Central bankers are not nimble traders. By their very bureaucratic nature, they leave big muddy footprints all over markets. Sometimes that is by design, a show of force to scare some evil speculators into going straight. Other times, it just can’t be helped.

The way it works in China, the autocratic structure doesn’t leave much to interpretation – at least as to what may be going on. Why something is happening can be an entirely different matter.

The muddiest feet in the bunch surely belongs to Big Mama. It’s not quite an affectionate nickname, though people do tend to see the People’s Bank of China (PBOC) in that way for a lot of more selfish reasons. Cultivated by the regime of autocracy, and in a West allured by dreams of technocracy, once Big Mama is spotted it is immediately assumed that’s the best thing.

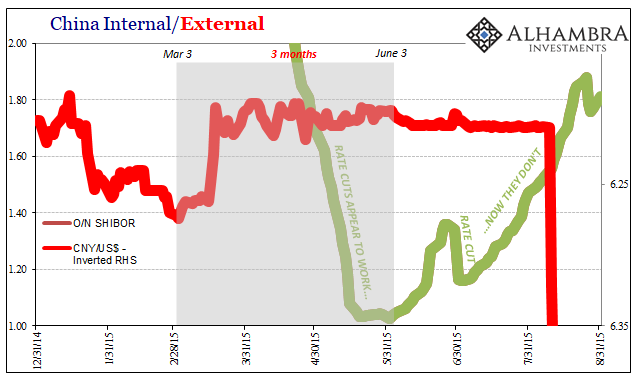

By far the most openly audacious intervention came starting in March 2015. China’s currency for reasons the mainstream just couldn’t fathom had been falling and unsteady for over a year. At the same time, the Chinese economy had shown equally unsteady signs, the accumulation of shocking weakness.

There was no way Communist authorities would allow it go any further. The PBOC intervened first in February 2015 with a “double shot”, rate and RRR cuts, followed in March by a CNY exchange rate that looked like it was purposely put under control. Many were relieved by what they saw as Big Mama very publicly and skillfully planting a green shoot at just the right time.

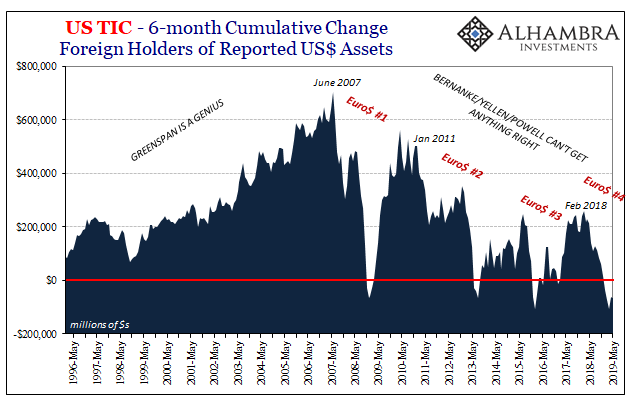

The problem, however, wasn’t China it was dollar; as in eurodollar. This wasn’t stimulus or even all that voluntary. This was an increasingly desperate monetary accident waiting to happen. I wrote at the end of April 2015:

Even the Chinese yuan has become far more stable despite the rash of nasty economic indications and even more uncertainty about what the PBOC might or might not do about it. In other words, forget what is happening in China, the yuan is all about the “dollar” in the purest financial sense.

Then, on June 3, as if to leave no doubt, CNY which had looked to be pegged by some unknown force before that day really looked pegged thereafter. Whomever was doing the pegging, as if it wasn’t clear, had upped the ante.

And it was also then that things really started to fall apart. Call it the law of unintended consequences if you want, but interventions are costly affairs regardless. Nothing is free in this world, not even for central banks. This is especially true when the central bank being forced into doing something is taking on the mightiest force in global finance – the eurodollar system.

I wrote on August 3, 2015, just one week before CNY finally snapped and three weeks before the global liquidations which closely followed (the DJIA lost 1300 pts in three days between August 18 and 21, then opened August 24 down 1000 more before finishing the day 588 pts lower):

There is very little optimism in this curve, as the “dollar” storm grows worse. As if to emphasize that interpretation, only the Chinese yuan appears oblivious. Rather than being a reassuringly placid node to the eurodollar network, its obvious artificiality actually adds greater apprehension as the flatness of the yuan surely belies what is really taking place there (and what the PBOC must be doing to generate such counterproductive and continued nothingness).

When the clock finally ticked down to zero on June 3, 2015, for reasons we will never know the PBOC threw all its chips into the pot. The central bank obviously didn’t want CNY to fall at that point – which only made it worse once they had to let it go just a little over two months later.

The internal costs (to RMB, as shown by SHIBOR) came to be too much to absorb ongoing external intervention.

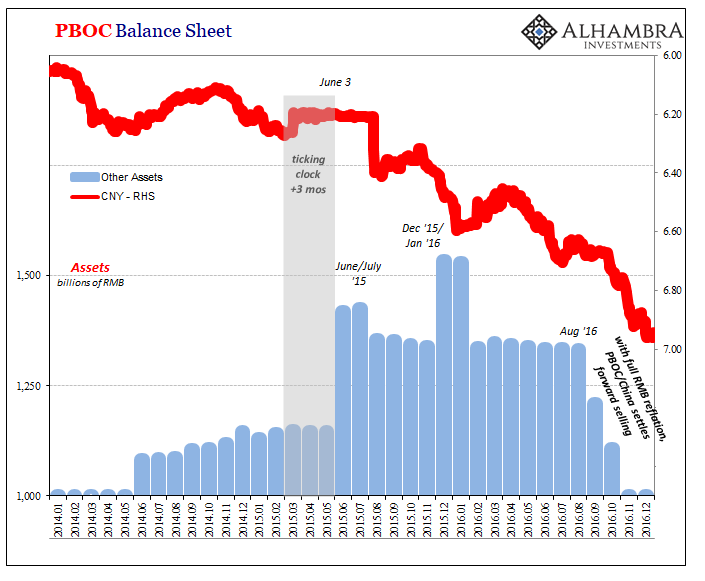

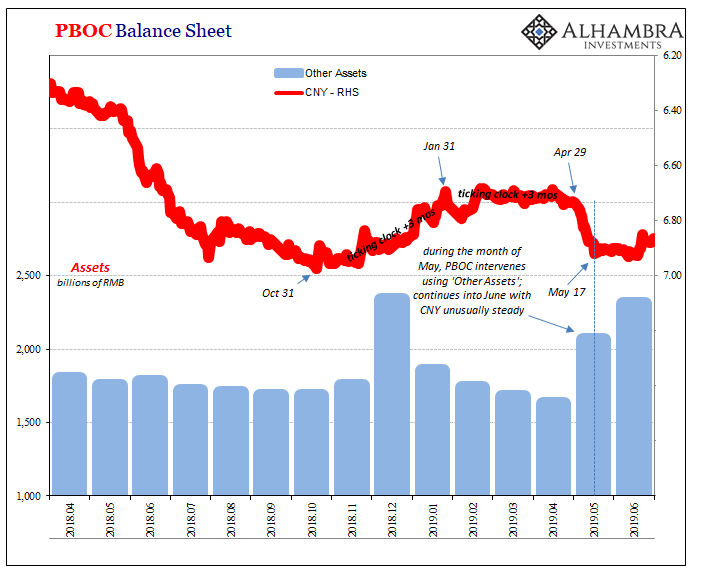

But what was that intervention? The PBOC is notoriously secretive to start with, but there are some clues. One is the “other assets” on its balance sheet.

When June 2015 rolled around and a loosely pegged CNY was ready to be set free (likely to resume its prior fall since the dollar was still rising against China), as you can see clearly on the chart above the Chinese monetary authorities sprang into action. We can’t tell what the PBOC may have done to start the clock ticking on March 3, but when that first three months was up the central bank was right in the middle in a big way.

And whatever (unwise) course was tried in June and July 2015, it was repeated again in December 2015 and January 2016 – the worst months of Euro$ #3. No matter the costs at that point, no matter how it hadn’t actually worked, they surely wanted to get a handle on CNY before CNY DOWN = BAD became CNY MORE DOWN = TOO FAR.

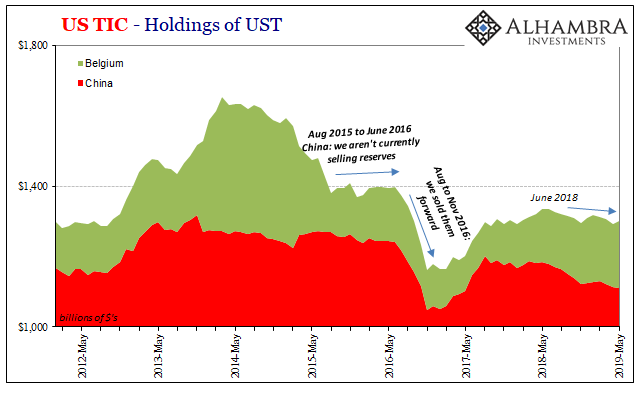

With the flood of RMB reflation early in 2016, by the second half of the year those interventions were unwound. The level of “other assets” dropped as China closed out its likely derivatives by actually “selling UST’s” (below).

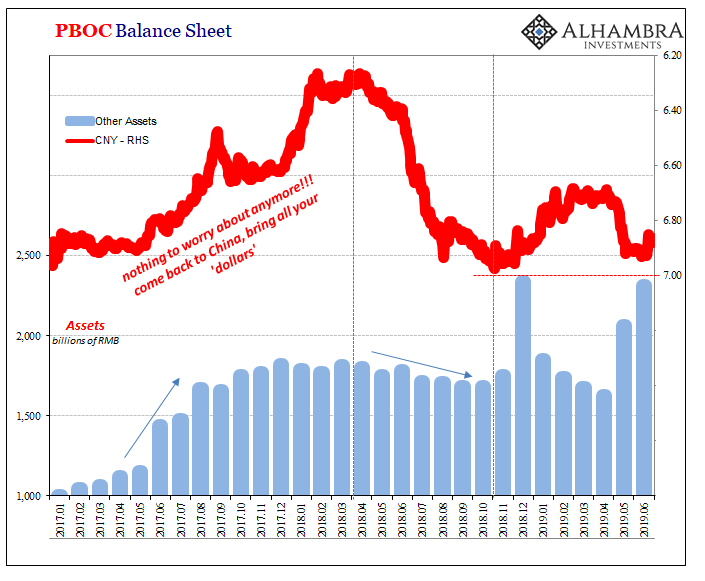

And with Reflation #3 in full bloom by 2017, under the cover of emotionally-driven and disingenuous Western central bankers banging only the drums of globally synchronized growth, China’s central bank hit upon an audacious plan to cement the positive status while they could.

At the same time Hong Kong would spring to life as an opaque shadow shadow dollar center, the PBOC would take advantage (I have to believe that was the plan all along).

Providing that (expensive) cover, authorities had to have hoped a sharply reversing, rising CNY might trigger some real monetary power in order to bring the fairy tale of globally synchronized growth to real life.

It was not to be, however, a fact driven home first by China’s very own 19th Communist Party Congress and then Japanese banks’ very destructive reaction to it. Beginning in January 2018, as new “overseas turmoil” sprang up, the PBOC stopped the interventions and then allowed some of them to roll off – all the while CNY DOWN = BAD and EFF became a mainstream topic.

To cushion the blow, at the end of April 2018 the PBOC began its serious of internal interventions. The Western media dutifully called them “stimulus”, RRR cuts mostly, lapping up the clear genius of China’s unfettered technocrats who in reality were making things up as they went and not getting very far while they did.

That’s why by October 2018, it had to get serious. With CNY back down to near 7 again for the first time since December 2016, Chinese authorities had a choice to make: either let CNY drop however it may and risk the pure chaos that would come with it; or, intervene and rescue CNY like they did in June and July 2015, and try as best as they might with internal offsets (also like 2015).

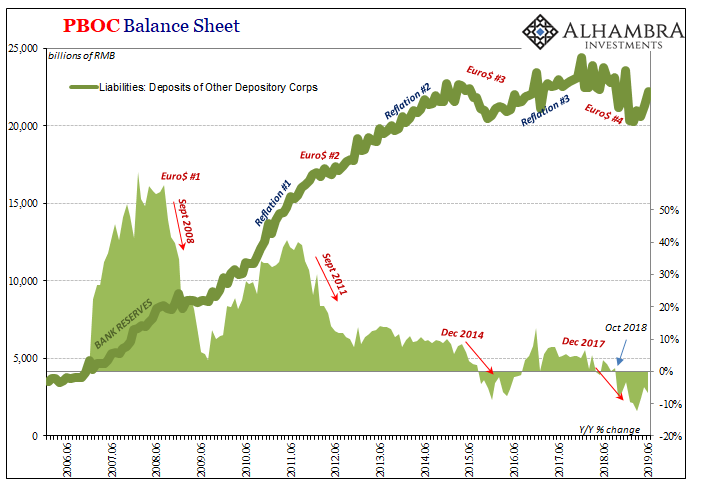

That was, in essence, China’s October 2018 warning – right at the very start of the global landmine. To rescue CNY, this would require sacrificing something; a couple of things, actually. At the top of the list was RMB bank reserves (above).

For as much as authorities realized it would eventually cost when these currency and dollar interventions might settle, the PBOC would have to carve out balance sheet space ahead of time to minimize the blow at that future point. Liabilities would have to suffer, and suffer they did (currency growth, too).

What the PBOC has done at least from what we can see in “other assets” is far and away greater than was ever done during Euro$ #3. In the month of June 2015, China’s central bank added RMB273 billion to “other assets”; during December 2018, it was +RMB587 billion.

They let that much go during the green shoots of early 2019 only to be forced back into the pile starting in May – probably May 17, as you can see above. The intervention continued into June 2019 at an even higher level matching December’s.

The first question anyone should ask is, why are they doing the same things they did last time around, those kinds of rescues that didn’t actually work? Where the mainstream conditioned to see central bank genius thinks this a solid stimulus plan, in light of the repeat we have to wonder if they really have been painted into such a small corner with no other options but to try it all once again.

The bigger question is one of time; it tends to run out. That’s because these efforts aren’t meant to be permanent. They are only supposed to buy time such that whatever is going wrong in the world, the eurodollar world, it can start to go right and the central bank can offload its additional costs at a more opportune moment (like 2017). Using its balance sheet and redistribution capabilities to try and smooth over the rough stuff.

It may therefore be a race – Chinese authorities hoping Euro$ #4 does little damage and that Reflation #4 shows up before the countdown to chaos reaches zero. Like it did in that hot summer of 2015.

But what is anyone basing Reflation #4 on? Many might answer with the Federal Reserve and its rate cuts. It may be that China has no choice but to hope that their American central bank counterparts don’t keep too busy searching for their lost LABOR SHORTAGE!!!, and that the FOMC will quite out of the blue transform itself into a competent and capable global partner.

Maybe FRBNY’s John Williams was on to something recently jumping the gun for full-on ZIRP. The markets are already expecting it to a high enough level of probability anyway.

Can these things which haven’t worked in the past all start to go right before China has to pay for all that it has done so far? Pay in CNY and therefore dollars. In this one area, at least, Euro$ #4 is already much bigger than Euro$ #3 ever was. Whatever you make of the gamble, it’s an enormous bet.

Then again, do they really have any choice?

Stay In Touch