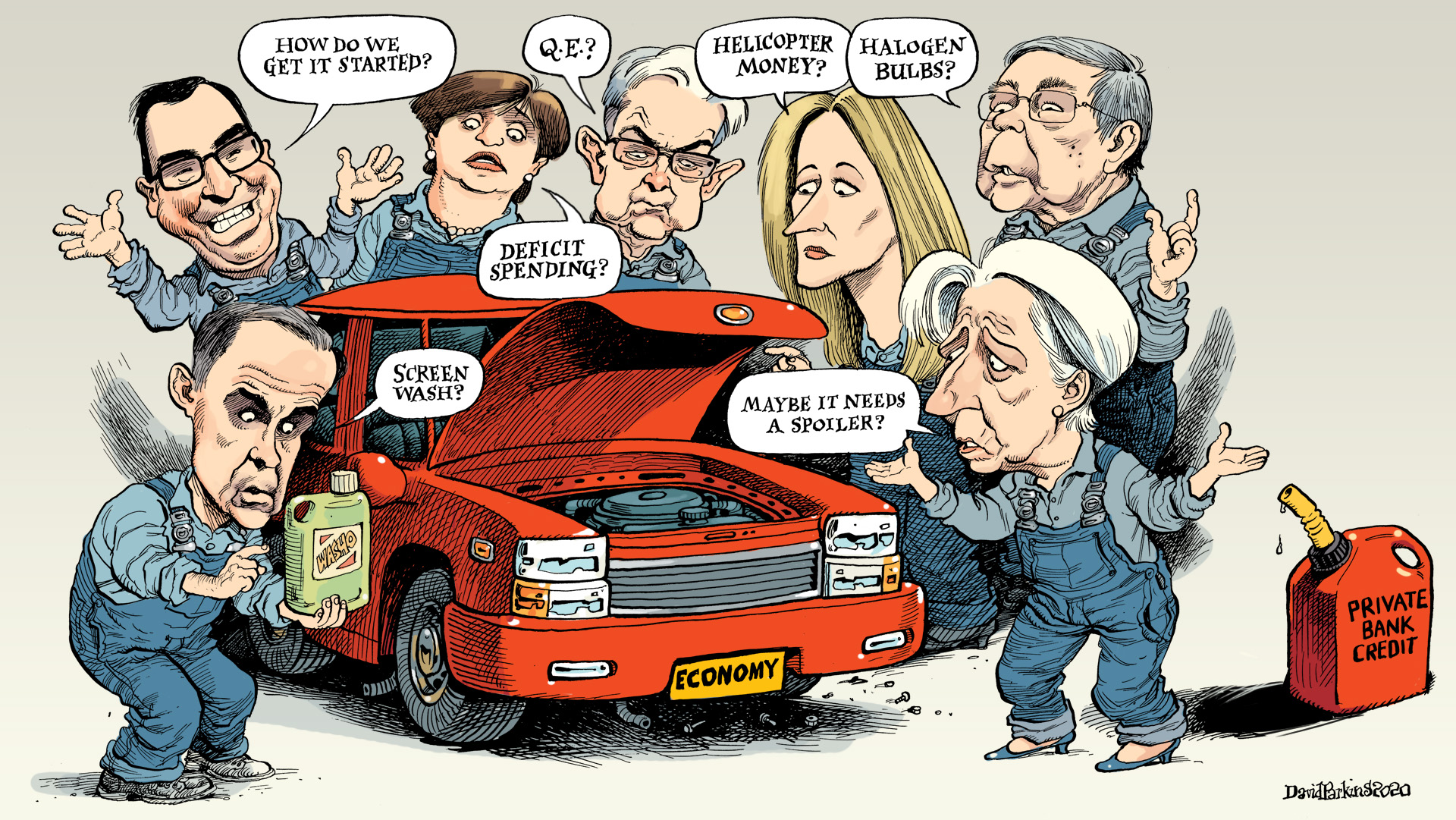

I Have Questions

I spend a lot of time asking questions. I don't always have answers to these questions but I think it is critical to ask them. Think about how the consensus might be wrong or, more importantly, how you might be. Question the narrative and try to determine what's important and what's not, who you can ignore, and who merits your [...]

Stay In Touch