The celebration was premature. As usual, people were extrapolating reflation into recovery. Getting relatively better after being really bad is not the same as truly healing. Reflation is a necessary but by itself insufficient condition for normalcy. The latter requires the former as a first step and then needs enough momentum (of opportunity) to carry it through only then completing the journey.

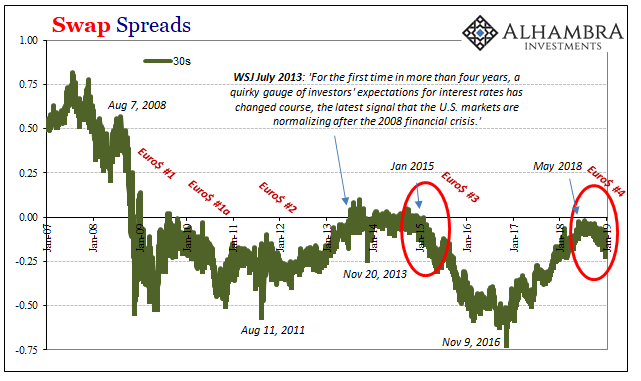

In July 2013, amidst the so-called taper tantrum the 30-year swap spread registered above zero for the first time since the 2008-09 panic. Naturally, though few people are aware of this crucial part of the “bond market” it made headlines anyway. Round numbers are always appealing as is any time you can say “the first time since 2009.”

The Wall Street Journal reported at the time:

For the first time in more than four years, a quirky gauge of investors’ expectations for interest rates has changed course, the latest signal that the U.S. markets are normalizing after the 2008 financial crisis.

The swap spread is the fixed interest rate price of an interest rate swap compared to the same maturity US Treasury. A 30-year swap spread, then, is the price of the fixed part of a 30-year interest rate swap relative to the 30-year long bond yield standing in as the risk-free component. In conventional terms, it should never be negative; that is, the equivalent interest on the swap below the interest demanded from the US government.

Up until the immediate aftermath of Lehman et. al., it had never been (outside of a specific episode in Japan; ironically due to the same dollar reasoning showing up a decade before the Great Financial Crisis). When the 30-year spread first turned negative, there were whispers and rumors how trading systems weren’t programmed to recognize a negative spread input (apocryphal or not, the stories persisted and said something about how stunned even insiders were about the impossibility of what had just happened).

But a positive swap spread for the first time in four years wasn’t near enough improvement. You can explore a much deeper dive into what, how, and why these things matter here. In 2013, it was a good sign on the possible road to recovery but one that really only said the journey was still young.

Real normalcy would’ve followed in the same direction all the way back toward +50 bps or more. In the WSJ article itself, to their credit the author includes that fact:

Mr. Gilhooly says the spread “should go back to 15/20 basis points and over time it should rise back to 50 basis points.”

It never got much more than a little positive before, around January 2015, plunging all over again via the worldwide dollar shortage that was Euro$ #3. In other words, the fact that the swap market paused in the 30-year space at around zero was pretty solid evidence of continuing abnormality – that Reflation #2 especially as it moved into 2014 was never going to push past reflation into recovery.

Thus, in 2014 while Euro$ #3 sprang up Janet Yellen went way too positive on economic overheating that by virtue of the swap spread had no real chance of happening. Her models said the economy was going to take off; the swap market, where real money meets economy via balance sheet space, said no way.

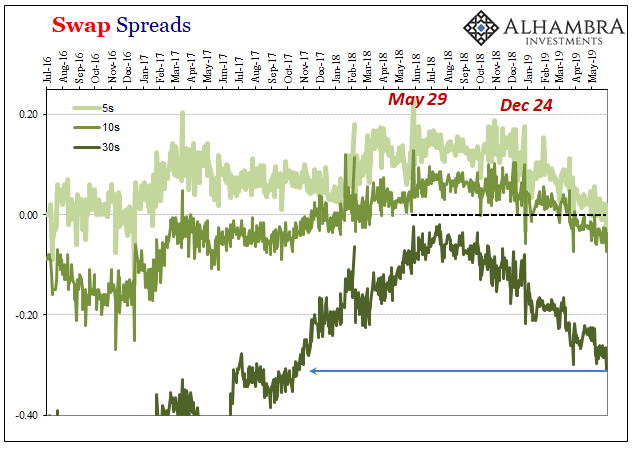

I bring this up because here we are again. Swap rates never did normalize during Reflation #3, either. The 30s came close to positive, but didn’t actually register a plus sign. And then May 29.

Since we are into round numbers today, the 30-year swap spread broke one yesterday falling below -30 bps for the first time since October 2017. Like July 2013, that doesn’t necessarily mean anything specific. What does matter is the trend which, as you can see above, has been pretty well established unlike what transpired six years ago. Recovery was more hope back then than consistent with the context.

The Fed and ECB have said recently that financial conditions have improved. All that does is set up an interesting dichotomy, an experiment of sorts about which market actually discounts what.

I’ve marked December 24 on the chart above for a reason – that was the same day the stock market hit its last bottom. The S&P 500, for example, fell to 2351 on Christmas Eve and has been moving upward ever since. Quite the opposite in interest rate swaps.

Obviously, these are two very different views of what are supposed to be the same thing. And not just the 30-year, the 10-year swap spread is now firmly in the minuses while the 5-year has more and more flirted on the wrong side of zero (two of the last three days).

All of swaps vs. All of stocks.

The stock market is enthused by the Fed “pause” and this global dovishness from central banks around the world. If you think rate hikes and QT are to blame for what’s being described as a “soft patch”, no more rate hikes nor QT terminate the soft patch. Back to boom.

The swap market, which is much closer to economy and money, knows that’s not the case. The Fed therefore throwing in the towel on rate hikes merely confirms in this perspective the gravity of the situation – even the most optimistic group of optimists is no longer so optimistic.

Had monetary policy been at all effective in that way, four QE’s by the start of 2013, July 2013 would’ve turned out to have been that first step toward normal. The swap spread would’ve gone back to +50 bps and more (probably closer to +100 bps in a real recovery).

The very fact it never got anywhere close to those levels already proves there never was a punchbowl. As Dallas Fed President Richard Fisher was incredulously admitting at much the same time, this was all a monetary head fake. In the collective imagination of equity investors eager to cash in on an imagined recovery, they were spurred on by all that “money printing” mythology spread far and wide by the complicit media, central bankers, Economists, and politicians.

The next several months should truly settle the matter once and for all (but probably won’t, so long as Economics remains as it is). It’s simple really. Inflation, as in the S&P 500 (before this week), or deflation as in swaps? Back to rate hikes and hawks, or the start of many rate cuts and yet more extreme doves?

Like a zero bp spread on the way up, -30 bps on the way down should also be just the start of another journey. This isn’t a quirky gauge of investor expectations, these swap spreads, it’s the real money being bet on the lower road. Again.

Stay In Touch