In 2005, Ben Bernanke kicked up quite a bit of controversy, or what qualifies as drama in the dry space of top-level Economics. It was Alan Greenspan who really started the conversation, practically begging for someone to offer an answer. Long-term interest rates were not behaving the way they were supposed to; the maestro’s true swan song was his “conundrum.”

Bernanke saw what everyone else did; there was suddenly a whole lot of monetary and financial activity going on outside the US. Even Greenspan had come to realize there was a relationship between it and his interest rate puzzle. His successor, Bernanke, simply provided the only explanation he could given the ideological constraints of modern Economics.

For the next Federal Reserve Chairman, it had to be a “global savings glut.” For our purposes here, we’ll just say it was a UFO – unidentified finance offshore.

However or wherever anyone wanted to explain the monetary bloat, it held very deep implications for the US central bank in particular. Monetary policy is believed to work mainly through the interest rate channel, the one most people are familiar with having been taught from the very beginning the wrong thing.

The Fed alters the short-term interest rate which then feeds into longer-term rates that more directly affect economic activity (starting with investment). It’s supposed to work in both directions; lower meaning stimulus; higher, as in 2005, meaning tightening. No one listened to Milton Friedman nor bothered to look at a historical chart of interest rates.

Greenspan’s problem was his “rate hikes” were not showing up anywhere in long-term rates (thus, rate hikes in name only; RHINO). The implications of the UFO had meant a possible divorce between short rates and those longer run; the Fed thinking about the yield curve as a series of one-year forwards stacked one on top of another running into the unsettling idea that bond yields might reflect instead independent and global market conditions well beyond the monetary policy envelope.

It introduced the idea of a potential clog in the transmission channel. As one St. Louis Fed essay written in 2005 immediately following Bernanke’s UFO sighting said in fascinated horror:

The possibility that domestic real long-term interest rates are segmented from domestic short-term rates has strong implications for perhaps the most widely held theory of the monetary policy transmission mechanism—the interest rate channel of monetary policy…If long-term real interest rates are determined in a global market, the FOMC’s scope for affecting domestic real long-term yields by adjusting its target for the federal funds rate may be limited.

The transmission problem would only get worse over time. Obviously, there was that little matter in 2008 beginning in 2007 which happened even though Bernanke’s Fed reduced the federal funds target from 5.25% to ZIRP in just over a year. Undeterred, panic was unleashed on a global scale. This UFO didn’t crash at Roswell, it crashed London first and then contamination was spread worldwide from there.

In other words, the Global Financial Crisis uncorked a new challenge and therefore another potential transmission clog: how much does the Fed actually influence short-term rates and more so conditions?

And the question of all questions: what if the market at the long end not only sets longer-term rates independently of monetary policy, what if one of the primary reasons is because bond market participants know the Fed isn’t what the textbooks all say?

It’s this last question we aim to get Economists to start thinking about. There really might be aliens (money) running around in the UFO.

One way is for especially central bankers to stop denying what their very eyes are seeing. Building upon yesterday’s discussions (both of them) of the foreign repo pool, the mysterious flashing lights of the UFO, we can put together all these factors simultaneously.

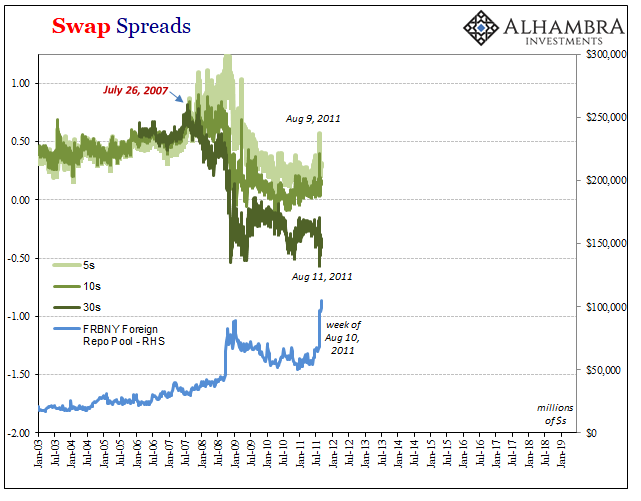

Start with short-term money rates. In August 2011, as I’ve recounted on many occasions, US policymakers were confronted with what to them seemed impossible. After having created $1.6 trillion in bank reserves via two QE’s, US$ money markets were experiencing grave difficulties anyway. Again, independence; policy expecting one thing after what everyone thought had been unmistakably heavy intervention, but finding out something very different.

Chairman Bernanke was abrupt in an emergency conference call held on August 1:

I think a point that was somewhat underemphasized is that our transmission of monetary policy is an issue here as well. So to take an example, doing repos to keep the RP rate from uncoupling from the federal funds rate, arguably there are issues there relating to transmission.

He wasn’t talking about the interest rate channel, either. Bernanke was stunned by the lack of transmission in money markets themselves! You aren’t going to influence long-term rates and therefore activate the interest rate channel if you can’t even get the policies off the ground at the source (money markets).

Therefore, we need only piece together the other two issues; the UFO and longer-term interest rates. The foreign repo pool stands in for the former, and we can use any number of market indications for the latter. Here I’ll just use swap spreads because they are an essential component of the credit markets which build bond yields and interest rates.

The swap market also happens to tell us something even more crucial about the capacities of dealers to transmit (effective) monetary conditions into the real economy through any and every channel.

No less than the Federal Reserve Chairman admits (privately, of course) that money markets are a mess despite what was supposed to have been unequivocal policy influence at the same time foreign officials panic into building up a more robust dollar buffer (and accessing SOMA collateral, too) while the swap market goes haywire in all directions.

It’s like a seismograph registering the earthquake from the stricken UFO crashing back to the ground a second time. Economists may not notice the connections, but market participants unlike policymakers don’t have that opportunity to fail upward.

It is nothing more than the 2005 conundrum turned upside down; the UFO which once buzzed around effortlessly suddenly crashed and its wreckage remains strewn about for anyone who wants to see. Unlike little green men from Mars, in this case you really, really have to fool yourself into not believing it is real.

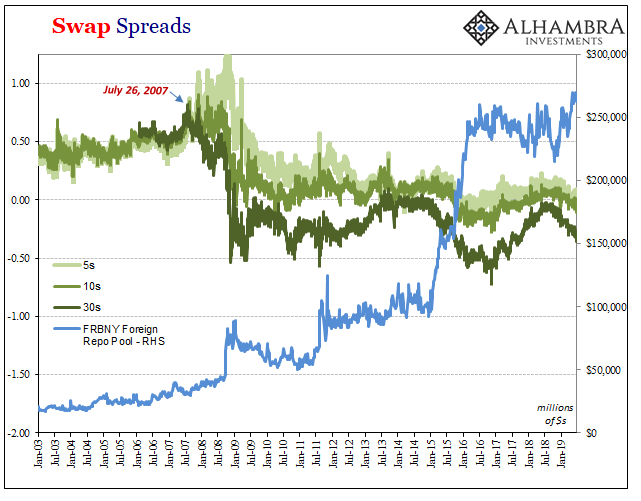

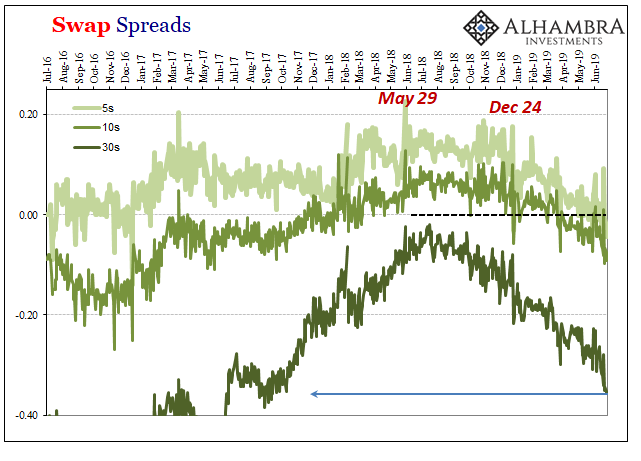

As noted yesterday, the process has repeated twice more; the latest, a fourth outbreak since the summer of 2007, following along the same pattern. Breakdown in money market transmission which leads to a panicky increase in the foreign repo pool dollar buffer and finally bond yields not just acting independently but outright chastising Economists and policymakers for living in a land of denial where for them the UFO is always easily explained away by some convoluted, absurd theory.

Anything but the most direct and obvious explanation.

Swap spreads today are now uniformly negative (again) across the major parts of the interest rate curve, a major blow to a lot of deeply held beliefs. Things are not getting better in 2019, they are worse all the time. Most of all, policymakers have no answers in the face of so much independent motion. They can’t even come to terms with the puzzle.

They first started looking into the possibility of UFO fourteen years ago. Having left all rational sense, policymakers have perverted Sherlock Holmes: once you eliminate the only thing possible, whatever remains no matter how ridiculous is better than the truth. Interest rates (and a lot of other things, like disappeared economic growth on a global scale) are only a conundrum if you don’t see the UFO.

Stay In Touch