The anniversary actually seems more poignant with each passing year. You would think it would be easy to get used to it, or at least become numb and normalized for the deep inflection it had represented. But the more everything stays the same the closer you are pulled to going back in time and rethinking things from the start.

How the hell can it have reached twelve years? That in and of itself is a tremendous intuitive hurdle; it doesn’t seem that it could ever be possible in this very modern, scientific world.

There is a living history to August 9, 2007. The literal description of that day doesn’t do it near enough justice. The 12 bps jump in 3-month LIBOR is akin to the assassination of Archduke Ferdinand, the tiny little butterfly whose wings flapped just enough to unleash monumental forces, all sorts of unending chaos and difference which had effectively wiped out the old world and started over.

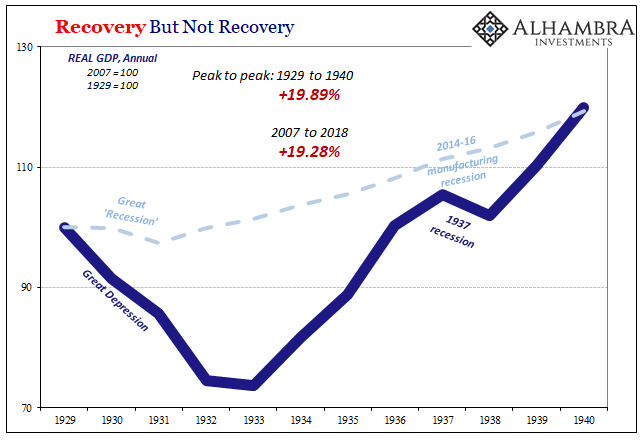

While you may think such a comparison fatuous hyperbole, I do not. We don’t yet know just how August 9 will end because it hasn’t yet ended. To us, the Great Depression is academic history, an exercise in thought experiment. The year 2008, that which August 9, 2007, immediately created, will be treated the same way by future historians.

But it isn’t yet turned over to them because we aren’t done with it. Though an enormous gap of time has opened, it’s as if the world hasn’t advanced at all through it. It’s been an almost perfectly analogous purgatory. The whole world stuck in limbo wondering when it will all be over and in which way it will finally go when the penance is finally paid up in full.

To the high side toward salvation, there is tremendous opportunity. Get it right, and the animal spirits central bankers have only been talking about pent up for all these years will be at once set free. Economic growth the likes of which people could only imagine. Think only EM countries can hit double-digit GDP? Just you wait.

Like a heavy spring that’s been weighed down by an unjust burden, just tipping that artificial mass a little off its axis will begin the process; and once started, it won’t stop until the giant coil expresses all of its powerfully positive energy. There are and have been good things in the global economy the last dozen years, few of which have been fully exploited because it is still August 9, 2007.

On the other side of the probability spectrum looms the real abyss. The true scale of horror which the Great Depression unleashed wasn’t breadlines and unemployment, it was the darker side of mankind. When no one has answers, people naturally divert their common sense to seek out the most compelling emotional appeal. The world is broken, and it must be that guy’s fault!

The costs of August 9, 2007, are no longer strictly economic or financial in nature. And even where they are, these are not appreciated. Take the latter; stocks are at or near record highs in the US. If you only watch your 401(k), and that’s your sense of the whole world, I may as well be writing in a foreign language. This doesn’t make any sense, even if the entire world no longer seems to make any sense in the context of your 401(k).

On the opposite financial end, the whole bond world has gone mad – or so it may appear. The amount of negative yielding “risk-free” debt only defies the term ever more as ever more debt becomes negative yielding. To the pre-August 9 framework, this could only be described as literal insanity. The world today would rather pay for the privilege of lending money.

Surely there is a white rabbit around here somewhere; how else to explain what can only be described as the descent into pure absurdity. But if you speak the language of Wonderland, you suddenly appreciate how it is actually the bank who would pay to lend the German or Japanese state money which is acting rationally.

The Rosetta Stone, if you aren’t familiar, was a Ptolemaic Egyptian stele onto which had been carved three different versions of the same official decree, one that had been given in 196 BC on behalf of King Ptolemy V Epiphanes. The pronouncement was written in ancient Egyptian hieroglyphics as well as demotic script. The third was put in ancient Greek, the language of Egypt’s rulers.

Up until its discovery, the world had been baffled by ancient Egyptian writing. There was simply no way to translate the pictures into modern words because every frame of reference had been lost to history or the desert. The great builders of the great pyramids seemed like some alien civilization who had something to say but no way for anyone to hear what they were saying.

Once found, the Rosetta Stone provided the means for translation and therefore to begin understanding this ancient society. The modern scientist could read and comprehend ancient Greek and from there could begin to decipher the system. Without being able to see the hieroglyphs for the words and phrases they were, the whole thing had been stuck as an enormous puzzle which spanned thousands of years.

The last twelve years of economic and financial history don’t make much sense, like some newly discovered foreign language. People have a very hard time coming to terms with what has been unfolding. There has been no legitimate frame of reference from which to interpret what are increasingly extreme events; not just economy and finance, but more so society and politics. The economy is booming, so why is the world so damn unhappy and angry?

In many ways, the eurodollar is our Rosetta Stone. It gives us the prospective to explain all the facts, rather than fleetingly a few here or there. We can translate the last dozen years into their original phrasing, without all the incompetent guesswork of officials who have no skill or training in the area.

These others are the ones who say the economy is booming, but how would they know? They can’t even read the language. To them, the global economic and financial system is nothing more than a train of pretty pictures upon which to project their own emotionally-driven hopes and desires (mostly not to be blamed).

It only seems like an incomprehensible Wonderland for as long as you stay with the conventional. Once you can translate the words and the customs properly, what you find is a perfectly logical system whose only real stumbling block is that it is so different than what you are used to.

It all began on August 9, 2007. And we are still stuck on that one date simply because convention or the mainstream has never once truly translated and deciphered just what it was that had happened that day. Yes, LIBOR jumped. Yes, Countrywide had some bad numbers. Yes, BNP Paribas suspended the NAV on some of its money funds. But what did all those things really mean?

The first overt liquidity action in the crisis period was TAF auctions performed only after several months of growing and “unexpected” chaos. And when the auction list was finally put together after it was over, the “best and brightest” just never put two and two together. For all their complex statistical models and regressions, the math was really that simple.

When the first one [TAF auction] was conducted on December 20, 2007, we can now see that the first name on the list is Citigroup. As a courtesy, it seems, the big NYC bank had bid for a minimal $10 million.

The biggest borrowers, though, were other sorts of ostensibly New York banks; firms like, Landesbank Hessen-Thurin, Bayerische Landesbank, Dresdner Bank AG, Deustche Zentra AG, Landesbank Baden Wuerttemb, and WestLB (the LB stands for, as you probably guessed, landesbank). Those six “New York” banks alone accounted for half of the $20 billion allotted. Given the style of these names, you might already be sensing a theme.

And when the TAF auctions along with overseas dollar swaps and an alphabet soup of acronym-ed programs failed to account, and the panic came on anyway, who was it that was most desperate knocking at the liquidity door?

In September 2008, the US central bank would conduct two more TAF offerings, one before Lehman on the 11th and one after on the 25th, combined tallying $124.55 billion in presumed liquidity. Of that, $31.6 billion or one-quarter went to just five banks: Depfa, Dexia, Dresdner, Bayerische, and Barclays. Again, the main theme.

Everyone said 2008 was a temporary problem with out-of-control greedy Wall Street bankers getting their subprime comeuppance. As bad as it may have been, it was fixed by the scientific precision, the skillful introduction and execution of quantitative easing. With so much money printing and all over the world, there couldn’t possibly be a liquidity problem anywhere ever again – surely not in dollars.

Here’s the thing, though. Liquidity and effective money supply, those are all Greek to central bankers. The more troubling aspect? Central bankers don’t need to sit around waiting for the random good luck of someone to dig up the monetary equivalent of a Rosetta Stone. They only need to open their eyes and their minds to a mountain of evidence.

And that’s why after twelve more August 9’s the anniversary takes on more not less importance with each passing one. The future is left wide open, totally uncertain. It could turn out to be really good. Or…

Twelve years after the Crash of ’29 was a month and a half shy of Pearl Harbor. More fatuous hyperbole?

The essential business of Decoding Curves

The language of monetary heirarchy

The hieroglyphs of liquidity, what are bank reserves anyway?

Translating the eurodollar into the official language

Stay In Touch