In March 1999, Economists James Stock of Harvard and Mark Watson of Princeton published a paper in the Journal of Monetary Economics seeking answers for an inflation problem. For many years, it had been accepted that the unemployment rate was the only measure of economic activity necessary to infer inflation. The implications were enormous, especially in the age of interest rate targeting when central banks operated via expectations instead of money. This shift, among other things, meant total reliance on the ability to forecast with a high degree of precision.

In 1997 and 1998, however, inflation deviated sharply from the unemployment rate view. The Asian flu was, by convention of Economists, largely an Asian matter. Therefore, sharply decelerating inflation should not have happened given the low level of unemployment expressed by the conventional rate.

To seek an answer, to improve potentially econometric forecasting models, the paper’s authors tested a number of variables and hypotheses. They didn’t figure out the Asian flu, of course, since that would’ve required looking at a global economy and its one systemic monetary component – the eurodollar system.

It would be these same two Economists who just a few years after publication coined the term Great “Moderation” even though it was left as an open question how and why it had come about. When it came to money, which is supposed to be inseparable from inflation, Stock and Watson were stumped. They wrote in 2002:

But because most of the reduction seems to be due to good luck in the form of smaller economic disturbances, we are left with the unsettling conclusion that the quiescence of the past fifteen years could well be a hiatus before a return to more turbulent economic times. [emphasis added]

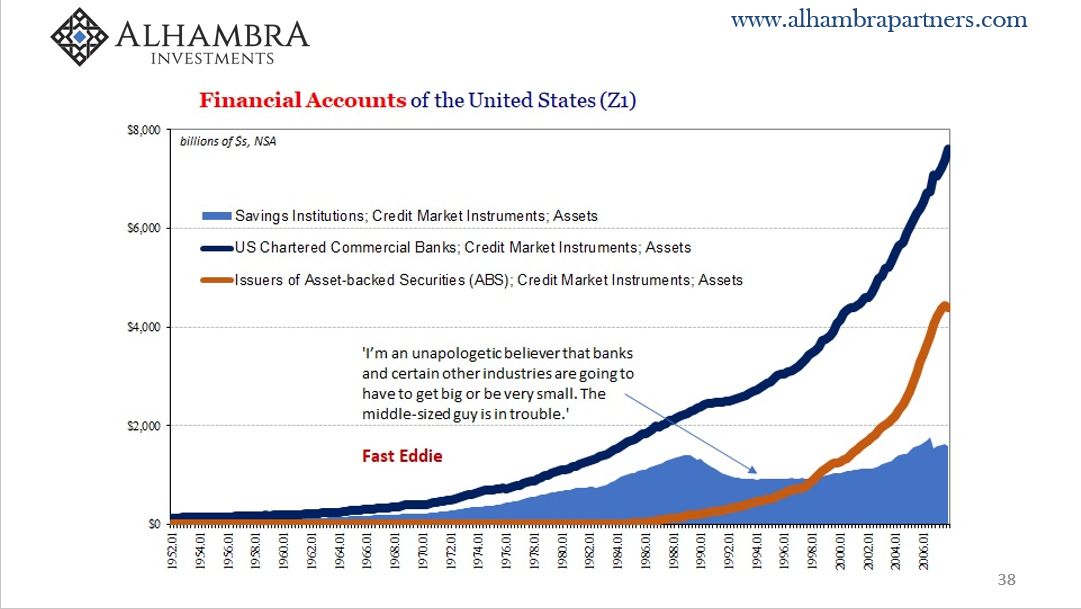

The “reduction” being written about in 2002 for the Great Moderation was a curious dearth of severe financial and monetary crises. In the US, there hadn’t been any in a good long while. Even the S&L crisis of the early nineties proved to be more of an annoyance than anything – as if “something” else was driving monetary conditions completely detached from the ailing traditional depository system.

There was, however, a relatively recent (in 2002) and prominent distortion in global money mechanics. We call it the Asian flu.

Therefore, to Stock and Watson in both 1999 as well as 2002 it was all just “something” else beyond the scope of their orthodox, closed system conventions. They never did fix the unemployment rate or better define the Phillips Curve, nor did they explain the Great “Moderation” in time for 2007 (when that presumed “good luck” suddenly and unexpectedly ran out).

Rather these Economists simply created an alternative framework which seemed to fit the earlier data just a little bit better.

Perhaps the most intriguing result is that the best-performing forecast is a Phillips curve forecast that uses a new composite index of aggregate activity comprised of the 61 individual activity measures. The forecasting gains from using this index are economically large and statistically significant over the 1970-1996 sample period, and we were unable to improve upon this forecast by combining it with other forecasts.

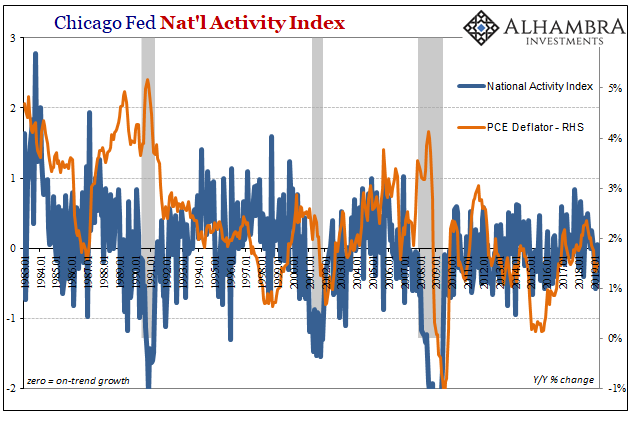

Those 61 variables began what is today known as the Chicago Fed’s National Activity Index (CFNAI). Growing now to 85 individual indicators, the CFNAI is “constructed to have an average value of zero and a standard deviation of one.” Therefore, like the OECD’s leading indicators, it can only tell us whether growth is and is expected to be above or below trend.

From it, we are to infer that within twelve months inflation should follow above or below trend, too.

Whether or not the CFNAI has improved upon forecasting techniques is an open debate. The index appears more useful in the same way as other multivariate models attempting to describe levels current economic activity.

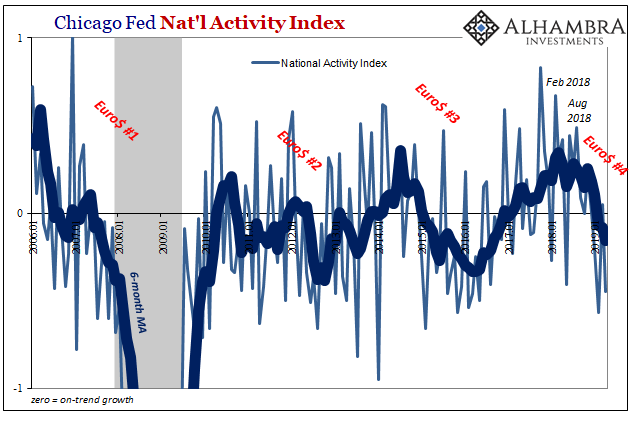

In either case, it’s bad news for Jay Powell. Today, the Fed’s Chicago branch calculated April’s index level to be -0.45. After rebounding to +0.05 in March, last month’s negative number makes three minuses out of the past four months. And since two of the three months before them were exactly zero, there have only been two slightly positive readings in the last seven months dating back to, surprise, October 2018.

What it suggests is the same thing we’ve been saying since October; Euro$ #4 is upon us, and it’s going to lead to a worldwide slowdown likely downturn maybe full-scale recession. The CFNAI is evidence only for the first one in the procession, though more confirmation that the US economy hasn’t at all been spared the negative effects of the latest global deflationary impulse.

The implications are along the lines of consistency as seen elsewhere. In other words, it sure seems the global economy hit a landmine October to December 2018, therefore? This wouldn’t appear to be a transitory triviality, something that can be cured by a Fed “pause” or mouthing off a little differently about inflation expectations (the symmetry puppet show).

Indeed, if the CFNAI is at all worthwhile for inflation forecasting above and beyond the unemployment rate (which is now totally disconnected), then the below-trend readings for all of 2019 point the wrong way on both counts: inflation and growth. With April onboard in the minus column, no green shoots here in either aggregate.

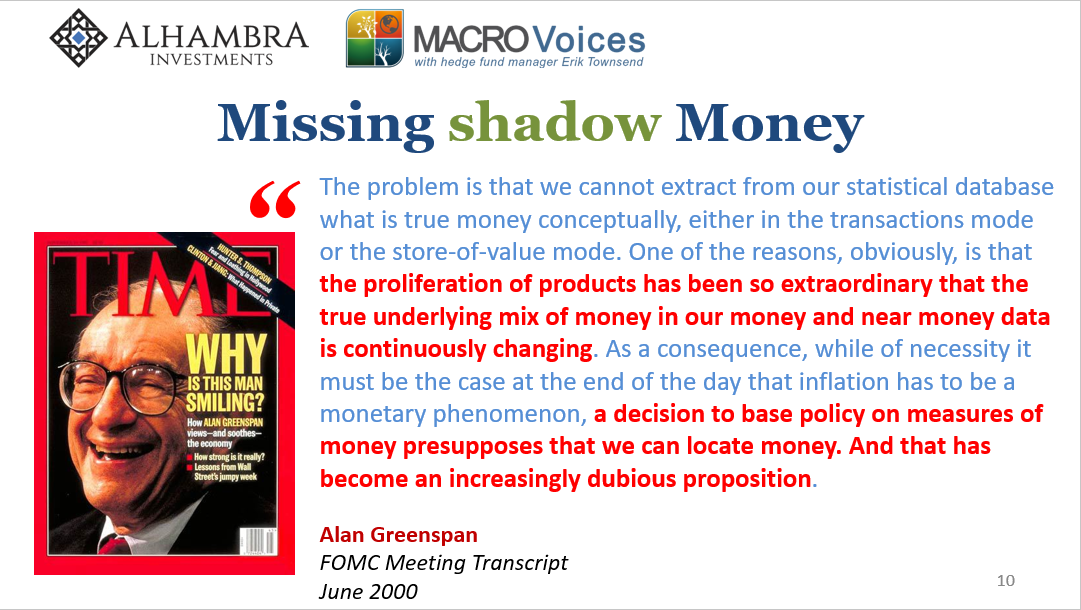

Interestingly, in their original 1999 paper Stock and Watson acknowledge their mainstream conceit. Though inflation has to be, in the end, a monetary phenomenon, the authors admit how going back to the early seventies any money supply models “do not perform well.” The missing money seventies.

Rather than appreciate the massive implications of the impediment, these Economists were only too happy to be freed from further investigation. Thus, the Great “Moderation” was like random “good luck” and the Great (global) Financial Crisis perhaps bad luck. Poor Ben Bernanke.

Obviously, they were not alone in thinking this way. Central banks still think this way. That about sums up the last few decades. It’s how we’re left facing a fourth global monetary event since 2007, one that consumes more and more what’s left of economic opportunity.

Stay In Touch