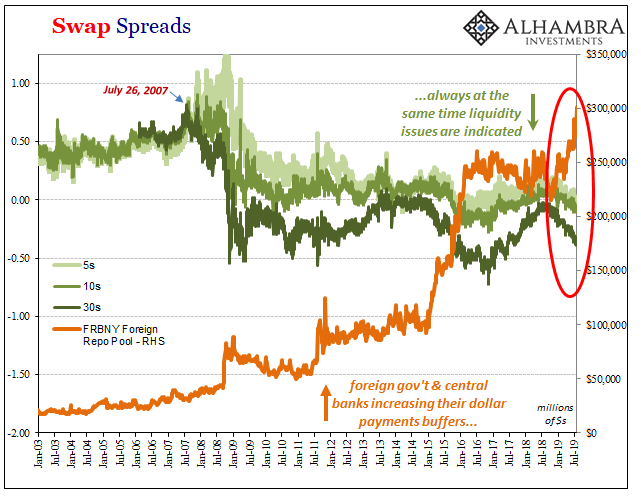

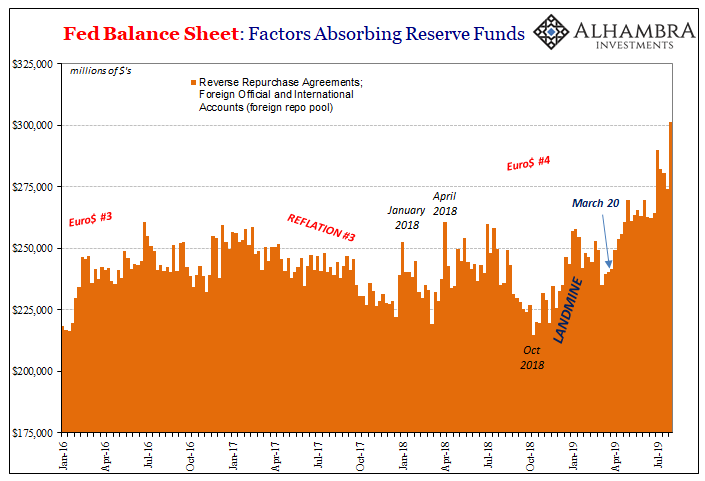

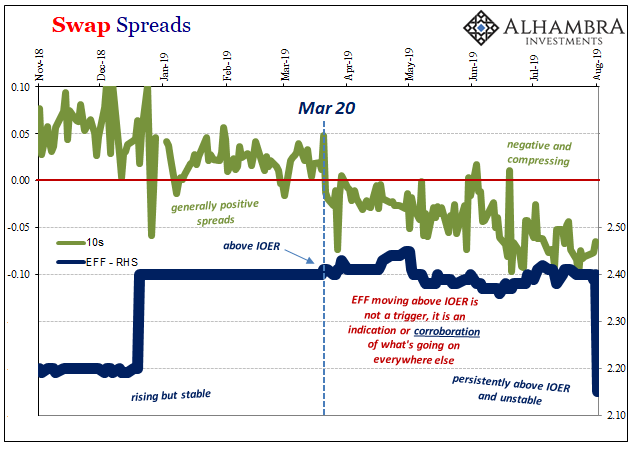

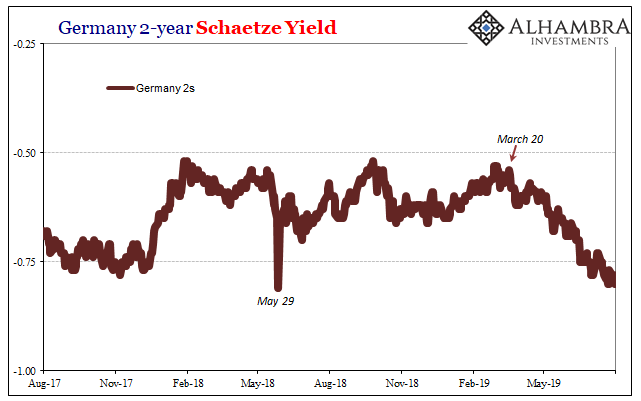

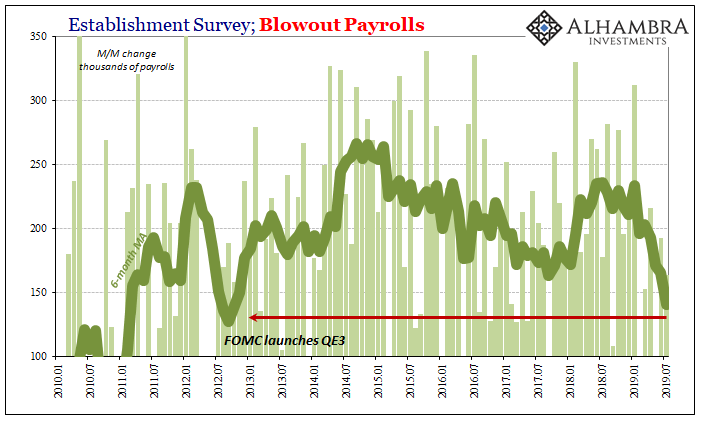

We’ve got repo, erratic federal funds market, German 2s correlated with it, plunging bond yields, angry swaps (IR and FX), and economic data increasingly and more speedily in the wrong direction. Overseas official entities piled even more into the foreign repo pool, their payments dollar buffer, another definitive sign of a much more acute dollar shortage worldwide.

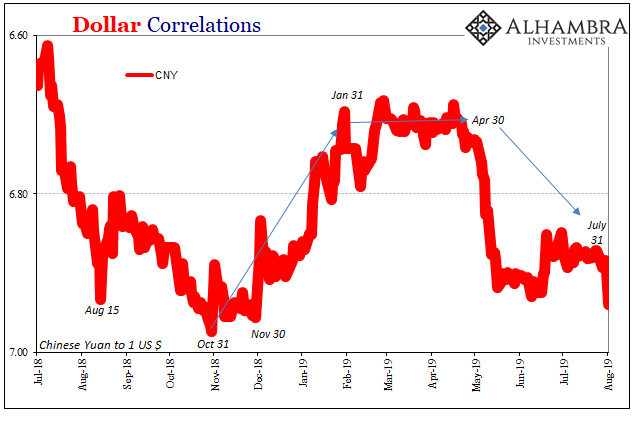

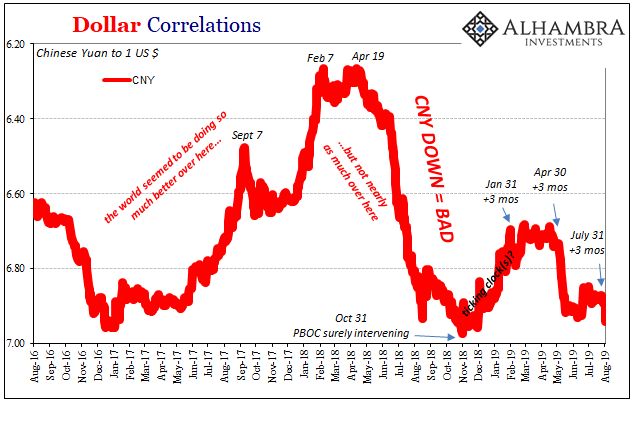

Is it even possible to add anything else that would make this all seem worse? Oh yeah, China’s ticking clock just expired, too. Let’s throw some currency turmoil into the mix. CNY DOWN, everybody.

And if all that’s not enough, there’s the decidedly non-random but still unexplained tendency for the first few weeks of August to unleash let’s call it volatility.

Sorry, never mind all that stuff. My mistake. I forgot to mention there was a rate cut, too.

Stay In Touch