In Europe, the ECB’s minutes for its April 2019 meeting claimed:

Financial market developments, which were typically more forward looking, were more upbeat.

In the US, the Federal Reserve’s minutes for its April 2019 meeting claimed:

Participants noted that even if global economic and financial conditions continued to improve, a patient approach would likely remain warranted, especially in an environment of continued moderate economic growth and muted inflation pressures.

Let’s see if we can find this upbeat improvement, these markets full of perhaps greenish shoots.

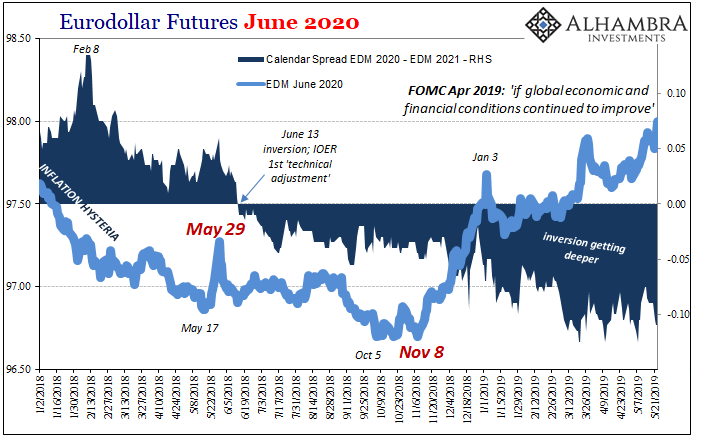

Eurodollar futures?

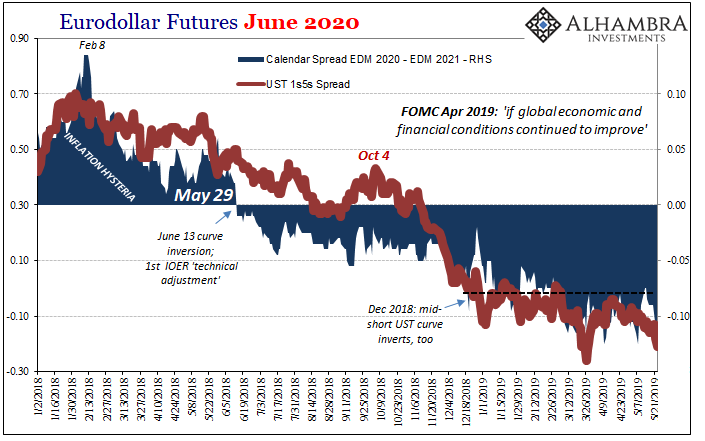

UST curve?

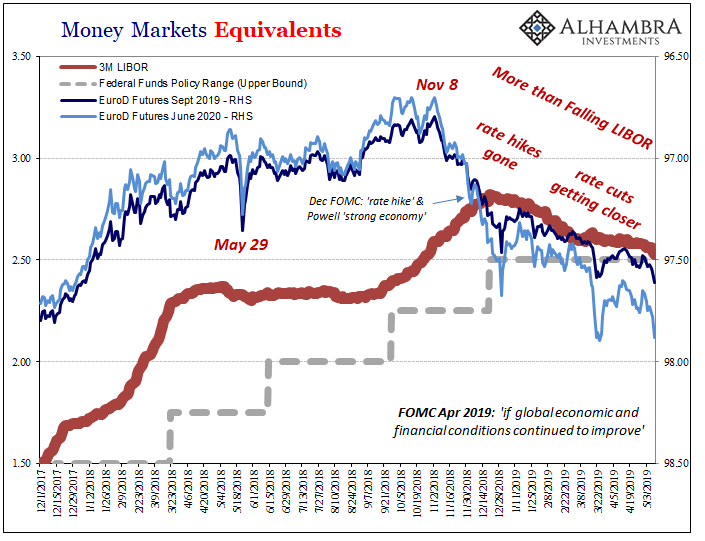

Projections back toward rate hikes?

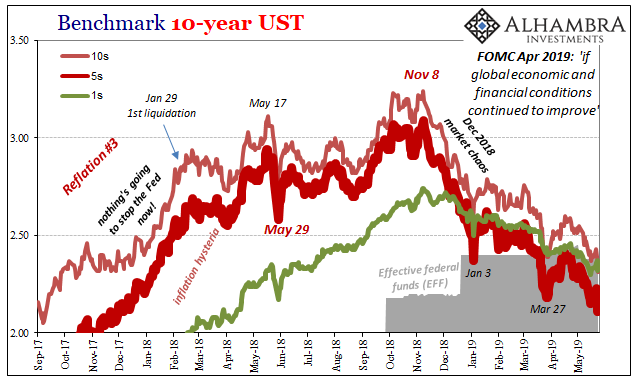

Nominal UST yields?

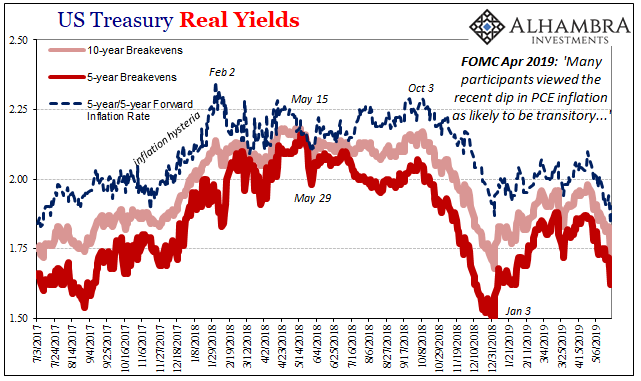

Must be inflation expectations, right?

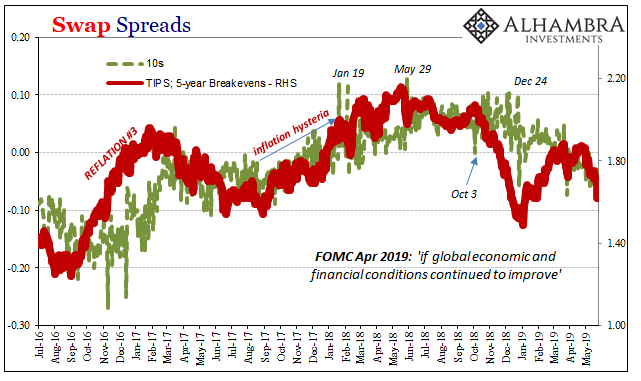

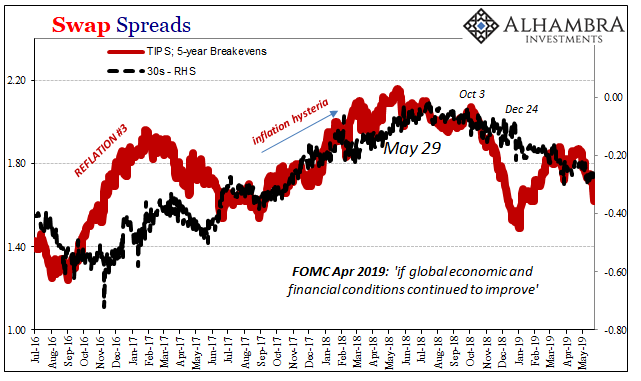

The deeper, inside financial stuff, the parts of the system that really matter like swap spreads?

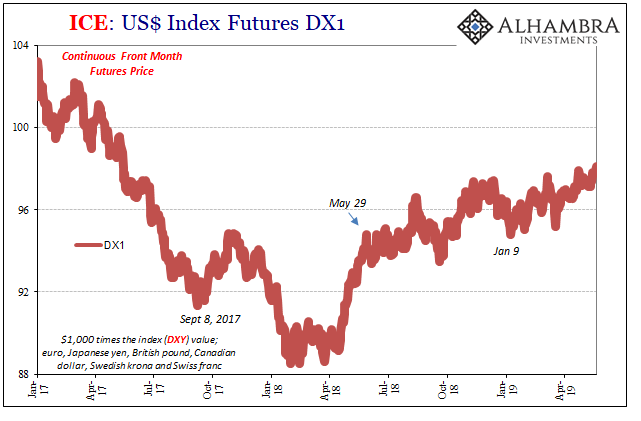

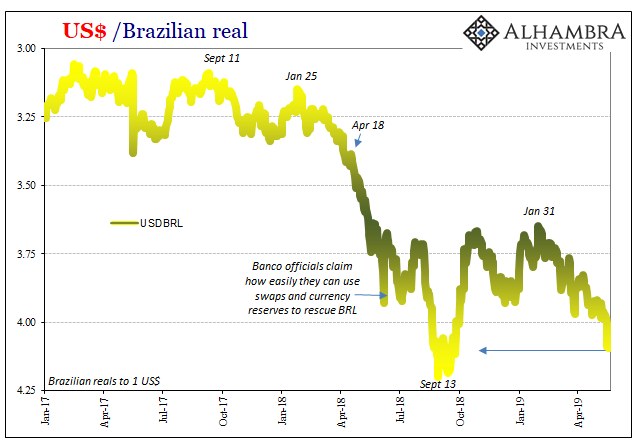

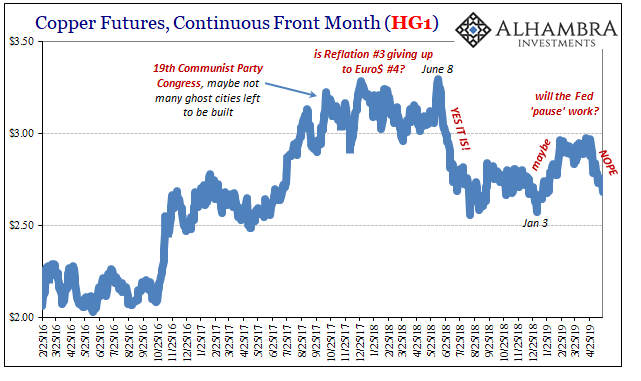

Dollar, commodities; something?

And so, and so on.

Outside the NYSE, everything looks exactly the same. The downward spiral, the one officials didn’t admit was anything too bad until the S&P 500 stumbled, keeps on chugging downward.

It’s a damn roadmap. The world’s best and brightest, though, they can’t read it because they absolutely insist they are not holding it upside down.

Think I’m kidding?

Stay In Touch