If you have nothing left, it can sound like a winning argument but you have to really try hard enough. In October 2015, with another false dawn dawning on the public, former Federal Reserve Chairman Ben Bernanke wrote and op-ed published in the Wall Street Journal. As had become his habit, it was full of praise – for his own work.

Though he likely didn’t choose the title, it reflected his article nonetheless; and it tells you all you need to know about it. How the Fed Saved the Economy. How did they do it, you might ask. By being aggressive and courageous, Dr. Bernanke has answered.

The better question was, how do we know the economy was saved? The primary piece of evidence presented: at least we aren’t Europe. Maybe the US economy wasn’t good but it wasn’t Europe bad, therefore success!

Europe’s failure to employ monetary and fiscal policy aggressively after the financial crisis is a big reason that eurozone output is today about 0.8% below its precrisis peak. In contrast, the output of the U.S. economy is 8.9% above the earlier peak—an enormous difference in performance.

Actually, no, it wasn’t any difference in performance. I wrote a few days after:

That ends the favorability, however, as cycles prior again demonstrate that Bernanke’s attempted distinction against Europe is none at all. From the 1990 peak, 31 quarters forward saw real GDP gain 26.0% while nominal GDP advanced almost 50%; from the peak in 1980 (which, again, is a highly advantageous starting point to Bernanke’s display since I have reflected through both of the double dip as the cycle peak) real GDP gained 27.1% with nominal GDP riding the remnants of the Great Inflation to 79.6%; from the 1973 peak, real GDP rose 22.0% while nominal GDP flew apart at 120.5%.

During and after the nasty 1973-75 recession, the one that led into the worst parts of the Great Inflation, a time period from which no serious person would ever confuse with anything but awful economic conditions, real GDP managed almost three times more expansion than what Bernanke was holding up as his standard.

This is why he chose to compare his record against his European counterparts. Their failure was more miserable. What that ultimately means is that the US economy was the least worst, nothing more. It was then, and remains now, all in the same category as either Europe or Japan. Being the best of the worst class doesn’t quite add up to a compelling case.

Having the world’s largest economies all share this distinction should be a major clue, or at least a starting point for someone somewhere to investigate how that would be. But if they did, they’d have to do so coming face to face with the bond market. Economists and central bankers hate bonds, so yield curves and interest rates are for the mainstream economic story like some undiscovered wilderness.

It’s always been globally synchronized – just never once in growth. What he was trying to say was how his actions, the Fed’s monetary policies, made all the difference. What the bond market instead pointed out was how Bernanke’s so-called courage made no difference whatsoever.

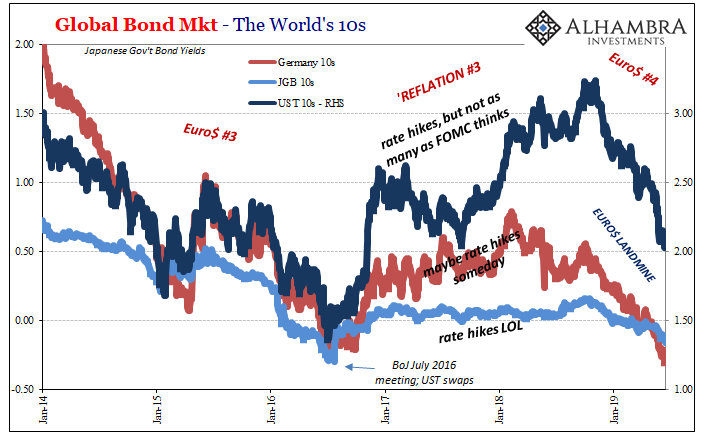

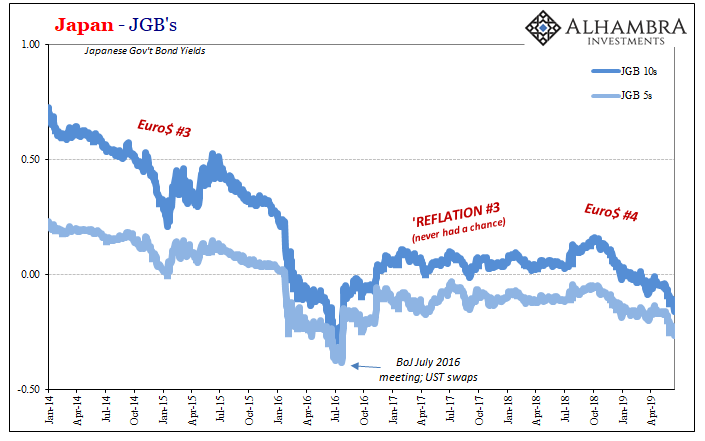

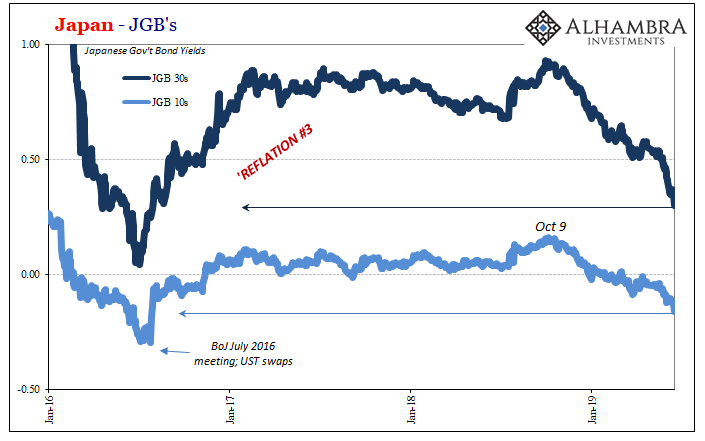

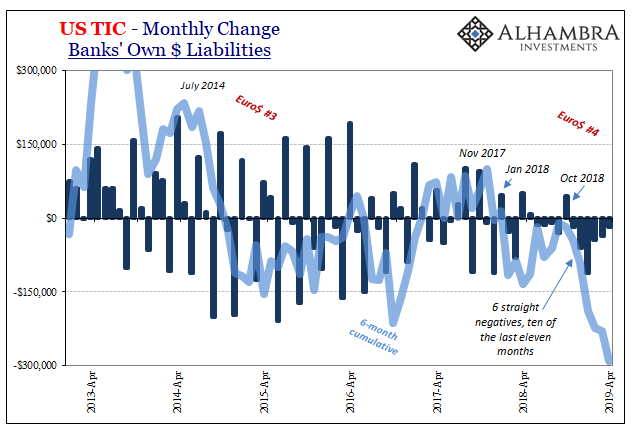

It may look initially like globally synchronized growth in 2017 was making Bernanke’s 2015 case for him; like there was some space between US rates and the others, but none of three major markets ever projected any real possibility of a radical change for the better. Bond yields had all converged in 2016 because Milton Friedman was right about the significance, and meaning, of interest rates. Coming out of it, Reflation #3, each major system priced the same factors amounting only to slight variances.

The UST market saw the most reflation, and that wasn’t very much – curves flattened at historically low nominal levels. The nominal increase was almost entirely due to “rate hikes”; that there were actually some. The flat curves said the FOMC wouldn’t likely get very far (they didn’t).

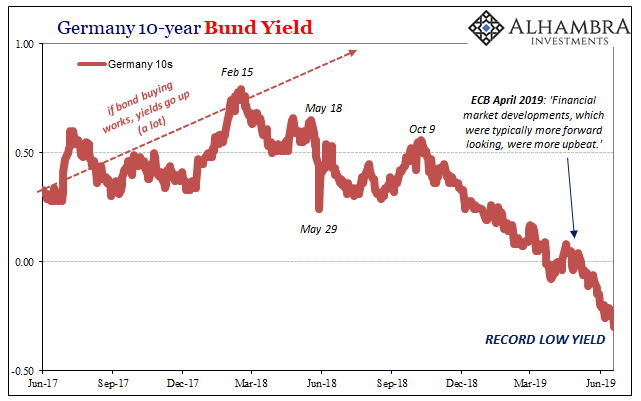

The German market never really bought into Mario Draghi’s worldview. There was very little chance Europe’s version of a “boom” would provide the ECB with enough justification for even a first. Yields never really moved all that much at any point.

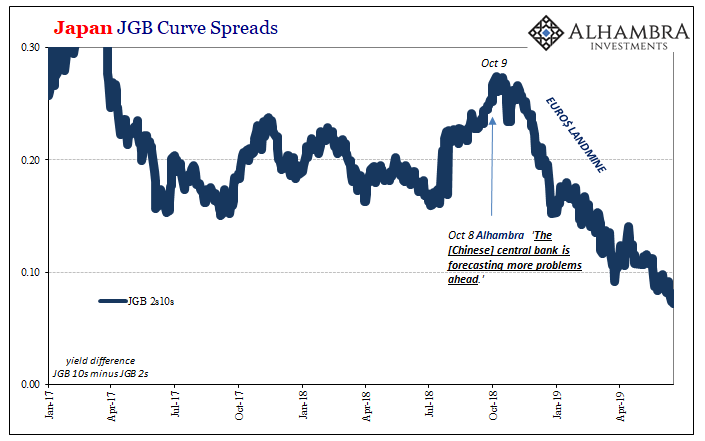

Japan, well, enough said.

In the end, these amount to only slightly different probabilities of continuing the low rate paradigm. Japanification Euro$ #4 is simply the same mechanism for it, and ultimately the confirmation that the lack of growth remains the deciding condition for all of us.

The 10-year UST yield is today not really that far above its post-crisis low. The German 10s are already at a record. And Japan’s 10-year JGB is once more in the same vicinity as the last trough, also near a record low.

In short, Reflation #3 never had a chance in any of these places because people like Bernanke were simply rationalizing failure. Globally synchronized growth, from the view of global bonds, was either emotional pleading or globally synchronized propaganda. There was never a market consensus for Bernanke’s view, nor Draghi’s and certainly not anything Kuroda has been thinking or saying.

During what were supposed to have been the best of times, 2017, the only thing really different in each bond market was by how much each central bank was projected to inevitably fall short of real recovery. The fact that the US may have come the closest will be some small comfort only to central bankers like Bernanke looking for some way, any way, to maintain his reputation in posterity.

Because in the end they all fell short. Far short. The word appearing uniformly in all these falling global bond yields is landmine. More to the current point, what’s already going wrong is still just the opening act in the whole globally economy going the wrong way from growth.

Sorry, Dr. Bernanke, globally synchronized the whole time.

Stay In Touch