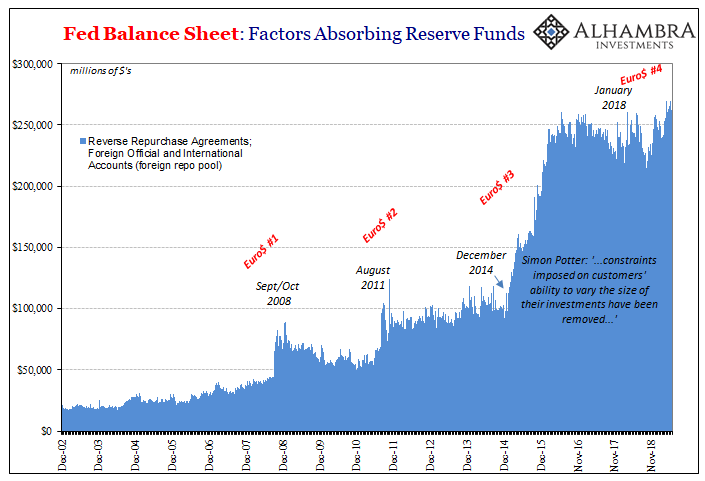

I thought this one needed a separate notation, though the same subject as the previous article. We’re still talking about the foreign repo pool, or monetary policy’s original reverse repo. It’s basically a way for overseas official governments and central banks to tell the Fed’s New York branch they’re uncomfortable with the dollar condition.

How US central bankers interpret that signal is a matter for, I guess, psychologists. What I wrote before was:

In other words, the Fed removed restrictions on the size of investments in it, foreign central banks couldn’t find similar dollar capacities in the private sector, and for some reason decided they needed an increasingly robust dollar liquidity buffer. There are many different ways to say dollar shortage, and Potter manages to get almost all of them into this one sentence.

In other places, they just come right out and say it. It doesn’t describe the outlines of a dollar shortage; it actually uses those words. For instance, the Monetary Policy Report submitted to Congress this past February defines the foreign repo pool in no uncertain terms:

The Federal Reserve has long offered this service as part of a suite of banking and custody services to foreign central banks, foreign governments, and international official institutions. Accounts at the Federal Reserve provide foreign official institutions with access to immediate dollar liquidity to support operational needs, to clear and settle securities in their accounts, and to address unexpected dollar shortages or exchange rate volatility. [emphasis added]

You see, that’s the institutional laziness or arrogance of not appreciating the nature of the global reserve currency. The Fed takes the view that an “unexpected dollar shortage” can only be your problem, not its. If Argentina or Turkey beefs up its action in the foreign repo pool, FRBNY will look upon it as Argentina or Turkey not doing its part, not keeping its affairs enough in order.

Pity only them.

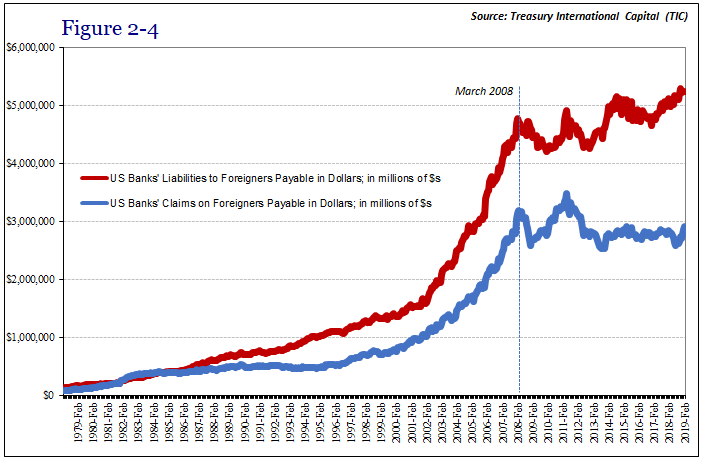

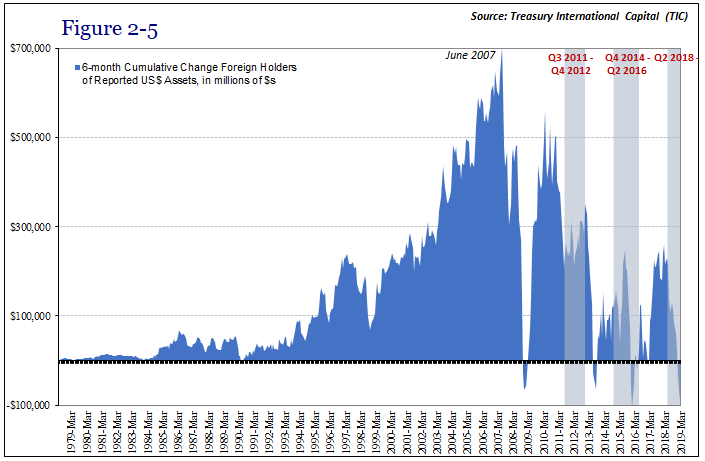

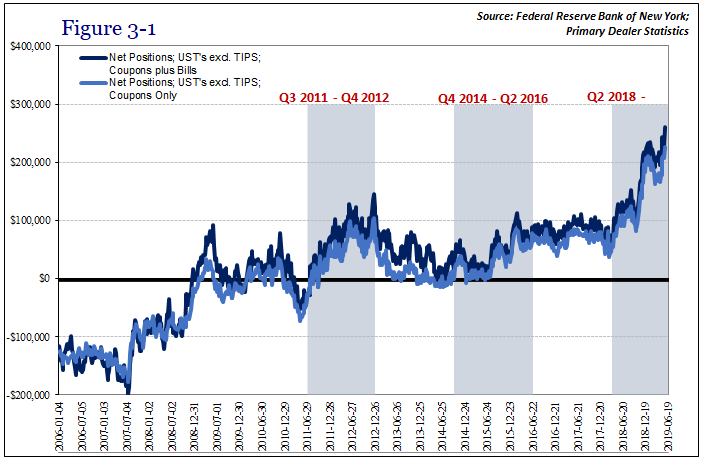

What they never consider, what they can’t even begin to think about, is if the “unexpected dollar shortage” is a systemic and chronic issue. Not with QE and those trillions in bank reserves. In this situation, though, it’s not Argentina or Turkey; it’s Argentina, Turkey, Japan, China, etc.

They all build up their dollar buffers because…

It’s another abject lesson in how you can look right at a thing, and still see nothing. Ideological blindness at its most destructive.

Stay In Touch