nope, they’re now onto rate cuts no matter what these Economists keep saying about the unemployment rate.

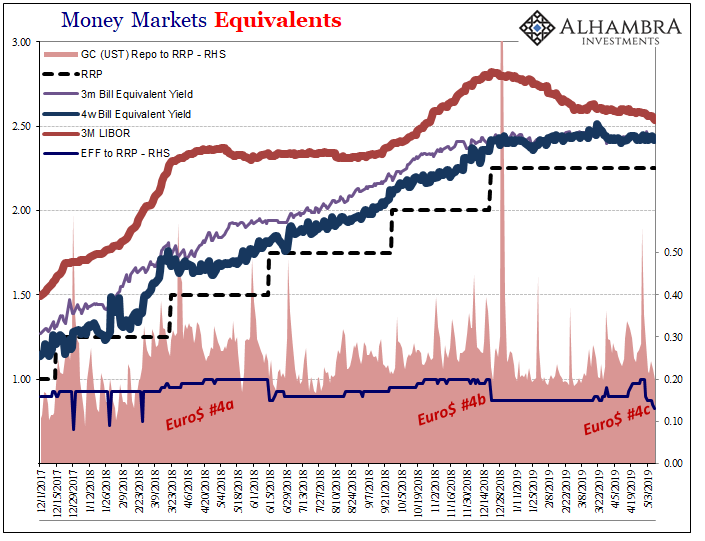

And LIBOR continues to vindicate that position. Yesterday and Wednesday, 3-month LIBOR was down sharply again. This rate was a touch above 2.60% when federal funds started to go screwy in mid-April, still around 2.58% as last month ended, and 2.562% this past Tuesday. As of yesterday, 2.535%.

The eurodollar futures market has been absolutely spot on about LIBOR, and therefore what the Fed will do whether or not its officials believe that’s what they think they will do.

Falling LIBOR could be a very good thing. In certain contexts, it might suggest an easing to financial conditions. This is not one of those contexts.

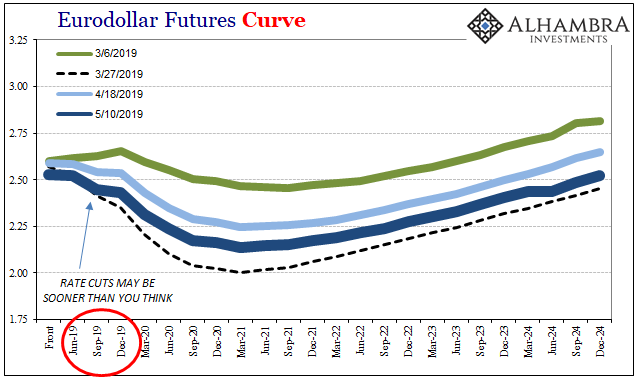

The eurodollar futures curve beyond the front month spells out what this really means. Falling LIBOR is very likely to keep falling, even as it closes in on things like federal funds and the Fed’s upper bound for it (just 3 bps away).

I wrote back when 3-month LIBOR was just about 2.70%, in early February:

That’s what the inverted eurodollar futures curve means – LIBOR is going to drop. How is everyone so shocked when it does? That’s right, Jay Powell. People still think the central bank is central and that central bankers aren’t clueless statisticians…Let’s put this in big picture terms. Eurodollar curve inversion implies LIBOR is going to fall, and fall more than it has to this point. That would happen for a couple reasons but most of all rate cuts.

The only question to ask is, why would Jay Powell’s Fed start lowering the federal funds stuff?

It’s pretty serious already with one heavyweight market weighing in on this question – rate cuts sooner than you think. But eurodollar futures (and, of course, UST’s) are not the only place where the “thing” that would make Powell panic in reverse is being priced. The indications are actually quite widespread, not that you would know it by the NASDAQ.

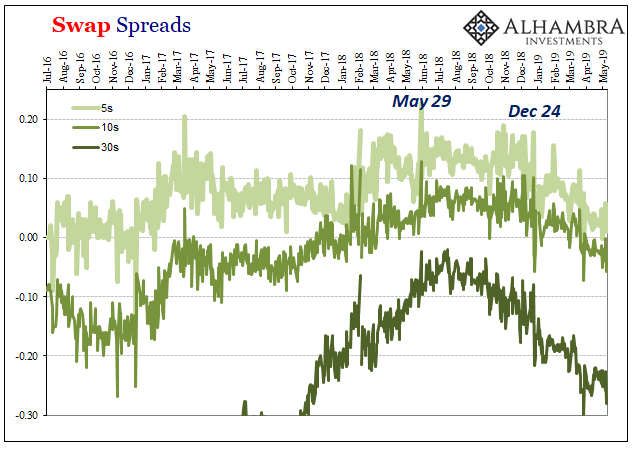

Interest rate swaps are, as I’ve noted before, arguably the most important indications in all the world. It is the intersection between real world economy and the big finance we never hear about. Not only have swap spreads been going the wrong way of late, it’s also when they turned around we should pay attention to.

May 29. All that time last year Powell and his bunch were gushing over their economic success, markets were warning him to exercise more caution. Something wasn’t right. Something big.

Rather than turn out to be an anomaly, after May 29 this inflection has been proved over and over and over to be precisely the kind of thing that would lead directly to, eventually, the Fed kicking and screaming, holding its nose while blaming external factors far beyond its control for rate cuts.

Now almost an entire year later, no deviation in course, no falling for “rate hikes” then “dovishness” now “growth scare.” An unbroken trend that gets picked up by more and more markets where hundreds of billions if not trillions of dollars are on the line. Any idiot can plot a dot in imaginary 25 bps increments; figuring out LIBOR when you are taught from the very beginning those idiots are all that matter, and when it sure seems like they don’t, there’s a lot of money in it.

“Rate hikes.” Nope. Cuts. They are coming. Who do you really trust? Powell, Jamie Dimon and his public Bill Gross impression, or curves (plural).

Stay In Touch